PG&E 2015 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2015 PG&E annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

48

PART II

ITEM 7.MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

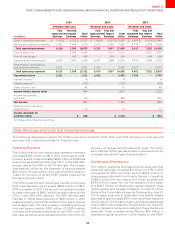

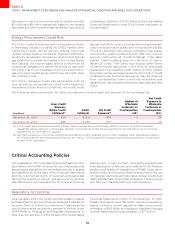

Operating Activities

The Utility’s cash flows from operating activities primarily

consist of receipts from customers less payments of

operating expenses, other than expenses such as

depreciation that do not require the use of cash. During

2015, net cash provided by operating activities increased by

$101 million compared to 2014. This increase was primarily

due to higher base revenue collections authorized in the

2014 GRC and lower purchased power costs (see “Cost of

Electricity” under “Results of Operations – Utility Revenues

and Costs that did not Impact Earnings” above), oset by

the payment of a $300 million fine to the State General

Fund as required by the Penalty Decision. During 2014,

net cash provided by operating activities increased by

$203 million compared to 2013. This increase was primarily

due to tax refunds received during 2014 compared to

tax payments made during 2013 and additional collateral

returned to the Utility in 2014 as compared to 2013, oset

by higher purchased power costs (see “Cost of Electricity”

under “Results of Operations – Utility Revenues and Costs

that did not Impact Earnings” above).

Future cash flow from operating activities will be aected

by various factors, including:

đ

the shareholder-funded bill credit of $400 million to

natural gas customers in 2016, as required by the Penalty

Decision (see “Enforcement and Litigation Matters”

in Note 13 of the Notes to the Consolidated Financial

Statements);

đ

the timing and amounts of other fines or penalties

that may be imposed in connection with the

criminal prosecution of the Utility and the remaining

investigations and other enforcement matters (see

“Enforcement and Litigation Matters” in Note 13 of

the Notes to the Consolidated Financial Statements

in Item 8 below);

đ

the timing and outcome of ratemaking proceedings,

including the 2015 GT&S rate case;

đ

the timing and amount of costs the Utility incurs, but

does not recover, associated with its natural gas system

(including costs to implement remedial measures and

$850 million to pay for designated pipeline safety projects

and programs, as required by the Penalty Decision);

đ

the timing and amount of tax payments (including the

bonus depreciation extension), tax refunds, net collateral

payments, and interest payments;

đthe timing of the resolution of the Chapter 11 disputed

claims and the amount of principal and interest on these

claims that the Utility will be required to pay.

Investing Activities

Net cash used in investing activities increased

by $412million during 2015 as compared to 2014

primarily due to an increase of $340 million in capital

expenditures and an increase in net purchases of

nuclear decommissioning trust investments in 2015

as compared to net proceeds associated with sales of

nuclear decommissioning trust investments in 2014.

Net cash used in investing activities decreased by $343

million during 2014 as compared to 2013 primarily due

a decrease of $374 million in capital expenditures. This

decrease was primarily due to lower PSEP-related capital

expenditures and the absence of additional investment

in the Utility’s photovoltaic program.

Future cash flows used in investing activities are

largely dependent on the timing and amount of capital

expenditures. The Utility estimates that it will incur between

$5.4 billion and $5.6 billion in 2016.

Financing Activities

During 2015, net cash provided by financing activities

increased by $325 million as compared to 2014. During

2014, net cash provided by financing activities decreased

by $427 million as compared to 2013. Cash provided by

or used in financing activities is driven by the Utility’s

financing needs, which depend on the level of cash

provided by or used in operating activities, the level

of cash provided by or used in investing activities, the

conditions in the capital markets, and the maturity date

of existing debt instruments. The Utility generally utilizes

long-term debt issuances and equity contributions from

PG&E Corporation to maintain its CPUC-authorized

capital structure, and relies on short-term debt to fund

temporary financing needs.