PG&E 2015 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2015 PG&E annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

78

PART II

ITEM 8.FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA

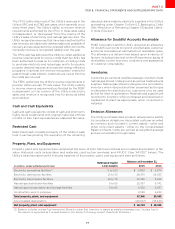

The Utility depreciates property, plant, and equipment

using the composite, or group, method of depreciation,

in which a single depreciation rate is applied to the gross

investment balance in a particular class of property.

This method approximates the straight line method of

depreciation over the useful lives of property, plant,

and equipment. The Utility’s composite depreciation

rates were 3.80% in 2015, 3.77% in 2014, and 3.51% in

2013. The useful lives of the Utility’s property, plant, and

equipment are authorized by the CPUC and the FERC,

and the depreciation expense is recovered through rates

charged to customers. Depreciation expense includes a

component for the original cost of assets and a component

for estimated cost of future removal, net of any salvage

value at retirement. Upon retirement, the original cost

of the retired assets, net of salvage value, is charged

against accumulated depreciation. The cost of repairs

and maintenance, including planned major maintenance

activities and minor replacements of property, is charged

to operating and maintenance expense as incurred.

AFUDC

AFUDC represents the estimated costs of debt

(i.e.,interest) and equity funds used to finance regulated

plant additions before they go into service and is

capitalized as part of the cost of construction. AFUDC

is recoverable from customers through rates over the life

of the related property once the property is placed in

service. AFUDC related to the cost of debt is recorded

as a reduction to interest expense. AFUDC related to

the cost of equity is recorded in other income. The

Utility recorded AFUDC related to debt and equity,

respectively, of $48 million and $107 million during

2015, $45 million and $100 million during 2014, and

$47million and $101million during 2013.

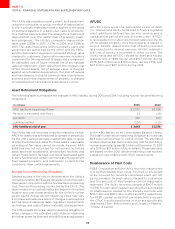

Asset Retirement Obligations

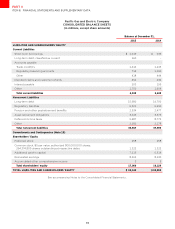

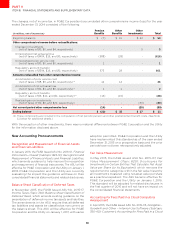

The following table summarizes the changes in ARO liability during 2015 and 2014, including nuclear decommissioning

obligations:

(inmillions)

AROliabilityatbeginningofyear

Revisioninestimatedcashflows ()

Accretion

Liabilitiessettled () ()

AROliabilityatendofyear

The Utility has not recorded a liability related to certain

ARO’s for assets that are expected to operate in perpetuity.

As the Utility cannot estimate a settlement date or range

of potential settlement dates for these assets, reasonable

estimates of fair value cannot be made. As such, ARO

liabilities are not recorded for retirement activities

associated with substations, photovoltaic facilities, and

certain hydroelectric facilities; removal of lead-based paint

in some facilities and certain communications equipment

from leased property; and restoration or land to the

conditions under certain agreements.

Nuclear Decommissioning Obligation

Detailed studies of the cost to decommission the Utility’s

nuclear generation facilities are generally conducted every

three years in conjunction with the Nuclear Decommissioning

Cost Triennial Proceeding conducted by the CPUC. The

decommissioning cost estimates are based on the plant

location and cost characteristics for the Utility’s nuclear

power plants. Actual decommissioning costs may vary

from these estimates as a result of changes in assumptions

such as decommissioning dates; regulatory requirements;

technology; and costs of labor, materials, and equipment.

The Utility adjusts its nuclear decommissioning obligation to

reflect changes in the estimated costs of decommissioning

its nuclear power facilities and records this as an adjustment

to the ARO liability on its Consolidated Balance Sheets.

The total nuclear decommissioning obligation accrued was

$2.5 billion at December 31, 2015 and 2014. The estimated

undiscounted nuclear decommissioning cost for the Utility’s

nuclear power plants was $3.5 billion at December 31, 2015

and 2014 (or $6.1 billion in future dollars). These estimates

are based on the 2012 decommissioning cost studies,

prepared in accordance with CPUC requirements.

Disallowance of Plant Costs

PG&E Corporation and the Utility record a charge when

it is both probable that costs incurred or projected

to be incurred for recently completed plant will not

be recoverable through rates charged to customers

and the amount of disallowance can be reasonably

estimated. The Utility recorded charges of $407 million

in 2015 for estimated capital spending that is probable

of disallowance related to the Penalty Decision and

$116million and $196 million in 2014 and 2013, respectively,

for PSEP capital costs that are expected to exceed

the CPUC’s authorized levels or that are specifically

disallowed. (See “Enforcement and Litigation Matters”

in Note 13 below).