PG&E 2015 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2015 PG&E annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

39

PART II

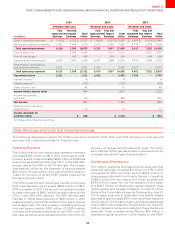

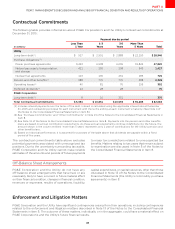

ITEM 7.MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

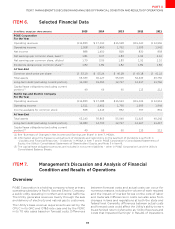

ITEM 6. Selected Financial Data

(inmillionsexceptpershareamounts)

PG&ECorporation

FortheYear

Operatingrevenues

Operatingincome

Netincome

Netearningspercommonsharebasic()

Netearningspercommonsharediluted

Dividendsdeclaredpercommonshare()

AtYear-End

Commonstockpricepershare

Totalassets

Long-termdebt(excludingcurrentportion)

Capitalleaseobligations(excludingcurrent

portion)()

PacificGasandElectricCompany

FortheYear

Operatingrevenues

Operatingincome

Incomeavailableforcommonstock

AtYear-End

Totalassets

Long-termdebt(excludingcurrentportion)

Capitalleaseobligations(excludingcurrent

portion)()

() See“SummaryofChangesinNetIncomeandEarningsperShare”inItemMD&A

() Informationaboutthefrequencyandamountofdividendsandrestrictionsonthepaymentofdividendsissetforthin

“LiquidityandFinancialResources–Dividends”inMD&AinItemandinPG&ECorporation’sConsolidatedStatementsof

EquitytheUtility’sConsolidatedStatementsofShareholders’EquityandNoteinItem

() Thecapitalleaseobligationsamountsareincludedinnoncurrentliabilities–otherinPG&ECorporation’sandtheUtility’s

ConsolidatedBalanceSheets

ITEM 7. Management’s Discussion and Analysis of Financial

Condition and Results of Operations

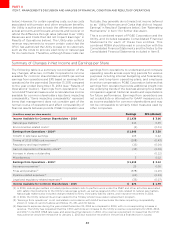

Overview

PG&E Corporation is a holding company whose primary

operating subsidiary is Pacific Gas and Electric Company,

a public utility operating in northern and central California.

The Utility generates revenues mainly through the sale

and delivery of electricity and natural gas to customers.

The Utility’s base revenue requirements are set by the

CPUC in its GRC and GT&S rate case and by the FERC

in its TO rate cases based on forecast costs. Dierences

between forecast costs and actual costs can occur for

numerous reasons, including the volume of work required

and the impact of market forces on the cost of labor

and materials. Dierences in costs can also arise from

changes in laws and regulations at both the state and

federal level. Generally, dierences between actual costs

and forecast costs could aect the Utility’s ability to earn

its authorized return (referred to as “Utility Revenues and

Costs that Impacted Earnings” in Results of Operations