PG&E 2015 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2015 PG&E annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

93

PART II

ITEM 8.FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA

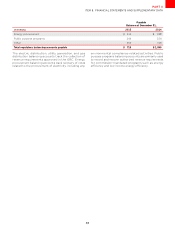

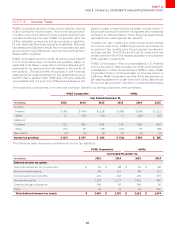

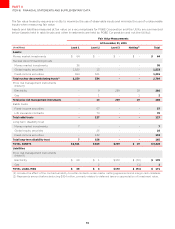

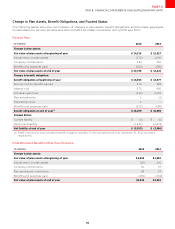

At December 31, 2014, the Utility’s outstanding derivative balances were as follows:

CommodityRisk

(inmillions)

GrossDerivative

Balance Netting CashCollateral

TotalDerivative

Balance

Currentassets–other ()

Othernoncurrentassets–other () -

Currentliabilities–other () ()

Noncurrentliabilities–other () ()

Totalcommodityrisk -

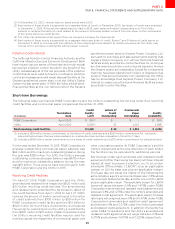

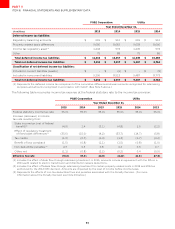

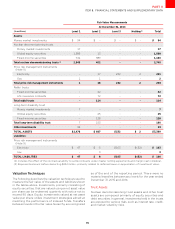

Gains and losses associated with price risk management activities were recorded as follows:

CommodityRisk

FortheyearendedDecember

(inmillions)

Unrealizedgain(loss)-regulatoryassetsandliabilities() ()

Realizedloss-costofelectricity() () () ()

Realizedloss-costofnaturalgas() () () ()

Totalcommodityrisk

()

() Unrealizedgainsandlossesoncommodityrisk-relatedderivativeinstrumentsarerecordedtoregulatoryliabilitiesorassets

respectivelyratherthanbeingrecordedtotheConsolidatedStatementsofIncomeTheseamountsexcludetheimpactof

cashcollateralpostings

() TheseamountsarefullypassedthroughtocustomersinratesAccordinglynetincomewasnotimpactedbyrealized

amountsontheseinstruments

Cash inflows and outflows associated with derivatives

are included in operating cash flows on the Utility’s

Consolidated Statements of Cash Flows.

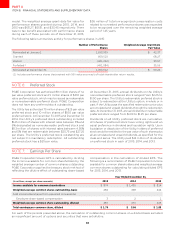

The majority of the Utility’s derivatives contain collateral

posting provisions tied to the Utility’s credit rating from

each of the major credit rating agencies. At December

31, 2015, the Utility’s credit rating was investment grade.

If the Utility’s credit rating were to fall below investment

grade, the Utility would be required to post additional

cash immediately to fully collateralize some of its net

liability derivative positions.

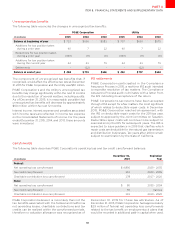

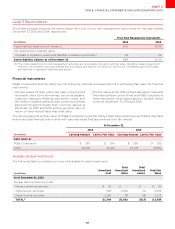

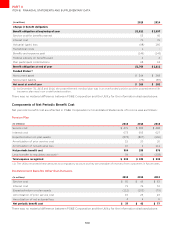

The additional cash collateral that the Utility would be

required to post if the credit risk-related contingency

features were triggered was as follows:

BalanceatDecember

(inmillions)

Derivativesinaliabilitypositionwithcreditrisk-relatedcontingenciesthatarenotfully

collateralized () ()

Relatedderivativesinanassetposition - -

Collateralpostinginthenormalcourseofbusinessrelatedtothesederivatives -

Netpositionofderivativecontractsadditionalcollateralpostingrequirements

()

() ()

() Thiscalculationexcludestheimpactofclosedbutunpaidpositionsastheirsettlementisnotimpactedbyanyofthe

Utility’screditrisk-relatedcontingencies

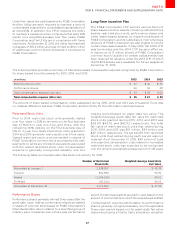

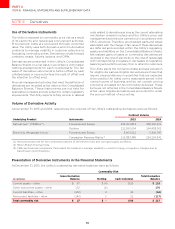

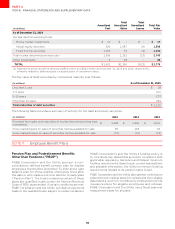

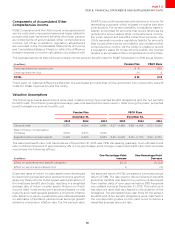

NOTE 10: Fair Value Measurements

PG&E Corporation and the Utility measure their cash equivalents, trust assets, price risk management instruments, and

other investments at fair value. A three-tier fair value hierarchy is established that prioritizes the inputs to valuation

methodologies used to measure fair value:

đ

Level 1 – Observable inputs that reflect quoted prices

(unadjusted) for identical assets or liabilities in active

markets.

đ

Level 2 – Other inputs that are directly or indirectly

observable in the marketplace.

đ

Level 3 – Unobservable inputs which are supported by

little or no market activities.