PG&E 2015 Annual Report Download - page 99

Download and view the complete annual report

Please find page 99 of the 2015 PG&E annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

91

PART II

ITEM 8.FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA

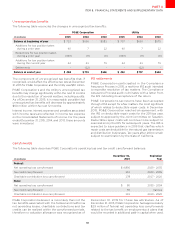

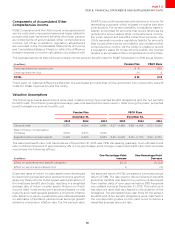

Unrecognized tax benefits

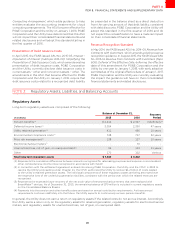

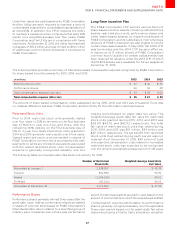

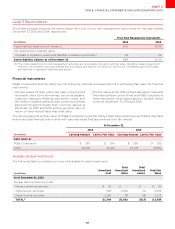

The following table reconciles the changes in unrecognized tax benefits:

PG&ECorporation Utility

(inmillions)

Balanceatbeginningofyear

Additionsfortaxpositiontaken

duringaprioryear

Reductionsfortaxpositiontaken

duringaprioryear () () () () () ()

Additionsfortaxpositiontaken

duringthecurrentyear

Settlements - () - - () -

Balanceatendofyear

The component of unrecognized tax benefits that, if

recognized, would aect the eective tax rate at December

31, 2015 for PG&E Corporation and the Utility was $50 million.

PG&E Corporation’s and the Utility’s unrecognized tax

benefits may change significantly within the next 12 months

due to the resolution of several matters, including audits.

As of December 31, 2015, it is reasonably possible that

unrecognized tax benefits will decrease by approximately

$60 million within the next 12 months.

Interest income, interest expense and penalties associated

with income taxes are reflected in income tax expense

on the Consolidated Statements of Income. For the years

ended December 31, 2015, 2014, and 2013, these amounts

were immaterial.

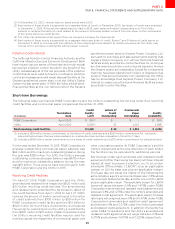

IRS settlements

PG&E Corporation participated in the Compliance

Assurance Process in 2015, a real-time IRS audit intended

to expedite resolution of tax matters. The Compliance

Assurance Process audit culminates with a letter from

the IRS indicating its acceptance of the return.

PG&E Corporation’s tax returns have been accepted

through 2014 except for a few matters, the most significant

of which relates to deductible repair costs. In December

2015, PG&E Corporation reached an agreement with

the IRS on deductible repair costs for the 2011 tax year,

subject to approval by the Joint Committee on Taxation.

Deductible repair costs will continue to be subject to

examination by the IRS for subsequent years. The IRS is

expected to issue guidance in 2016 that clarifies which

repair costs are deductible for the natural gas transmission

and distribution businesses. Tax years after 2004 remain

subject to examination by the state of California.

