Nordstrom 2013 Annual Report Download - page 21

Download and view the complete annual report

Please find page 21 of the 2013 Nordstrom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Nordstrom, Inc. and subsidiaries 21

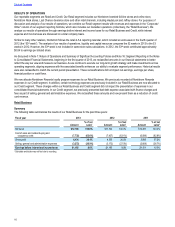

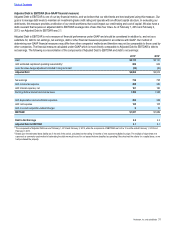

Credit Card Revenues

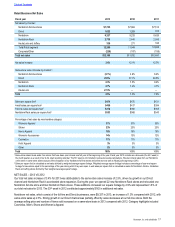

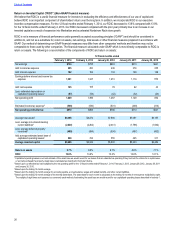

Fiscal year 2013 2012 2011

Finance charge revenue $244 $246 $240

Interchange — third party 86 84 82

Late fees and other revenue 44 42 41

Total Credit card revenues $374 $372 $363

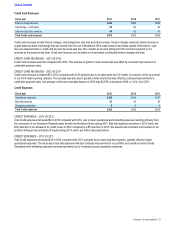

Credit card revenues include finance charges, interchange fees, late fees and other revenue. Finance charges represent interest earned on

unpaid balances while interchange fees are earned from the use of Nordstrom VISA credit cards at merchants outside of Nordstrom. Late

fees are assessed when a credit card account becomes past due. We consider an account delinquent if the minimum payment is not

received by the payment due date. Credit card revenues are recorded net of estimated uncollectible finance charges and fees.

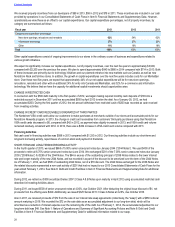

CREDIT CARD REVENUES – 2013 VS 2012

Credit card revenues were flat compared with 2012. This was due to growth in total volume that was offset by continued improvements in

cardholder payment rates.

CREDIT CARD REVENUES – 2012 VS 2011

Credit card revenues increased $9 in 2012 compared with 2011 primarily due to an extra week (the 53rd week) of revenue in 2012 as a result

of our 4-5-4 retail reporting calendar. The increase was also due to growth in total volume that was offset by continued improvements in

cardholder payment rates. Our average credit card receivable balance in 2012 was $2,076, a decrease of $29, or 1.4%, from 2011.

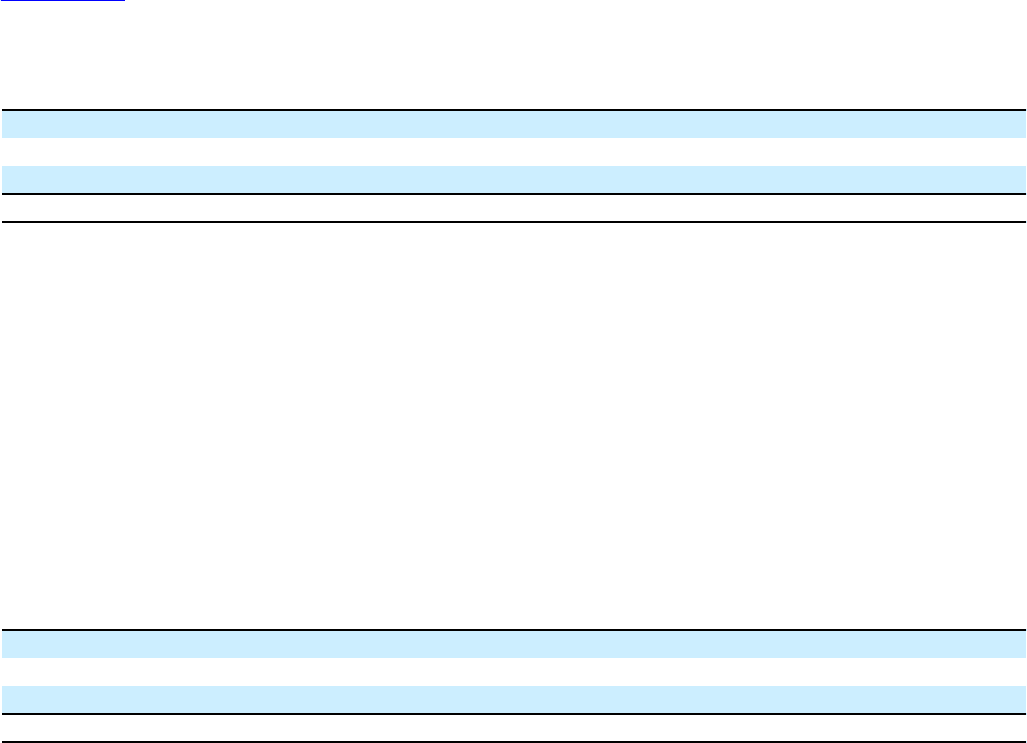

Credit Expenses

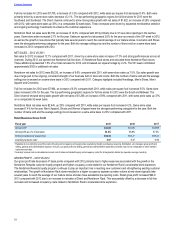

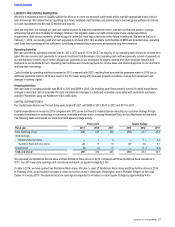

Fiscal year 2013 2012 2011

Operational expenses $129 $143 $127

Bad debt expense 52 42 84

Occupancy expenses 55 4

Total Credit expenses $186 $190 $215

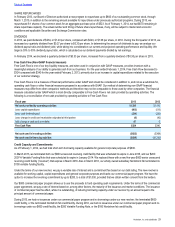

CREDIT EXPENSES – 2013 VS 2012

Total Credit expenses decreased $4 in 2013 compared with 2012, due to lower operational and marketing expenses resulting primarily from

the conversion of our Nordstrom Rewards travel benefit into Nordstrom Notes during 2013. Bad debt expense was lower in 2012 due to the

$30 reduction of our allowance for credit losses in 2012 compared to a $5 reduction in 2013. We experienced continued improvement in our

portfolio delinquencies and write-off results during 2013, which are further discussed below.

CREDIT EXPENSES – 2012 VS 2011

Total Credit expenses decreased $25 in 2012 compared with 2011, primarily due to lower bad debt expense, partially offset by higher

operational expenses. The decrease in bad debt expense reflected continued improvement in our portfolio and overall economic trends.

Operational and marketing expenses increased primarily due to increased account acquisition expenses.

Table of Contents