PG&E 2015 Annual Report Download - page 121

Download and view the complete annual report

Please find page 121 of the 2015 PG&E annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

113

PART II

ITEM 8.FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA

Interest accrues on the remaining net disputed claims

liability at the FERC-ordered rate, which is higher than

the rate earned by the Utility on the escrow balance.

Although the Utility has been collecting the dierence

between the accrued interest and the earned interest

from customers in rates, these collections are not held

in escrow. If the amount of accrued interest is greater

than the amount of interest ultimately determined to be

owed on the remaining net disputed claims liability, the

Utility would refund to customers any excess interest

collected. The amount of any interest that the Utility may

be required to pay will depend on the final determined

amount of the remaining net disputed claims liability and

when such interest is paid.

While the FERC and judicial proceedings are pending, the

Utility has pursued, and continues to pursue, settlements

with electricity suppliers. The Utility has entered into a

number of settlement agreements with various electricity

suppliers to resolve some of these disputed claims and to

resolve the Utility’s refund claims against these electricity

suppliers. Under these settlement agreements, amounts

payable by the parties are, in some instances, subject to

adjustment based on the outcome of the various refund

oset and interest issues being considered by the FERC.

Any net refunds, claim osets, or other credits that the

Utility receives from electricity suppliers either through

settlement or through the conclusion of the various FERC

and judicial proceedings are refunded to customers through

rates in future periods.

In July 2014, a settlement agreement between the Utility

and an electric supplier became eective, resolving a

portion of the Utility’s net disputed claims and resulting

in refunds to customers of $312 million. No significant

settlement agreements were reached in 2015. The Utility

is uncertain when and how the remaining net disputed

claims liability will be resolved.

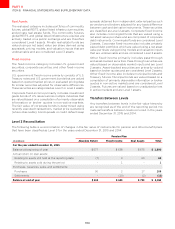

Purchase Commitments

The following table shows the undiscounted future expected obligations under power purchase agreements that have

been approved by the CPUC and have met specified construction milestones as well as undiscounted future expected

payment obligations for natural gas supplies, natural gas transportation, natural gas storage, and nuclear fuel as of

December 31, 2015:

PowerPurchaseAgreements

(inmillions)

Renewable

Energy

Conventional

Energy Other

Natural

Gas

Nuclear

Fuel Total

Thereafter

TOTALPURCHASECOMMITMENTS

Third-Party Power Purchase Agreements

In the ordinary course of business, the Utility enters

into various agreements, including renewable energy

agreements, QF agreements, and other power purchase

agreements to purchase power and electric capacity. The

price of purchased power may be fixed or variable. Variable

pricing is generally based on the current market price of

either natural gas or electricity at the date of delivery.

Renewable Energy Power Purchase Agreements

In order to comply with California’s RPS requirements,

the Utility is required to deliver renewable energy to its

customers at a gradually increasing rate. The Utility has

entered into various agreements to purchase renewable

energy to help meet California’s requirement. The Utility’s

obligations under a significant portion of these agreements

are contingent on the third party’s construction of

new generation facilities, which are expected to grow

significantly. As of December 31, 2015, renewable energy

contracts expire at various dates between 2016 and 2043.

Conventional Energy Power Purchase Agreements

The Utility has entered into many power purchase

agreements for conventional generation resources,

which include tolling agreements and resource adequacy

agreements. The Utility’s obligation under a portion of

these agreements is contingent on the third parties’

development of new generation facilities to provide capacity

and energy products to the Utility. As of December 31,

2015, these power purchase agreements expire at various

dates between 2016 and 2033.

Other Power Purchase Agreements

The Utility has entered into agreements to purchase

energy and capacity with independent power producers

that own generation facilities that meet the definition of