Nordstrom 2013 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2013 Nordstrom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

34

Item 7A. Quantitative and Qualitative Disclosures About Market Risk.

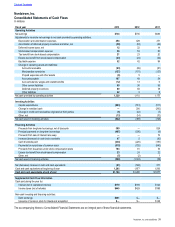

Dollars in millions

INTEREST RATE RISK

We are exposed to interest rate risk primarily from changes in short-term interest rates. As of February 1, 2014, we had cash and cash

equivalents of $1,194, which generate interest income at variable rates, and gross credit card receivables of $2,184, which generate finance

charge income at a combination of fixed and variable rates. Interest rate fluctuations can affect our interest income, credit card revenues and

interest expense. See Note 3: Accounts Receivable in Item 8: Financial Statements and Supplementary Data for additional information.

We use sensitivity analyses to measure and assess our interest rate risk exposure. For purposes of presenting the potential earnings effect

of a reasonably possible hypothetical change in interest rates from our reporting date, we utilized two sensitivity scenarios: (i) linear growth of

approximately 225 basis points over the year and (ii) linear decline of approximately 15 basis points over the year, due to the fact that current

interest rates are near historically low levels. Other key parameters and assumptions in our sensitivity analyses include the average cash and

cash equivalents balance, average credit card receivables balance and no new floating rate debt. The first hypothetical scenario would result

in an approximate $21 increase in future earnings, while the second hypothetical scenario would not have a material effect on future

earnings.

For our long-term fixed-rate debt of $3,113, our exposure to interest rate risk is limited to changes in the fair value of our debt. As our debt is

fixed-rate, changes in interest rates do not impact our cash flows, however, changes in interest rates increase or decrease the fair value of

our debt, depending on whether market rates are lower or higher than our fixed-rates. As of February 1, 2014, the fair value of our fixed-rate

debt was $3,511. See Note 8: Debt and Credit Facilities and Note 9: Fair Value Measurements in Item 8: Financial Statements and

Supplementary Data for additional information.

FOREIGN CURRENCY EXCHANGE RISK

The majority of our revenues, expenses and capital expenditures are transacted in U.S. dollars. However, we periodically enter into

merchandise purchase orders denominated primarily in British Pounds or Euros. From time to time, we may use forward contracts to hedge

against fluctuations in foreign currency prices. As of February 1, 2014, our outstanding forward contracts did not have a material impact on

our consolidated financial statements.

We have announced plans to open six full-line stores in Canada beginning in 2014. The functional currency of our Canadian operations is the

Canadian dollar. We translate assets and liabilities into U.S. dollars using the exchange rate in effect at the balance sheet date, while we

translate revenues and expenses using a weighted-average exchange rate for the period. We record these translation adjustments as a

component of accumulated other comprehensive loss on the Consolidated Balance Sheets in Item 8: Financial Statements and

Supplementary Data. In addition, our U.S. operations incurred certain expenditures denominated in Canadian dollars, and our Canadian

operations incurred certain expenditures denominated in U.S. dollars. This activity results in transaction gains and losses that arise from

exchange rate fluctuations and are recorded as gains or losses in the Consolidated Statements of Earnings in Item 8: Financial Statements

and Supplementary Data. As of February 1, 2014, activities associated with the future store openings have not had a material impact on our

consolidated financial statements.

Table of Contents