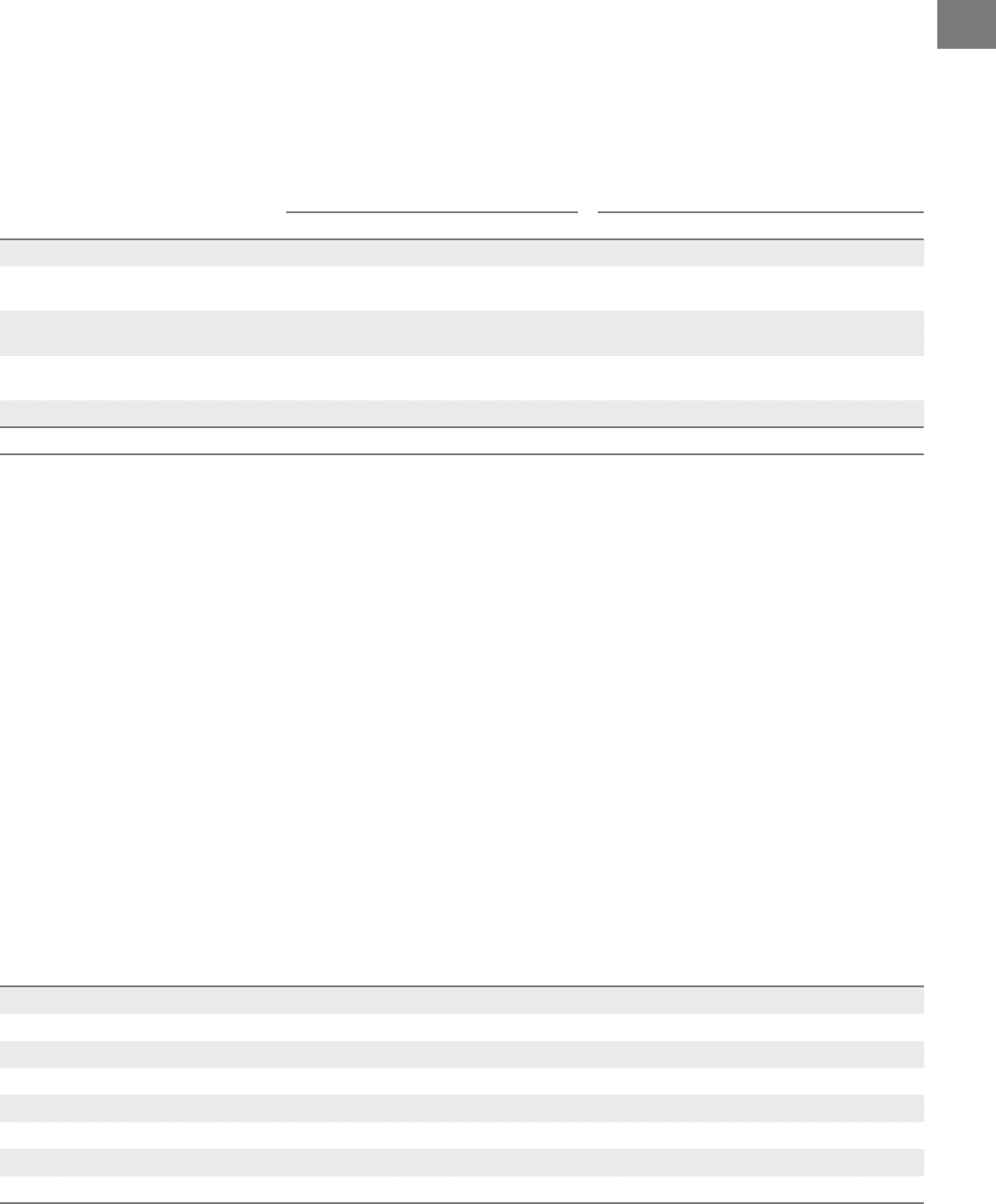

Carryforwards

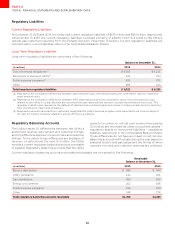

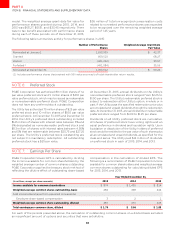

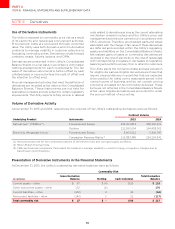

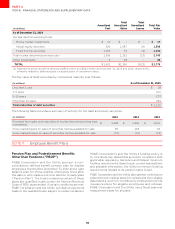

The following table describes PG&E Corporation’s operating loss and tax credit carryforward balances:

December

Expiration

Year

(inmillions)

Federal

Netoperatinglosscarryforward -

Taxcreditcarryforward -

Charitablecontributionlosscarryforward -

State

Netoperatinglosscarryforward -

Taxcreditcarryforward Various

Charitablecontributionlosscarryforward -

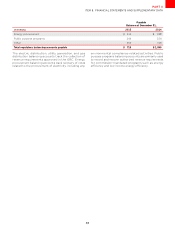

PG&E Corporation believes it is more likely than not the

tax benefits associated with the federal and California

net operating losses, charitable contributions and tax

credits can be realized within the carryforward periods,

therefore no valuation allowance was recognized as of

December 31, 2015 for these tax attributes. As of

December31, 2015, PG&E Corporation had approximately

$29 million of federal net operating loss carryforwards

related to the tax benefit on employee stock plans that

would be recorded in additional paid-in capital when used.