PG&E 2015 Annual Report Download - page 111

Download and view the complete annual report

Please find page 111 of the 2015 PG&E annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

103

PART II

ITEM 8.FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA

Fair Value Measurements

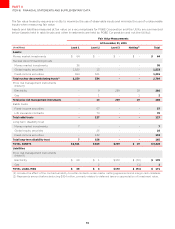

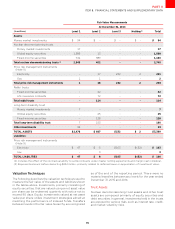

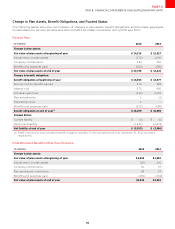

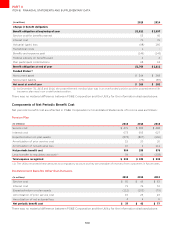

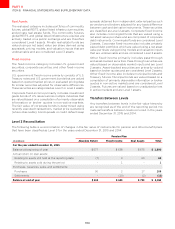

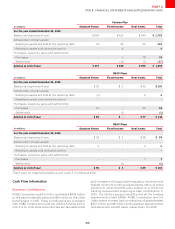

The following tables present the fair value of plan assets for pension and other benefits plans by major asset category

at December 31, 2015 and 2014.

FairValueMeasurements

AtDecember

(inmillions) Level Level Level Total Level Level Level Total

PensionPlan

Short-terminvestments - -

Globalequity - -

Absolutereturn - - - -

Realassets - -

Fixed-income

Total

PBOPPlans

Short-terminvestments - - - -

Globalequity - -

Absolutereturn - - - -

Realassets - -

Fixed-income -

Total

TOTALPLANASSETSATFAIRVALUE

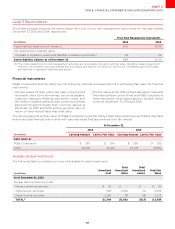

In addition to the total plan assets disclosed at fair value in the table above, the trusts had other net assets of $13million

and $24 million at December 31, 2015 and 2014, respectively, comprised primarily of cash, accounts receivable, deferred

taxes, and accounts payable.

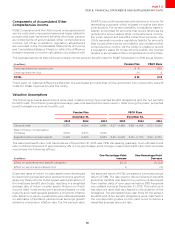

Valuation Techniques

The following describes the valuation techniques used to

measure the fair value of the assets and liabilities shown

in the table above. All investments that are valued using

a net asset value per share can be redeemed quarterly

with a notice not to exceed 90 days.

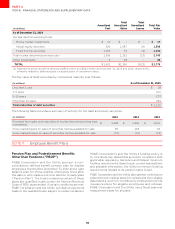

Short-Term Investments

Short-term investments consist primarily of commingled

funds across government, credit, and asset-backed sectors.

These securities are categorized as Level 1 and Level 2 assets.

Global Equity

The global equity category includes investments in common

stock, equity-index futures, and commingled funds comprised

of equity securities spread across multiple industries and

regions of the world. Equity investments in common stock

are actively traded on public exchanges and are therefore

considered Level 1 assets. These equity investments are

generally valued based on unadjusted prices in active markets

for identical securities. Equity-index futures arevalued

based on unadjusted prices in active markets and are Level

1 assets. Commingled equity funds are valued using a net

asset value per share and are maintained by investment

companies for large institutional investors and are not publicly

traded. Commingled equity funds are comprised primarily

of underlying equity securities that are publicly traded on

exchanges, and price quotes for the assets held by these

funds are readily observable and available. Commingled

equity funds are categorized as Level 1 and Level 2 assets.

Absolute Return

The absolute return category includes portfolios of hedge

funds that are valued using a net asset value per share

based on a variety of proprietary and non-proprietary

valuation methods, including unadjusted prices for publicly-

traded securities in active markets. Hedge funds are

considered Level 3 assets.