PG&E 2015 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2015 PG&E annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

47

PART II

ITEM 7.MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

the Dividend Reinvestment and Stock Purchase Plan, and

share-based compensation plans for total cash proceeds

of $354 million.

The proceeds from equity issuances were used for general

corporate purposes, including the contribution of equity

into the Utility. For the year ended December 31, 2015,

PG&E Corporation made equity contributions to the Utility

of $705 million, of which $300 million was used to pay a

fine to the State General Fund as required by the Penalty

Decision. Additionally, PG&E Corporation and the Utility

expect to continue to issue long-term and short-term

debt for general corporate purposes and to maintain the

CPUC-authorized capital structure during 2016.

Revolving Credit Facilities and Commercial

Paper Programs

At December 31, 2015, PG&E Corporation and the Utility

had $300 million and $1.9 billion available under their

respective $300 million and $3.0 billion revolving credit

facilities. (See Note 4 of the Notes to the Consolidated

Financial Statements in Item 8.)

The revolving credit facilities require that PG&E Corporation

and the Utility maintain a ratio of total consolidated debt

to total consolidated capitalization of at most 65% as

of the end of each fiscal quarter. At December 31, 2015,

PG&E Corporation’s and the Utility’s total consolidated

debt to total consolidated capitalization was 51% and

50%, respectively. PG&E Corporation’s revolving credit

facility agreement also requires that PG&E Corporation

own, directly or indirectly, at least 80% of the outstanding

common stock and at least 70% of the outstanding voting

capital stock of the Utility. In addition, the revolving credit

facilities include usual and customary provisions regarding

events of default and covenants including covenants limiting

liens to those permitted under PG&E Corporation’s and

the Utility’s senior note indentures, mergers, and imposing

conditions on the sale of all or substantially all of PG&E

Corporation’s and the Utility’s assets and other fundamental

changes. At December 31, 2015, PG&E Corporation and

the Utility were in compliance with all covenants under

their respective revolving credit facilities.

Dividends

PG&E Corporation

For each of the quarters in 2015, 2014, and 2013, the

Board of Directors of PG&E Corporation declared

common stock dividends of $0.455 per share, for annual

dividends of $1.82 per share. Dividends paid to common

stockholders by PG&E Corporation were $856 million

in 2015, $828 million in 2014, and $782 million in 2013.

In December 2015, the Board of Directors of PG&E

Corporation declared quarterly dividends of $0.455

pershare, totaling $224 million, of which approximately

$219million was paid on January 15, 2016 to shareholders

of record on December 31, 2015.

Utility

For each of the quarters in 2015, 2014, and 2013, the Utility’s

Board of Directors declared common stock dividends in

the aggregate amount of $179 million to PG&E Corporation

for annual dividends paid of $716 million in each of 2015,

2014, and 2013. In addition, the Utility paid $14 million of

dividends on preferred stock in each of 2015, 2014, and 2013.

The Utility’s preferred stock is cumulative and any dividends

in arrears must be paid before the Utility may pay any

common stock dividends. In December 2015, the Board of

Directors of the Utility declared dividends on its outstanding

series of preferred stock, payable on February 15,

2016, to shareholders of record on January 29, 2016.

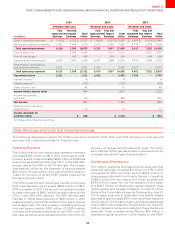

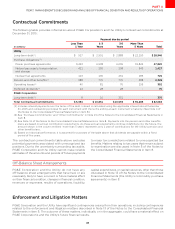

Utility Cash Flows

The Utility’s cash flows were as follows:

YearEndedDecember

(inmillions)

Netcashprovidedbyoperatingactivities

Netcashusedininvestingactivities () () ()

Netcashprovidedbyfinancingactivities

Netchangeincashandcashequivalents () ()