PG&E 2015 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2015 PG&E annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

89

PART II

ITEM 8.FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA

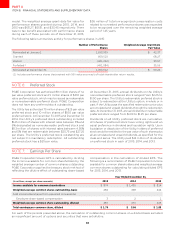

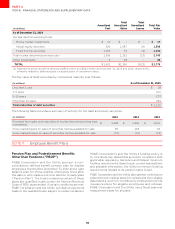

NOTE 8: Income Taxes

PG&E Corporation and the Utility use the liability method

of accounting for income taxes. The income tax provision

includes current and deferred income taxes resulting from

operations during the year. PG&E Corporation and the

Utility estimate current period tax expense in addition

to calculating deferred tax assets and liabilities. Deferred

tax assets and liabilities result from temporary tax and

accounting timing dierences, such as those arising from

depreciation expense.

PG&E Corporation and the Utility recognize a tax benefit

if it is more likely than not that a tax position taken or

expected to be taken in a tax return will be sustained upon

examination by taxing authorities based on the merits of

the position. The tax benefit recognized in the financial

statements is measured based on the largest amount of

benefit that is greater than 50% likely of being realized

upon settlement. As such, the dierence between a tax

position taken or expected to be taken in a tax return in

future periods and the benefit recognized and measured

pursuant to this guidance in the financial statements

represents an unrecognized tax benefit.

Investment tax credits are deferred and amortized

to income over time. PG&E Corporation amortizes its

investment tax credits over the projected investment

recovery period. The Utility amortizes its investment tax

credits over the life of the related property in accordance

with regulatory treatment.

PG&E Corporation files a consolidated U.S. federal

income tax return that includes the Utility and domestic

subsidiaries in which its ownership is 80% or more. PG&E

Corporation files a combined state income tax return in

California. PG&E Corporation and the Utility are parties to a

tax-sharing agreement under which the Utility determines

its income tax provision (benefit) on a stand-alone basis.

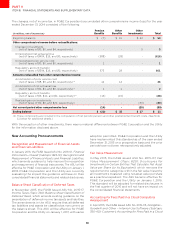

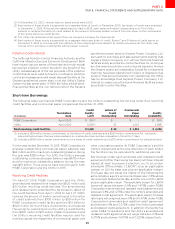

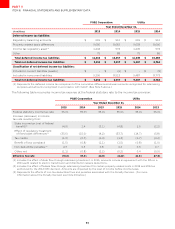

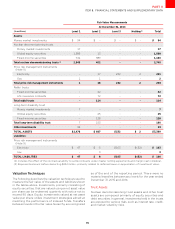

The significant components of income tax provision (benefit) by taxing jurisdiction were as follows:

PG&ECorporation Utility

YearEndedDecember

(inmillions)

Current

Federal () () () () () ()

State () () () ()

Deferred

Federal

State () () () ()

Taxcredits () () () () () ()

Incometaxprovision () ()

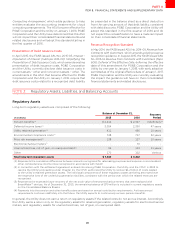

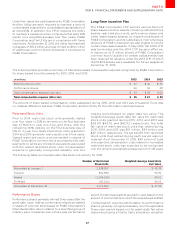

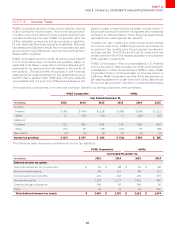

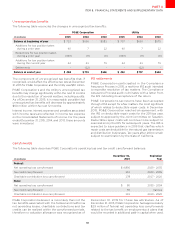

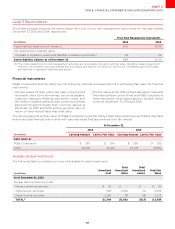

The following table describes net deferred income tax liabilities:

PG&ECorporation Utility

YearEndedDecember

(inmillions)

Deferredincometaxassets

Customeradvancesforconstruction

Environmentalreserve

Compensationandbenefits

Taxcarryforwards

Greenhousegasallowances

Other

Total deferred income tax assets