PG&E 2015 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2015 PG&E annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

58

PART II

ITEM 7.MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

may change, as well as site conditions, thereby possibly

aecting the cost of the remediation eort.

At December 31, 2015 and 2014, the Utility’s accruals for

undiscounted gross environmental liabilities were $969 million

and $954 million, respectively. The Utility’s undiscounted

future costs could increase to as much as $1.9 billion if the

extent of contamination or necessary remediation is greater

than anticipated or if the other potentially responsible parties

are not financially able to contribute to these costs, and could

increase further if the Utility chooses to remediate beyond

regulatory requirements. Although the Utility has provided

for known environmental obligations that are probable and

reasonably estimable, estimated costs may vary significantly

from actual costs, and the amount of additional future costs

may be material to results of operations in the period in

which they are recognized.

Legal and Regulatory Matters

PG&E Corporation and the Utility are subject to various

laws and regulations and, in the normal course of business,

are named as parties in a number of claims and lawsuits.

In addition, penalties may be incurred for failure to comply

with federal, state, or local laws and regulations. PG&E

Corporation and the Utility record a provision for a loss

contingency when it is both probable that a loss has been

incurred and the amount of the loss can be reasonably

estimated. PG&E Corporation and the Utility evaluate

the range of reasonably estimated losses and record a

provision based on the lower end of the range, unless an

amount within the range is a better estimate than any other

amount. The assessment of whether a loss is probable

or reasonably possible, and whether the loss or a range

of loss is estimable, often involves a series of complex

judgments about future events. Loss contingencies are

reviewed quarterly and estimates are adjusted to reflect

the impact of all known information, such as negotiations,

discovery, settlements and payments, rulings, advice of

legal counsel, and other information and events pertaining

to a particular matter. PG&E Corporation’s and the Utility’s

policy is to exclude anticipated legal costs from the

provision for loss and expense these costs as incurred.

(See “Enforcement and Litigation Matters” and “Legal and

Regulatory Contingencies” in Note 13 of the Notes to the

Consolidated Financial Statements in Item 8.)

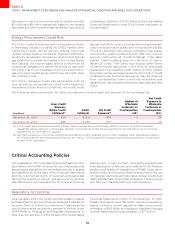

Asset Retirement Obligations

PG&E Corporation and the Utility account for an ARO at

fair value in the period during which the legal obligation

is incurred if a reasonable estimate of fair value and its

settlement date can be made. At the time of recording an

ARO, the associated asset retirement costs are capitalized

as part of the carrying amount of the related long-lived

asset. The Utility recognizes a regulatory asset or liability for

the timing dierences between the recognition of expenses

and costs recovered through the ratemaking process. (See

Notes 2 and 3 of the Notes to the Consolidated Financial

Statements in Item 8.)

To estimate its liability, the Utility uses a discounted

cash flow model based upon significant estimates and

assumptions about future decommissioning costs, inflation

rates, and the estimated date of decommissioning. The

estimated future cash flows are discounted using a

credit-adjusted risk-free rate that reflects the risk associated

with the decommissioning obligation.

At December 31, 2015, the Utility’s recorded ARO for the

estimated cost of retiring these long-lived assets was

$3.6 billion. Changes in these estimates and assumptions

could materially aect the amount of the recorded ARO

for these assets. For example, a premature shutdown of

the nuclear facilities at Diablo Canyon would increase

the likelihood of an earlier start to decommissioning and

cause an increase in the ARO. If the inflation adjustment

or discount rate increased 25 basis points, the result would

be an immaterial impact to ARO.

Pension and Other Postretirement Benefit Plans

PG&E Corporation and the Utility sponsor a

non-contributory defined benefit pension plan for eligible

employees as well as contributory postretirement health

care and medical plans for eligible retirees and their

eligible dependents, and non-contributory postretirement

life insurance plans for eligible employees and retirees.

Adjustments to the pension and other benefit obligation are

based on the dierences between actuarial assumptions

and actual plan results. These amounts are deferred in

accumulated other comprehensive income (loss) and

amortized into income on a gradual basis. The dierences

between pension benefit expense recognized in accordance

with GAAP and amounts recognized for ratemaking

purposes are recorded as regulatory assets or liabilities as

amounts are probable of recovery from customers. To the

extent the other benefits are in an overfunded position,

the Utility records a regulatory liability. (See Note 3 of the

Notes to the Consolidated Financial Statements in Item 8.)

The pension and other postretirement benefit obligations

are calculated using actuarial models as of the December31

measurement date. The significant actuarial assumptions

used in determining pension and other benefit obligations

include the discount rate, the average rate of future

compensation increases, the health care cost trend rate

and the expected return on plan assets. PG&E Corporation

and the Utility review these assumptions on an annual basis

and adjust them as necessary. While PG&E Corporation

and the Utility believe that the assumptions used are

appropriate, significant dierences in actual experience,

plan changes or amendments, or significant changes in

assumptions may materially aect the recorded pension