PG&E 2015 Annual Report Download - page 114

Download and view the complete annual report

Please find page 114 of the 2015 PG&E annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

106

PART II

ITEM 8.FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA

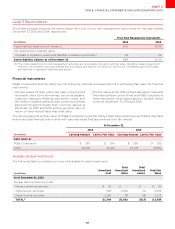

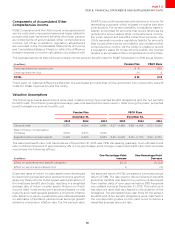

Benefits Payments and Receipts

As of December 31, 2015, the estimated benefits expected to be paid and the estimated federal subsidies expected

to be received in each of the next five fiscal years, and in aggregate for the five fiscal years thereafter, are as follows:

(inmillions) PensionPlan PBOPPlans FederalSubsidy

()

()

()

()

()

Thereafterinthesucceedingfiveyears ()

There were no material dierences between the estimated

benefits expected to be paid by PG&E Corporation and

paid by the Utility for the years presented above. There

were also no material dierences between the estimated

subsidies expected to be received by PG&E Corporation

and received by the Utility for the years presented above.

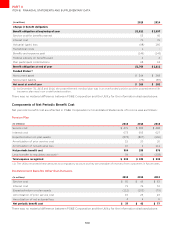

Retirement Savings Plan

PG&E Corporation sponsors a retirement savings plan,

which qualifies as a 401(k) defined contribution benefit plan

under the Internal Revenue Code 1986, as amended. This

plan permits eligible employees to make pre-tax and after-

tax contributions into the plan, and provide for employer

contributions to be made to eligible participants. Total

expenses recognized for defined contribution benefit plans

reflected in PG&E Corporation’s Consolidated Statements

of Income were $89 million, $80 million, and $71 million

in 2015, 2014, and 2013, respectively.

There were no material dierences between the employer

contribution expense for PG&E Corporation and the Utility

for the years presented above.

NOTE 12: Related Party Agreements and Transactions

The Utility and other subsidiaries provide and receive

various services to and from their parent, PG&E Corporation,

and among themselves. The Utility and PG&E Corporation

exchange administrative and professional services in

support of operations. Services provided directly to

PG&E Corporation by the Utility are priced at the higher

of fully loaded cost (i.e., direct cost of good or service

and allocation of overhead costs) or fair market value,

depending on the nature of the services. Services provided

directly to the Utility by PG&E Corporation are generally

priced at the lower of fully loaded cost or fair market value,

depending on the nature and value of the services. PG&E

Corporation also allocates various corporate administrative

and general costs to the Utility and other subsidiaries using

agreed-upon allocation factors, including the number

of employees, operating and maintenance expenses,

total assets, and other cost allocation methodologies.

Management believes that the methods used to allocate

expenses are reasonable and meet the reporting and

accounting requirements of its regulatory agencies.

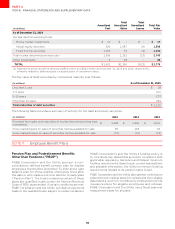

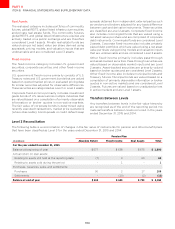

The Utility’s significant related party transactions were:

YearEndedDecember

(inmillions)

Utilityrevenuesfrom

AdministrativeservicesprovidedtoPG&ECorporation

Utilityexpensesfrom

AdministrativeservicesreceivedfromPG&ECorporation

UtilityemployeebenefitduetoPG&ECorporation

At December 31, 2015 and 2014, the Utility had receivables

of $22 million and $17 million, respectively, from PG&E

Corporation included in accounts receivable – other and

other noncurrent assets – other on the Utility’s Consolidated

Balance Sheets, and payables of $21 million and $20million,

respectively, to PG&E Corporation included in accounts

payable – other on the Utility’s Consolidated Balance Sheets.