Nordstrom 2013 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2013 Nordstrom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

58

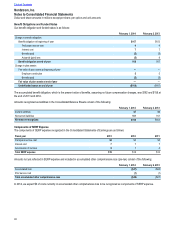

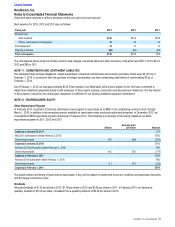

A reconciliation of the beginning and ending amount of unrecognized tax benefits for 2013, 2012 and 2011 is as follows:

Fiscal year 2013 2012 2011

Unrecognized tax benefit at beginning of year $15 $21 $43

Gross increase to tax positions in prior periods 31 14

Gross decrease to tax positions in prior periods (1) (7) (14)

Gross increase to tax positions in current period 11 2

Settlements (4) (1) (24)

Unrecognized tax benefit at end of year $14 $15 $21

Settlement activity in 2011 includes amounts paid for a state tax matter and to close our 2008 IRS audit.

At the end of 2013, 2012 and 2011, $7, $7 and $11 of the ending gross unrecognized tax benefit related to items which, if recognized, would

affect the effective tax rate.

Our income tax expense included an increase to expense of $1 in 2013 and a decrease to expense of $1 and $4 in 2012 and 2011 for tax-

related interest and penalties. At the end of 2013, 2012 and 2011, our liability for interest and penalties was $7, $7 and $5.

We file income tax returns in the U.S. and a limited number of foreign jurisdictions. With few exceptions, we are no longer subject to federal,

state and local, or non-U.S. income tax examinations for years before 2009. Unrecognized tax benefits related to federal, state and local tax

positions may decrease by $1 by January 31, 2015, due to the completion of examinations and the expiration of various statutes of

limitations.

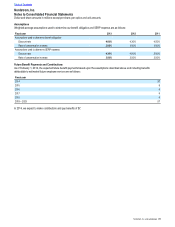

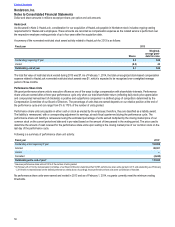

NOTE 15: EARNINGS PER SHARE

Earnings per basic share is computed using the weighted-average number of common shares outstanding during the year. Earnings per

diluted share uses the weighted-average number of common shares outstanding during the year plus dilutive common stock equivalents,

primarily stock options. Dilutive common stock reflects the issuance of stock for all outstanding options that could be exercised, and would

also reduce the amount of earnings that each share is entitled to. Anti-dilutive shares (including stock options and other shares) are excluded

from the calculation of diluted shares and earnings per diluted share because their impact could increase earnings per diluted share.

The computation of earnings per share is as follows:

Fiscal year 2013 2012 2011

Net earnings $734 $735 $683

Basic shares 194.5 203.0 213.5

Dilutive effect of stock options and other 3.2 3.7 4.2

Diluted shares 197.7 206.7 217.7

Earnings per basic share $3.77 $3.62 $3.20

Earnings per diluted share $3.71 $3.56 $3.14

Anti-dilutive stock options and other 4.1 4.2 3.9

Table of Contents

Nordstrom, Inc.

Notes to Consolidated Financial Statements

Dollar and share amounts in millions except per share, per option and unit amounts