PG&E 2015 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2015 PG&E annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

44

PART II

ITEM 7.MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

The Utility’s operating and maintenance expenses that

impacted earnings decreased $127 million or 3% in 2014

compared to 2013, primarily due to lower third-party

claims and associated legal costs of $117 million resulting

from the settlement of all outstanding third-party claims,

lower disallowed capital expenditures of $80 million and

lower insurance recoveries for third-party claims and

associated legal costs of $42 million related to the San

Bruno accident. These decreases were oset by higher

benefit-related expenses and other operating expenses

of $120 million in 2014 as compared to 2013.

Depreciation, Amortization, and Decommissioning

The Utility’s depreciation, amortization, and

decommissioning expenses increased $179 million or 7%

in 2015 compared to 2014 and $355 million or 17% in 2014

compared to 2013. In 2015, the increase was primarily due

to the impact of capital additions and higher depreciation

rates as authorized by the FERC in the TO rate case. In

2014, the increase was primarily due to higher depreciation

rates as authorized by the CPUC in the 2014 GRC decision

and higher nuclear decommissioning expense reflecting

the year-to-date increase as authorized by the CPUC in the

nuclear decommissioning triennial proceeding. Additionally,

depreciation, amortization, and decommissioning expenses

were impacted by an increase in capital additions during

2014 as compared to 2013.

Interest Expense

The Utility’s interest expenses increased by $43 million in

the year ended December 31, 2015 compared to the same

period in 2014, primarily due to the issuance of additional

long-term debt. There were no material changes to interest

expense in the year ended December 31, 2014 compared

to the same period in 2013.

Interest Income and Other Income, Net

There were no material changes to interest income and

other income, net for the periods presented.

Income Tax Provision

The Utility’s revenue requirements for the 2014 GRC

decision period reflects flow-through ratemaking

for income tax expense benefits attributable to the

accelerated recognition of repair costs and certain

other property-related costs for federal tax purposes.

PG&E Corporation and the Utility’s eective tax rates

for 2015 are lower as compared to 2014 and for 2014

as compared to 2013 and are expected to remain lower

than the statutory rate in 2016 due to these temporary

dierences.

The Utility’s income tax provision decreased $403 million

or 105% in 2015 as compared to 2014. This is primarily

the result of the statutory tax eect, $397 million, of the

lower income before income taxes in 2015 as compared

to 2014. The lower eective tax rate is the result of the tax

benefits from property-related timing dierences applied

to this lower income before income taxes.

The Utility’s income tax provision increased $58 million or

18% in 2014 as compared to 2013 primarily due to higher

income before income taxes, partially oset by certain

reductions in tax expense for flow-through treatment as

discussed above.

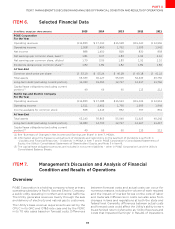

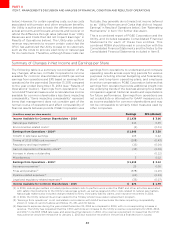

The following table reconciles the income tax expense at the federal statutory rate to the income tax provision:

Federalstatutoryincometaxrate

Increase(decrease)inincometaxrateresultingfrom

State income tax (net of federal benefit)(1) () ()

Eect of regulatory treatment of fixed asset dierences(2) () () ()

Tax credits () () ()

Benefit of loss carryback () () ()

Non-deductible penalties(3)

Other, net () ()

Eectivetaxrate ()

() Includestheeffectofstateflow-throughratemakingtreatmentInamountsreflectanagreementwiththeIRSona

auditrelatedtoelectrictransmissionanddistributionrepairsdeductions

() Includestheeffectoffederalflow-throughratemakingtreatmentforcertainproperty-relatedcostsinandas

authorizedbytheGRCdecisionAmountsareimpactedbythelevelofincomebeforeincometaxes

() Representstheeffectsofnon-taxdeductiblefinesandpenaltiesassociatedwiththePenaltyDecisionFormoreinformation

aboutthePenaltyDecisionsee“EnforcementandLitigationMatters”inNoteoftheNotestotheConsolidatedFinancial

StatementsinItem