Nordstrom 2013 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2013 Nordstrom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Nordstrom, Inc. and subsidiaries 45

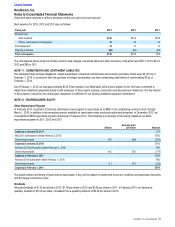

NOTE 2: HAUTELOOK

In 2011, we acquired 100% of the outstanding equity of HauteLook, Inc., an online private sale retailer offering limited-time sale events on

fashion and lifestyle brands, for upfront consideration of $180 in Nordstrom stock and an “earn-out” provision of up to $90 that was ultimately

settled in 2011 for $30 of additional Nordstrom stock. The upfront consideration included $27 related to amounts attributable to HauteLook

employees that are subject to ongoing vesting requirements and are recorded as compensation expense as the related service is performed

over the respective employee vesting periods of up to four years after the acquisition date.

On the acquisition date, we recorded intangible assets of $62 and goodwill of $146, offset by other net liabilities of $13. We amortize the

intangible assets over their estimated lives of two to seven years on a straight-line basis, which reasonably approximates the pattern of

expected economic benefit. We recorded intangible amortization expense of $10 for 2013 and $19 for 2012.

The goodwill value of $146 recorded at the time of the acquisition was the excess of the purchase price over the net assets recognized. We

include this goodwill, which is not deductible for tax purposes, in our Retail segment. In 2011, we recognized a goodwill impairment charge of

$25, reducing the HauteLook goodwill to $121 due to a reorganization of HauteLook, changes in expected business results and market

dynamics. Additionally, as part of the reorganization, we recorded income of $12 related to the settlement of the earn-out liability. We

recognized no goodwill impairment charge for fiscal 2012 and 2013. See Note 9: Fair Value Measurements for additional information relating

to the valuation of the goodwill impairment charge.

NOTE 3: ACCOUNTS RECEIVABLE

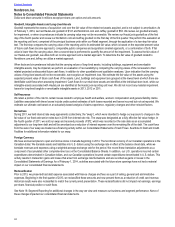

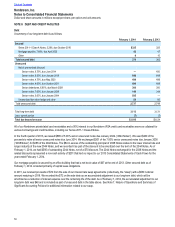

The components of accounts receivable are as follows:

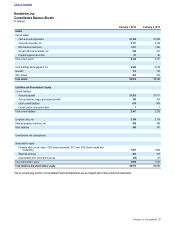

February 1, 2014 February 2, 2013

Credit card receivables:

Nordstrom VISA credit card receivables $1,316 $1,348

Nordstrom private label card receivables 868 794

Total credit card receivables 2,184 2,142

Allowance for credit losses (80) (85)

Credit card receivables, net 2,104 2,057

Other accounts receivable173 72

Accounts receivable, net $2,177 $2,129

1 Other accounts receivable consist primarily of third party credit and debit card receivables.

Our credit card receivables are restricted under our securitization program. Our Series 2011-1 Class A Notes are secured by 100% of the

Nordstrom private label credit card receivables and 90% of the Nordstrom VISA credit card receivables. As of February 1, 2014 and

February 2, 2013, our restricted credit card receivables included more receivables than necessary to collateralize our outstanding secured

debt and variable funding facilities, and as such can be utilized to increase the current usage of our securitization program. Our credit card

securitization agreements set a maximum percentage of receivables that can be associated with various receivable categories, such as

employee or foreign receivables, and as of February 1, 2014 and February 2, 2013, these maximums were not exceeded.

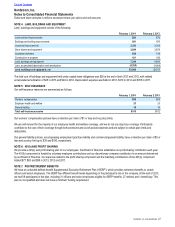

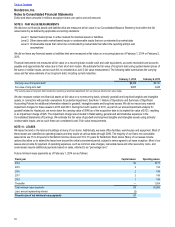

Activity in the allowance for credit losses is as follows:

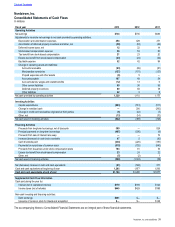

Fiscal year 2013 2012 2011

Allowance at beginning of year $85 $115 $145

Bad debt expense 52 42 84

Write-offs (80) (97) (136)

Recoveries 23 25 22

Allowance at end of year $80 $85 $115

Table of Contents

Nordstrom, Inc.

Notes to Consolidated Financial Statements

Dollar and share amounts in millions except per share, per option and unit amounts