PG&E 2015 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2015 PG&E annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

79

PART II

ITEM 8.FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA

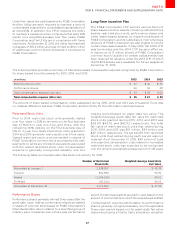

Nuclear Decommissioning Trusts

The Utility’s nuclear generation facilities consist of two

units at Diablo Canyon and one retired facility at Humboldt

Bay. Nuclear decommissioning requires the safe removal

of a nuclear generation facility from service and the

reduction of residual radioactivity to a level that permits

termination of the NRC license and release of the property

for unrestricted use. The Utility’s nuclear decommissioning

costs are recovered from customers through rates and

are held in trusts until authorized for release by the CPUC.

The Utility classifies its investments held in the nuclear

decommissioning trusts as “available-for-sale.” Since the

Utility’s nuclear decommissioning trust assets are managed

by external investment managers, the Utility does not have

the ability to sell its investments at its discretion. Therefore,

all unrealized losses are considered other-than-temporary

impairments. Gains or losses on the nuclear decommissioning

trust investments are refundable or recoverable, respectively,

from customers through rates. Therefore, trust earnings

are deferred and included in the regulatory liability for

recoveries in excess of the ARO. There is no impact on

the Utility’s earnings or accumulated other comprehensive

income. The cost of debt and equity securities sold by the

trust is determined by specific identification.

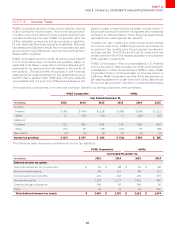

Variable Interest Entities

A VIE is an entity that does not have sucient equity

at risk to finance its activities without additional

subordinated financial support from other parties, or whose

equity investors lack any characteristics of a controlling

financial interest. An enterprise that has a controlling

financial interest in a VIE is a primary beneficiary and is

required to consolidate the VIE.

Some of the counterparties to the Utility’s power purchase

agreements are considered VIEs. Each of these VIEs was

designed to own a power plant that would generate

electricity for sale to the Utility. To determine whether

the Utility was the primary beneficiary of any of these

VIEs at December 31, 2015, it assessed whether it absorbs

any of the VIE’s expected losses or receives any portion

of the VIE’s expected residual returns under the terms of

the power purchase agreement, analyzed the variability

in the VIE’s gross margin, and considered whether it had

any decision-making rights associated with the activities

that are most significant to the VIE’s performance, such as

dispatch rights and operating and maintenance activities.

The Utility’s financial obligation is limited to the amount

the Utility pays for delivered electricity and capacity. The

Utility did not have any decision-making rights associated

with any of the activities that are most significant to the

economic performance of any of these VIEs. Since the

Utility was not the primary beneficiary of any of these VIEs

at December 31, 2015, it did not consolidate any of them.

Other Accounting Policies

For other accounting policies impacting PG&E Corporation’s

and the Utility’s consolidated financial statements, see

“Income Taxes” in Note 8, “Derivatives” in Note 9, “Fair

Value Measurements” in Note 10, and “Contingencies and

Commitments” in Note 13 of the Notes to the Consolidated

Financial Statements.

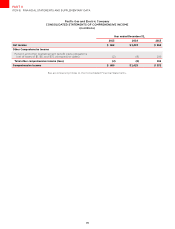

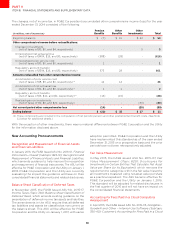

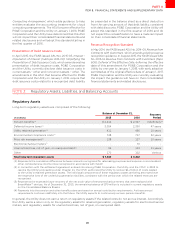

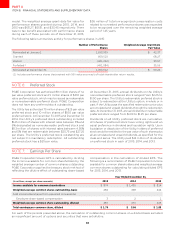

Reporting of Amounts Reclassified Out of Accumulated Other Comprehensive Income

The changes, net of income tax, in PG&E Corporation’s accumulated other comprehensive income (loss) for the year

ended December 31, 2015 consisted of the following:

(inmillionsnetofincometax)

Pension

Benefits

Other

Benefits

Other

Investments Total

Beginningbalance ()

Othercomprehensiveincomebeforereclassifications

Unrecognizednetactuarialloss

(netoftaxesofandrespectively) () () - ()

Regulatoryaccounttransfer

(netoftaxesofandrespectively) -

Amountsreclassifiedfromothercomprehensiveincome

Amortizationofpriorservicecost

(netoftaxesofandrespectively)() -

Amortizationofnetactuarialloss

(netoftaxesofandrespectively)() -

Regulatoryaccounttransfer

(netoftaxesofandrespectively)() () () - ()

Realizedgainoninvestments

(netoftaxesofandrespectively) - - () ()

Netcurrentperiodothercomprehensiveloss

() () ()

Endingbalance () - ()

() Thesecomponentsareincludedinthecomputationofnetperiodicpensionandotherpostretirementbenefitcosts(SeeNote

belowforadditionaldetails)