PG&E 2015 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2015 PG&E annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

57

PART II

ITEM 7.MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

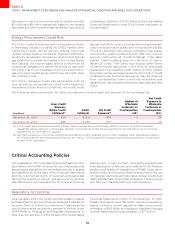

Determining probability requires significant judgment

by management and includes, but is not limited to,

consideration of testimony presented in regulatory hearings,

proposed regulatory decisions, final regulatory orders,

and the strength or status of applications for rehearing

or state court appeals. For some of the Utility’s regulatory

assets, including utility retained generation, the Utility

has determined that the costs are recoverable based on

specific approval from the CPUC. The Utility also records a

regulatory asset when a mechanism is in place to recover

current expenditures and historical experience indicates

that recovery of incurred costs is probable, such as the

regulatory assets for pension benefits; deferred income

tax; price risk management; and unamortized loss, net of

gain, on reacquired debt. The CPUC has not denied the

recovery of any material costs previously recognized by

the Utility as regulatory assets for the periods presented.

If the Utility determined that it is no longer probable that

regulatory assets would be recovered or reflected in future

rates, or if the Utility ceased to be subject to rate regulation,

the regulatory assets would be charged against income

in the period in which that determination was made. If

regulatory accounting did not apply, the Utility’s future

financial results could become more volatile as compared

to historical financial results due to the dierences in the

timing of expense or revenue recognition.

In addition, regulatory accounting standards require

recognition of a loss if it becomes probable that capital

expenditures will be disallowed for ratemaking purposes and

if a reasonable estimate of the amount of the disallowance

can be made. Such assessments require significant judgment

by management regarding probability of recovery, as

described above, and the ultimate cost of construction of

capital assets. The Utility records a loss to the extent capital

costs are expected to exceed the amount to be recovered.

The Utility records a provision based on its best estimate; to

the extent there is a high degree of uncertainty in the Utility’s

forecast, it will record a provision based on the lower end of

the range of possible losses. The Utility’s capital forecasts

involve a series of complex judgments regarding detailed

project plans, estimates included in third-party contracts,

historical cost experience for similar projects, permitting

requirements, environmental compliance standards, and

a variety of other factors. The Utility recorded charges of

$407 million in 2015 for estimated capital spending that is

probable of disallowance related to the Penalty Decision.

Management will continue to evaluate and estimate capital

spending that may be probable of disallowance in future

periods. These estimates are subject to adjustment based

on the final 2015 GT&S rate case decision which is expected

in 2016. The Utility also recorded $116 million and $196

million in 2014 and 2013, respectively, for PSEP capital costs

that are expected to exceed the amount to be recovered.

See “Enforcement and Litigation Matters” in Note 13 of

the Notes to the Consolidated Financial Statements in

Item 8. Management will continue to periodically assess

its safety-related capital costs and the related CPUC

regulatory proceedings, and further charges could be

required in future periods.

Loss Contingencies

Environmental Remediation Liabilities

The Utility is subject to loss contingencies pursuant to

federal and California environmental laws and regulations

that in the future may require the Utility to pay for

environmental remediation at sites where it has been, or

may be, a potentially responsible party. Such contingencies

may exist for the remediation of hazardous substances

at various potential sites, including former manufactured

gas plant sites, power plant sites, gas compressor stations,

and sites used by the Utility for the storage, recycling, or

disposal of potentially hazardous materials, even if the

Utility did not deposit those substances on the site.

The Utility generally commences the environmental

remediation assessment process upon notification from

federal or state agencies, or other parties, of a potential

site requiring remedial action. (In some instances, the

Utility may initiate action to determine its remediation

liability for sites that it no longer owns in cooperation with

regulatory agencies. For example, the Utility has begun a

program related to certain former manufactured gas plant

sites.) Based on such notification, the Utility completes an

assessment of the potential site and evaluates whether it

is probable that a remediation liability has been incurred.

The Utility records an environmental remediation liability

when site assessments indicate remediation is probable

and it can reasonably estimate the loss or a range of

possible losses. Given the complexities of the legal and

regulatory environment and the inherent uncertainties

involved in the early stages of a remediation project, the

process for estimating remediation liabilities is subjective

and requires significant judgment. Key factors evaluated

in developing cost estimates include the extent and

types of hazardous substances at a potential site, the

range of technologies that can be used for remediation,

the determination of the Utility’s liability in proportion to

other responsible parties, and the extent to which such

costs are recoverable from third parties.

When possible, the Utility estimates costs using site-specific

information, but also considers historical experience for

costs incurred at similar sites depending on the level of

information available. Estimated costs are composed

of the direct costs of the remediation eort and the

costs of compensation for employees who are expected

to devote a significant amount of time directly to the

remediation eort. These estimated costs include remedial

site investigations, remediation actions, operations and

maintenance activities, post remediation monitoring, and

the costs of technologies that are expected to be approved

to remediate the site. Remediation eorts for a particular

site generally extend over a period of several years. During

this period, the laws governing the remediation process