PG&E 2015 Annual Report Download - page 104

Download and view the complete annual report

Please find page 104 of the 2015 PG&E annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

96

PART II

ITEM 8.FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA

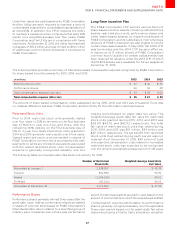

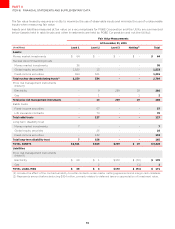

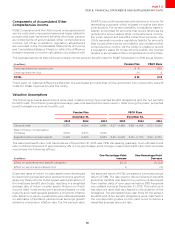

Global equity securities primarily include investments in

common stock that are valued based on quoted prices in

active markets and are classified as Level 1. Equity securities

also include commingled funds that are composed of equity

securities traded publicly on exchanges across multiple

industry sectors in the U.S. and other regions of the world.

Investments in these funds are classified as Level 2 because

price quotes are readily observable and available.

Debt securities are primarily composed of U.S. government

and agency securities, municipal securities, and other fixed-

income securities, including corporate debt securities. U.S.

government and agency securities primarily consist of U.S.

Treasury securities that are classified as Level 1 because

the fair value is determined by observable market prices

in active markets. A market approach is generally used

to estimate the fair value of debt securities classified as

Level 2 using evaluated pricing data such as broker quotes,

for similar securities adjusted for observable dierences.

Significant inputs used in the valuation model generally

include benchmark yield curves and issuer spreads. The

external credit ratings, coupon rate, and maturity of each

security are considered in the valuation model, as applicable.

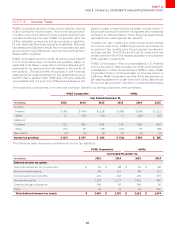

Price Risk Management Instruments

Price risk management instruments include physical and

financial derivative contracts, such as power purchase

agreements, forwards, swaps, options, and CRRs that

are traded either on an exchange or over-the-counter.

Power purchase agreements, forwards, and swaps are

valued using a discounted cash flow model. Exchange-

traded forwards and swaps that are valued using observable

market forward prices for the underlying commodity are

classified as Level 1. Over-the-counter forwards and swaps

that are identical to exchange-traded forwards and swaps,

or are valued using forward prices from broker quotes

that are corroborated with market data are classified

as Level 2. Exchange-traded options are valued using

observable market data and market-corroborated data

and are classified as Level 2.

Long-dated power purchase agreements that are valued

using significant unobservable data are classified as

Level 3. These Level 3 contracts are valued using either

estimated basis adjustments from liquid trading points

or techniques, including extrapolation from observable

prices, when a contract term extends beyond a period

for which market data is available. Market and credit risk

management utilizes models to derive pricing inputs for

the valuation of the Utility’s Level 3 instruments using

pricing inputs from brokers and historical data.

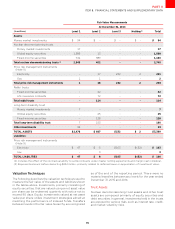

The Utility holds CRRs to hedge the financial risk of

CAISO-imposed congestion charges in the day-ahead

market. Limited market data is available in the CAISO

auction and between auction dates; therefore, the Utility

utilizes historical prices to forecast forward prices. CRRs

are classified as Level 3.

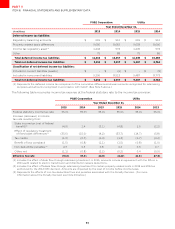

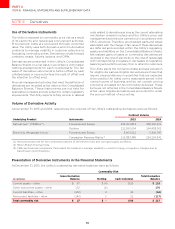

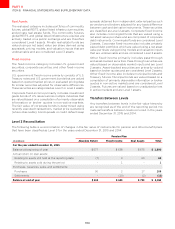

Level 3 Measurements and Sensitivity Analysis

The Utility’s market and credit risk management function,

which reports to the Chief Risk and Audit Ocer of the Utility,

is responsible for determining the fair value of the Utility’s

price risk management derivatives. The Utility’s finance and

risk management functions collaborate to determine the

appropriate fair value methodologies and classification for

each derivative. Inputs used and the fair value of Level 3

instruments are reviewed period-over-period and compared

with market conditions to determine reasonableness.

Significant increases or decreases in any of those inputs

would result in a significantly higher or lower fair value,

respectively. All reasonable costs related to Level 3

instruments are expected to be recoverable through

customer rates; therefore, there is no impact to net income

resulting from changes in the fair value of these instruments.

(See Note 9 above.)

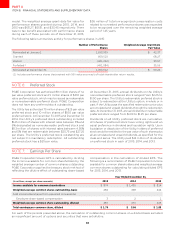

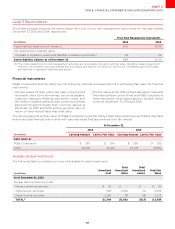

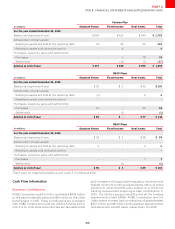

(inmillions)

FairValueat

AtDecember

ValuationTechnique

Unobservable

Input

FairValueMeasurement Assets Liabilities Range

()

Congestionrevenuerights Marketapproach CRRauctionprices ()-

Powerpurchaseagreements - Discountedcashflow Forwardprices -

() Representspricepermegawatt-hour

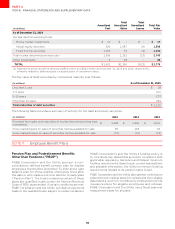

(inmillions)

FairValueat

AtDecember

ValuationTechnique

Unobservable

Input

FairValueMeasurement Assets Liabilities Range

()

Congestionrevenuerights Marketapproach CRRauctionprices ()-

Powerpurchaseagreements - Discountedcashflow Forwardprices -

() Representspricepermegawatt-hour