PG&E 2015 Annual Report Download - page 100

Download and view the complete annual report

Please find page 100 of the 2015 PG&E annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

92

PART II

ITEM 8.FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA

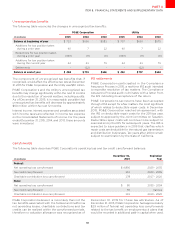

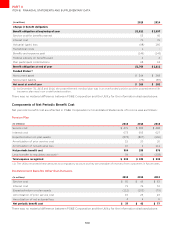

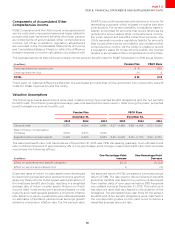

NOTE 9: Derivatives

Use of Derivative Instruments

The Utility is exposed to commodity price risk as a result

of its electricity and natural gas procurement activities.

Procurement costs are recovered through customer

rates. The Utility uses both derivative and non-derivative

contracts to manage volatility in customer rates due to

fluctuating commodity prices. Derivatives include forward

contracts, swaps, futures, options, and CRRs.

Derivatives are presented in the Utility’s Consolidated

Balance Sheets on a net basis in accordance with master

netting arrangements for each counterparty. The fair

value of derivative instruments is further oset by cash

collateral paid or received where the right of oset and

the intention to oset exist.

Price risk management activities that meet the definition of

derivatives are recorded at fair value on the Consolidated

Balance Sheets. These instruments are not held for

speculative purposes and are subject to certain regulatory

requirements. The Utility expects to fully recover in rates all

costs related to derivatives as long as the current ratemaking

mechanism remains in place and the Utility’s price risk

management activities are carried out in accordance with

CPUC directives. Therefore, all unrealized gains and losses

associated with the change in fair value of these derivatives

are deferred and recorded within the Utility’s regulatory

assets and liabilities on the Consolidated Balance Sheets.

Net realized gains or losses on commodity derivatives are

recorded in the cost of electricity or the cost of natural gas

with corresponding increases or decreases to regulatory

balancing accounts for recovery from or refund to customers.

The Utility elects the normal purchase and sale exception

for eligible derivatives. Eligible derivatives are those that

require physical delivery in quantities that are expected

to be used by the Utility over a reasonable period in the

normal course of business, and do not contain pricing

provisions unrelated to the commodity delivered. These

items are not reflected in the Consolidated Balance Sheets

at fair value. Eligible derivatives are accounted for under

the accrual method of accounting.

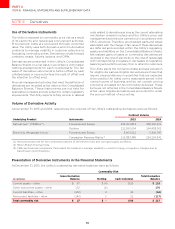

Volume of Derivative Activity

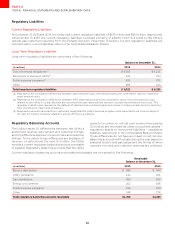

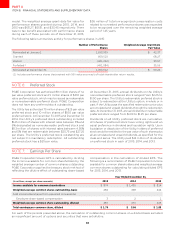

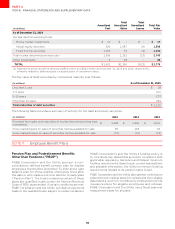

At December 31, 2015 and 2014, respectively, the volumes of the Utility’s outstanding derivatives were as follows:

ContractVolume

UnderlyingProduct Instruments

NaturalGas()(MMBtus()) ForwardsandSwaps

Options

Electricity(Megawatt-hours) ForwardsandSwaps

CongestionRevenueRights()

() Amountsshownareforthecombinedpositionsoftheelectricfuelsandcoregassupplyportfolios

() MillionBritishThermalUnits

() CRRsarefinancialinstrumentsthatenabletheholderstomanagevariabilityinelectricenergycongestionchargesdueto

transmissiongridlimitations

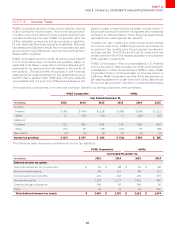

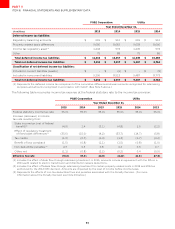

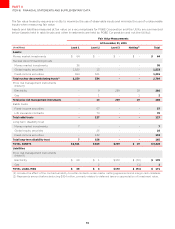

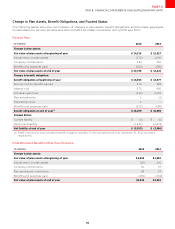

Presentation of Derivative Instruments in the Financial Statements

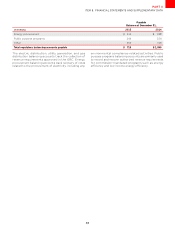

At December 31, 2015, the Utility’s outstanding derivative balances were as follows:

CommodityRisk

(inmillions)

GrossDerivative

Balance Netting CashCollateral

TotalDerivative

Balance

Currentassets–other ()

Othernoncurrentassets–other () -

Currentliabilities–other () ()

Noncurrentliabilities–other () ()

Totalcommodityrisk -