PG&E 2015 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2015 PG&E annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

85

PART II

ITEM 8.FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA

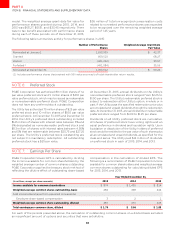

() AtDecemberinterestratesonthesebondswere

() EachseriesofthesebondsissupportedbyaseparateletterofcreditInDecemberthelettersofcreditwereextended

toDecemberAlthoughthestatedmaturitydateiseachserieswillremainoutstandingonlyiftheUtility

extendsorreplacestheletterofcreditrelatedtotheseriesorotherwiseobtainsconsentfromtheissuertothecontinuation

oftheserieswithoutacreditfacility

() TheUtilityhasobtainedcreditsupportfromaninsurancecompanyforthesebonds

() Eachseriesofthesebondsissupportedbyaseparatedirect-payletterofcreditSeriesCandDlettersofcreditexpireon

DecembertocoincidewiththematurityoftheunderlyingbondsSubjecttocertainrequirementstheUtilitymay

choosenottoprovideacreditfacilitywithoutissuerconsent

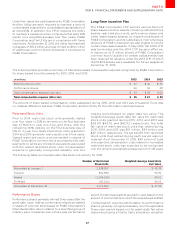

Pollution Control Bonds

The California Pollution Control Financing Authority and the

California Infrastructure and Economic Development Bank

have issued various series of fixed rate and multi-modal

tax-exempt pollution control bonds for the benefit of the

Utility. Substantially all of the net proceeds of the pollution

control bonds were used to finance or refinance pollution

control and sewage and solid waste disposal facilities at the

Geysers geothermal power plant or at the Utility’s Diablo

Canyon nuclear power plant. In 1999, the Utility sold all bond-

financed facilities at the non-retired units of the Geysers

geothermal power plant to Geysers Power Company, LLC

pursuant to purchase and sale agreements stating that

Geysers Power Company, LLC will use the bond-financed

facilities solely as pollution control facilities for so long as

any tax-exempt pollution control bonds issued to finance

the Geysers project are outstanding. Except for components

that may have been abandoned in place or disposed of as

scrap or that are permanently non-operational, the Utility

has no knowledge that Geysers Power Company, LLC

intends to cease using the bond-financed facilities solely

as pollution control facilities.

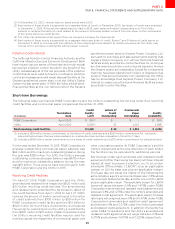

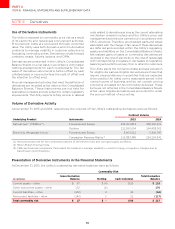

Short-term Borrowings

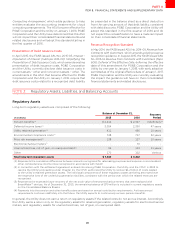

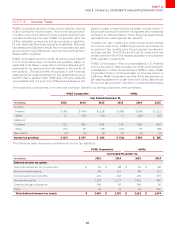

The following table summarizes PG&E Corporation’s and the Utility’s outstanding borrowings under their revolving

credit facilities and commercial paper programs at December 31, 2015:

(inmillions)

Termination

Date

Credit

Facility

Limit

Lettersof

Credit

Outstanding

Commercial

Paper

Outstanding

Facility

Availability

PG&ECorporation April () - -

Utility April ()

Totalrevolvingcreditfacilities

() Includesamillionlendercommitmenttotheletterofcreditsublimitsandamillioncommitmentfor“swingline”

loansdefinedasloansthataremadeavailableonasame-daybasisandarerepayableinfullwithindays

() Includesamillionlendercommitmenttotheletterofcreditsublimitsandamillioncommitmentforswinglineloans

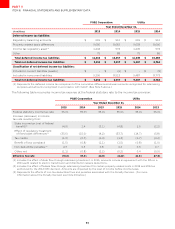

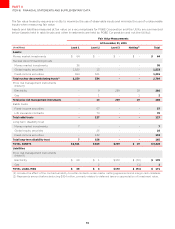

For the year ended December 31, 2015, PG&E Corporation’s

average outstanding commercial paper balance was

$64million and the maximum outstanding balance during

the year was $128 million. For 2015, the Utility’s average

outstanding commercial paper balance was $678 million

and the maximum outstanding balance during the year

was $1.5 billion. There were no bank borrowings for both

PG&E Corporation and the Utility in 2015.

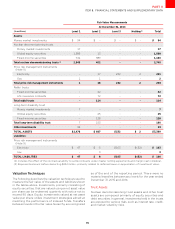

Revolving Credit Facilities

On April 27, 2015, PG&E Corporation and the Utility

amended and restated their respective $300 million and

$3.0 billion revolving credit facilities. The amendments

and restatements extended the termination dates of

the credit facilities from April 1, 2019 to April 27, 2020,

reduced the amount of lender commitments to the letter

of credit sublimits from $100 million to $50 million for

PG&E Corporation’s credit facility and from $1.0 billion to

$500 million for the Utility’s credit facility, and reduced

the swingline commitment on the Utility’s credit facility

from $300 million to $75 million. PG&E Corporation’s and

the Utility’s revolving credit facilities may be used for

working capital, the repayment of commercial paper, and

other corporate purposes. At PG&E Corporation’s and the

Utility’s request and at the sole discretion of each lender,

the facilities may be extended for additional periods.

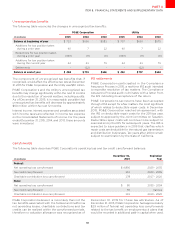

Borrowings under each amended and restated credit

agreement (other than swing line loans) will bear interest

based, at each borrower’s election, on (1) a London

Interbank Oered Rate (“LIBOR”) plus an applicable

margin or (2) the base rate plus an applicable margin.

The base rate will equal the higher of the following:the

administrative agent’s announced base rate, 0.5% above

the overnight federal funds rate, and the one-month LIBOR

plus an applicable margin. The applicable margin for LIBOR

loans will range between 0.9% and 1.475% under PG&E

Corporation’s amended and restated credit agreement and

between 0.8% and 1.275% under the Utility’s amended and

restated credit agreement. The applicable margin for base

rate loans will range between 0% and 0.475% under PG&E

Corporation’s amended and restated credit agreement

and between 0% and 0.275% under the Utility’s amended

and restated credit agreement. In addition, the facility fee

under PG&E Corporation’s and the Utility’s amended and

restated credit agreements will range between 0.1% and

0.275% and between 0.075% and 0.225%, respectively.