PG&E 2015 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2015 PG&E annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

51

PART II

ITEM 7.MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

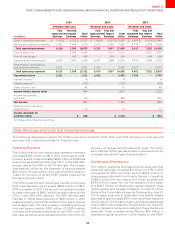

(inmillions)

Amounts

RequestedIn

theGRC

Application

Amounts

Currently

AuthorizedFor

Increase

Comparedto

Currently

Authorized

Amounts

LineofBusiness

Electricdistribution

Gasdistribution

Electricgeneration

Totalrevenuerequirements

CostCategory

Operationsandmaintenance

Customerservices

Administrativeandgeneral ()

LessRevenuecredits () () ()

Franchisefeestaxesotherthan

incomeandotheradjustments

Depreciation(includingcostsofassetremoval)

returnandincometaxes

Totalrevenuerequirements

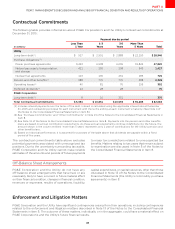

In its application, the Utility stated that over the 2017-

2019 GRC period the Utility plans to make average

annual capital investments of approximately $4 billion in

electric distribution, natural gas distribution and electric

generation infrastructure, and to improve safety, reliability,

and customer service. (These annual investments would

be incremental to the Utility’s capital expenditures for

electric and natural gas transmission infrastructure.) The

Utility also requested that the CPUC establish a ratemaking

mechanism that would increase the Utility’s authorized

revenues in 2018 and 2019, primarily to reflect increases

in rate base due to capital investments in infrastructure

and, to a lesser extent, anticipated increases in wages and

other expenses. The Utility estimates that this mechanism

would result in increases in revenue of $489 million in

2018 and an additional $390 million in 2019.

In October 2015, the Utility filed supplemental testimony

to reduce its original revenue requirement request by

approximately $17 million per year based on its forecast

that it will incur approximately $61 million for unrecoverable

costs to implement the remedies ordered in the Penalty

Decision.

On February 22, 2016 the Utility will file an update of its

forecasted increase, primarily to reflect the impact of

the recent five-year extension of the federal tax code

provisions regarding bonus depreciation.

According to the CPUC’s current procedural schedule,

testimony from the ORA and other parties is due

in April2016, evidentiary hearings are to be held this

summer, followed by a proposed decision to be released

in November 2016 and a final CPUC decision to be issued

in December 2016. The Utility has requested that the

CPUC issue an order directing that the authorized revenue

requirement changes be eective January 1, 2017, even if

the final decision is issued after that date.

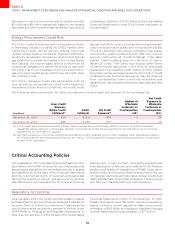

2015 Gas Transmission and Storage Rate Case

In the 2015 GT&S rate case, the Utility requested that

the CPUC authorize a 2015 revenue requirement of

$1.263billion to recover anticipated costs of providing

natural gas transmission and storage services, an increase

of $532million over currently authorized amounts. The

Utility also requested attrition increases of $83 million in

2016 and $142 million in 2017. The Utility requested that the

CPUC authorize the Utility’s forecast of its 2015 weighted

average rate base for its gas transmission and storage

business of $3.44 billion, which includes capital spending

above authorized levels for the prior rate case period.

The ORA has recommended a 2015 revenue requirement of

$1.044 billion, an increase of $329 million over authorized

amounts. TURN recommended that the Utility not recover

costs associated with hydrostatic testing for pipeline

segments placed in service after January 1, 1956, as well

as certain other work that TURN considers to be remedial.

TURN also recommended the disallowance of about

$200million of capital expenditures incurred over the

period 2011 through 2014 and recommended that about

$500 million of capital expenditures during this period be

subject to a reasonableness review and an independent

audit. TURN states that the Utility’s cost recovery should not

begin until the CPUC issues a decision on the independent

audit. On December 18, 2015, the ORA filed a motion in

the 2015 GT&S rate case for an Order to Show Cause