PG&E 2015 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2015 PG&E annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

80

PART II

ITEM 8.FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA

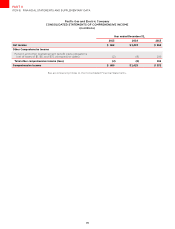

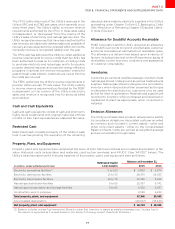

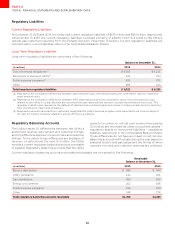

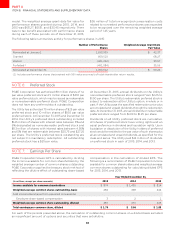

The changes, net of income tax, in PG&E Corporation’s accumulated other comprehensive income (loss) for the year

ended December 31, 2014 consisted of the following:

(inmillionsnetofincometax)

Pension

Benefits

Other

Benefits

Other

Investments Total

Beginningbalance ()

Othercomprehensiveincomebeforereclassifications

Changeininvestments

(netoftaxesofandrespectively) - -

Unrecognizednetactuarialloss

(netoftaxesofandrespectively) ()()-()

Unrecognizedpriorservicecost

(netoftaxesofandrespectively) - -

Regulatoryaccounttransfer

(netoftaxesofandrespectively) -

Amountsreclassifiedfromothercomprehensiveincome

Amortizationofpriorservicecost

(netoftaxesofandrespectively)() -

Amortizationofnetactuarialloss

(netoftaxesofandrespectively)() -

Regulatoryaccounttransfer

(netoftaxesofandrespectively)() ()()-()

Realizedgainoninvestments

(netoftaxesofandrespectively) - - ()()

Netcurrentperiodothercomprehensiveloss () - () ()

Endingbalance ()

() Thesecomponentsareincludedinthecomputationofnetperiodicpensionandotherpostretirementbenefitcosts(SeeNote

belowforadditionaldetails)

With the exception of other investments, there was no material dierence between PG&E Corporation and the Utility

for the information disclosed above.

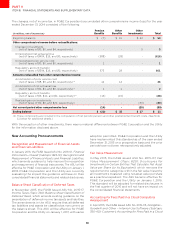

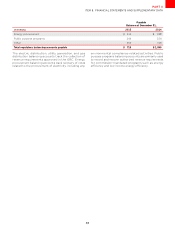

New Accounting Pronouncements

Recognition and Measurement of Financial Assets

and Financial Liabilities

In January 2016, the FASB issued ASU No. 2016-01, Financial

Instruments—Overall (Subtopic 825-10): Recognition and

Measurement of Financial Assets and Financial Liabilities,

which amends guidance to help improve the recognition

and measurement of financial instruments. The ASU will be

eective for PG&E Corporation and the Utility on January 1,

2018. PG&E Corporation and the Utility are currently

evaluating the impact the guidance will have on their

consolidated financial statements and related disclosures.

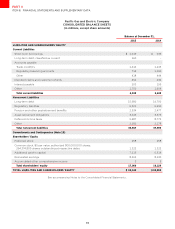

Balance Sheet Classification of Deferred Taxes

In November 2015, the FASB issued ASU No. 2015-17,

Income Taxes (Topic 740): Balance Sheet Classification of

Deferred Taxes, which amends existing guidance on the

presentation of deferred income tax assets and liabilities.

The amendments in the ASU require that all deferred

tax liabilities and assets be classified as noncurrent on

the balance sheet. This ASU will be eective for PG&E

Corporation and the Utility on January 1, 2017, with earlier

adoption permitted. PG&E Corporation and the Utility

have implemented this standard as of the year ended

December 31, 2015 on a prospective basis and the prior

periods have not been retrospectively adjusted.

Fair Value Measurement

In May 2015, the FASB issued ASU No. 2015-07, Fair

Value Measurement (Topic 820): Disclosures for

Investments in Certain Entities That Calculate Net Asset

Value per Share (or Its Equivalent), which removes the

requirement to categorize within the fair value hierarchy

all investments measured using net asset value per share

as a practical expedient. The ASU became eective for

PG&E Corporation and the Utility on January 1, 2016.

This standard will be adopted for related disclosures in

the first quarter of 2016 and will not have an impact on

the consolidated financial statements.

Accounting for Fees Paid in a Cloud Computing

Arrangement

In April 2015, the FASB issued ASU No. 2015-05, Intangibles –

Goodwill and Other – Internal-Use Software (Subtopic

350-40): Customer’s Accounting for Fees Paid in a Cloud