PG&E 2015 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2015 PG&E annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

59

PART II

ITEM 7.MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

and other postretirement benefit obligations and future

plan expenses.

In establishing health care cost assumptions, PG&E

Corporation and the Utility consider recent cost trends

and projections from industry experts. This evaluation

suggests that current rates of inflation are expected to

continue in the near term. In recognition of continued

high inflation in health care costs and given the design of

PG&E Corporation’s plans, the assumed health care cost

trend rate for 2015 is 7.2%, gradually decreasing to the

ultimate trend rate of 4% in 2024 and beyond.

Expected rates of return on plan assets were developed

by estimating future stock and bond returns and then

applying these returns to the target asset allocations

of the employee benefit trusts, resulting in a weighted

average rate of return on plan assets. Fixed-income returns

were projected based on real maturity and credit spreads

added to a long-term inflation rate. Equity returns were

projected based on estimates of dividend yield and real

earnings growth added to a long-term rate of inflation.

For the Utility’s defined benefit pension plan, the assumed

return of 6.1% compares to a ten-year actual return of 7.8%.

The rate used to discount pension benefits and other

benefits was based on a yield curve developed from

market data of approximately 688 Aa-grade non-callable

bonds at December 31, 2015. This yield curve has discount

rates that vary based on the duration of the obligations.

The estimated future cash flows for the pension and

other postretirement benefit obligations were matched

to the corresponding rates on the yield curve to derive a

weighted average discount rate.

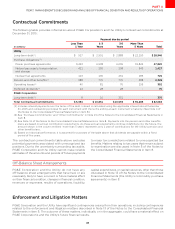

The following reflects the sensitivity of pension costs and projected benefit obligation to changes in certain actuarial

assumptions:

(inmillions)

Increase(Decrease)

inAssumption

Increasein

PensionCosts

IncreaseinProjected

BenefitObligationat

December

Discountrate ()

Rateofreturnonplanassets () -

Rateofincreaseincompensation

The following reflects the sensitivity of other postretirement benefit costs and accumulated benefit obligation to

changes in certain actuarial assumptions:

(inmillions)

Increase(Decrease)

inAssumption

Increasein

OtherPostretirement

BenefitCosts

IncreaseinAccumulated

BenefitObligationat

December

Healthcarecosttrendrate

Discountrate ()

Rateofreturnonplanassets () -

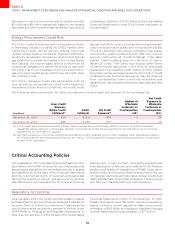

New Accounting Pronouncements

See Note 2 of the Notes to the Consolidated Financial Statements.

Cautionary Language Regarding Forward-Looking Statements

This report contains forward-looking statements that reflect

management’s judgment and opinions and management’s

knowledge of facts as of the date of this report. These

forward-looking statements relate to, among other matters,

estimated costs, including penalties and fines, associated

with various investigations and proceedings; forecasts of

pipeline-related expenses that the Utility will not recover

through rates; forecasts of capital expenditures; estimates

and assumptions used in critical accounting policies,

including those relating to regulatory assets and liabilities,

environmental remediation, litigation, third-party claims,

and other liabilities; and the level of future equity or debt

issuances. These statements are also identified by words

such as “assume,” “expect,” “intend,” “forecast,” “plan,”

“project,” “believe,” “estimate,” “predict,” “anticipate,” “may,”

“should,” “would,” “could,” “potential” and similar expressions.

These forward-looking statements are subject to various

risks and uncertainties, the realization or resolution of which

may be outside of management’s control. Actual results

could dier materially. PG&E Corporation and the Utility

are not able to predict all the factors that may aect future

results. Some of the factors that could cause future results