PG&E 2015 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2015 PG&E annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

41

PART II

ITEM 7.MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

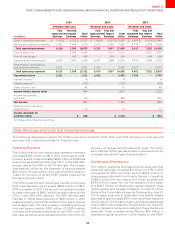

()Includeslegalandotherregulatoryrelatedcoststhatwerepartiallyoffsetbyincentiverevenues

()RepresentsthelargergainrecognizedduringtheyearendedDecemberascomparedto

()Representsinsurancerecoveriesofmillionpre-taxforthirdpartyclaimsandassociatedlegalcostsrelatedtotheSan

BrunoaccidenttheUtilityreceivedduringtheyearendedDecemberTheUtilityhasreceivedacumulativetotalof

millionthroughinsurancerelatedtomillionofthird-partyclaimsandmillionoflegalcostsincurredNofurther

insurancerecoveriesrelatedtotheseclaimsandcostsareexpected

()RepresentstheimpactofthePenaltyDecision(seeNoteoftheNotestotheConsolidatedFinancialStatementsinItem

forbefore-taxamounts)

()Inpipeline-relatedexpensesincludecostsincurredtoidentifyandremoveencroachmentsfromtransmissionpipeline

rightsofwayandtoperformremainingworkundertheUtility’sPSEPLegalandregulatoryrelatedexpensesincludecosts

incurredinconnectionwithvariousenforcementregulatoryandlitigationactivitiesregardingnaturalgasmattersand

regulatorycommunications

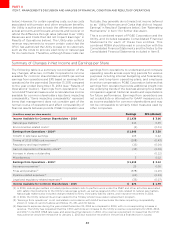

Key Factors Aecting Results of Operations, Financial Condition, and Cash Flows

PG&E Corporation and the Utility believe that their future

results of operations, financial condition, and cash flows

will be materially aected by the following factors:

đ

The Outcome of Enforcement and Litigation Matters.

Future financial results will be impacted by the

unrecoverable pipeline safety-related and remedies

costs required by the Penalty Decision. The Utility’s

future results may also be impacted by various other

pending enforcement and regulatory actions, including

the federal criminal charges and CPUC investigations

of the Utility’s compliance with natural gas distribution

record-keeping practices and potential violations of the

CPUC’s ex parte communication rules. (See “Enforcement

and Litigation Matters” in Note 13 of the Notes to the

Consolidated Financial Statements in Item 8.)

đ

The Timing and Outcome of Regulatory Matters.

The 2015 GT&S rate case remains pending. The Utility

requested that the CPUC authorize a $532 million increase

in annual revenue requirements for gas transmission

and storage operations beginning on January 1, 2015

with attrition increases in 2016 and 2017. Any revenue

requirement increase that the CPUC may authorize would

be retroactive to January 1, 2015 but would berecorded

in the period a final decision is reached. (See “Regulatory

Matters − 2015 Gas Transmission and Storage Rate Case”

below for more information.) In September 2015, the

Utility filed its 2017 GRC application to request that the

CPUC authorize revenue requirements for the Utility’s

electric generation business and its electric and natural

gas distribution business for 2017 through 2019. (See

“Regulatory Matters − 2017 General Rate Case” below

for more information.) In addition, the Utility has one

transmission owner rate case pending at the FERC (See

“Regulatory Matters – FERC TO Rate Cases” below.) The

outcome of regulatory proceedings can be aected

by many factors, including the level of opposition by

intervening parties, potential rate impacts, the Utility’s

reputation, the regulatory and political environments,

and other factors.

đ

The Ability of the Utility to Control Operating Costs

and Capital Expenditures. Whether the Utility is able

to earn its authorized rate of return could be materially

affected if the Utility’s actual costs differ from the

amounts authorized in the rate case decisions. In

addition to incurring shareholder-funded costs and

costs associated with remedial measures required by

the Penalty Decision, the Utility also forecasts that in

2016 it will incur unrecovered pipeline-related expenses

ranging from $100 million to $150 million which primarily

relate to costs to identify and remove encroachments

from transmission pipeline rights-of-way. The ultimate

amount of unrecovered costs also could be affected by

how the CPUC determines which costs are included in

determining whether the $850 million shareholder-funded

obligation under the Penalty Decision has been met, and

the outcome of pending and future investigations and

enforcement matters. (See “Enforcement and Litigation

Matters” in Note 13 of the Notes to the Consolidated

Financial Statements in Item 8.) The Utility’s ability to

recover costs in the future also could be affected by

decreases in customer demand driven by legislative and

regulatory initiatives relating to distributed generation

resources, renewable energy requirements, and changes

in the electric rate structure.

đ

The Amount and Timing of the Utility’s Financing Needs.

PG&E Corporation contributes equity to the Utility

as needed to maintain the Utility’s CPUC-authorized

capital structure. In 2015, PG&E Corporation issued

$801 million of common stock with cash proceeds and

made equity contributions to the Utility of $705 million.

PG&E Corporation forecasts that it will issue a material

amount of equity in 2016 and future years to support

the Utility’s capital expenditures. PG&E Corporation

will issue additional equity to fund charges incurred

by the Utility to comply with the Penalty Decision, to

fund unrecoverable pipeline-related expenses, and to

pay fines and penalties that may be required by the

final outcomes of pending enforcement matters. These

additional issuances would have a material dilutive impact

on PG&E Corporation’s EPS. PG&E Corporation’s and

the Utility’s ability to access the capital markets and the

terms and rates of future financings could be aected by

the outcome of the matters discussed in “Enforcement

and Litigation Matters” in Note 13 of the Notes to the

Consolidated Financial Statements in Item 8, Financial

Statements and Supplementary Data, changes in their

respective credit ratings, general economic and market

conditions, and other factors.