PG&E 2015 Annual Report Download - page 122

Download and view the complete annual report

Please find page 122 of the 2015 PG&E annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

114

PART II

ITEM 8.FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA

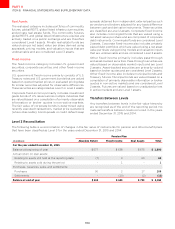

a QF under federal law. Several of these agreements are

treated as capital leases. At December 31, 2015 and 2014, net

capital leases reflected in property, plant, and equipment

on the Consolidated Balance Sheets were $54 million

and $74 million including accumulated amortization of

$147million and $128 million, respectively. The present value

of the future minimum lease payments due under these

agreements included $19 million and $20 million in Current

Liabilities and $35 million and $54 million in Noncurrent

Liabilities on the Consolidated Balance Sheet, respectively.

As of December 31, 2015, QF contracts in operation expire

at various dates between 2016 and 2028. In addition, the

Utility has agreements with various irrigation districts and

water agencies to purchase hydroelectric power.

The costs incurred for all power purchases and electric

capacity amounted to $3.5 billion in 2015, $3.6 billion in

2014, and $3.0 billion in 2013.

Natural Gas Supply, Transportation, and Storage

Commitments

The Utility purchases natural gas directly from producers

and marketers in both Canada and the United States to

serve its core customers and to fuel its owned-generation

facilities. The Utility also contracts for natural gas

transportation from the points at which the Utility takes

delivery (typically in Canada, the US Rocky Mountain supply

area, and the southwestern United States) to the points

at which the Utility’s natural gas transportation system

begins. These agreements expire at various dates between

2016 and 2026. In addition, the Utility has contracted for

natural gas storage services in northern California in order

to more reliably meet customers’ loads.

Costs incurred for natural gas purchases, natural gas

transportation services, and natural gas storage, which

include contracts with terms of less than 1 year, amounted

to $0.9 billion in 2015, $1.4 billion in 2014, and $1.6 billion

in 2013.

Nuclear Fuel Agreements

The Utility has entered into several purchase agreements

for nuclear fuel. These agreements expire at various dates

between 2016 and 2025 and are intended to ensure long-

term nuclear fuel supply. The Utility relies on a number of

international producers of nuclear fuel in order to diversify

its sources and provide security of supply. Pricing terms

are also diversified, ranging from market-based prices to

base prices that are escalated using published indices.

Payments for nuclear fuel amounted to $128 million in

2015, $105 million in 2014, and $162 million in 2013.

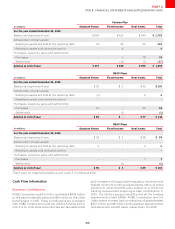

Other Commitments

PG&E Corporation and the Utility have other commitments related to operating leases (primarily oce facilities and

land), which expire at various dates between 2016 and 2052. At December 31, 2015, the future minimum payments

related to these commitments were as follows:

(inmillions) OperatingLeases

Thereafter

Totalminimumleasepayments

Payments for other commitments related to operating

leases amounted to $41 million in 2015, $42 million in 2014,

and $40 million in 2013. Certain leases on oce facilities

contain escalation clauses requiring annual increases in

rent. The rentals payable under these leases may increase

by a fixed amount each year, a percentage of increase over

base year, or the consumer price index. Most leases contain

extension operations ranging between one and five years.