Nordstrom 2013 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2013 Nordstrom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

50

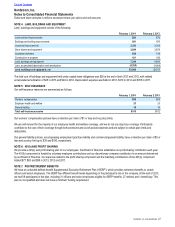

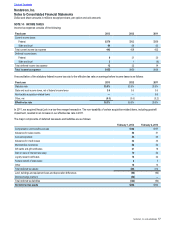

NOTE 8: DEBT AND CREDIT FACILITIES

Debt

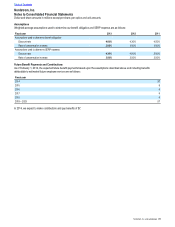

A summary of our long-term debt is as follows:

February 1, 2014 February 2, 2013

Secured

Series 2011-1 Class A Notes, 2.28%, due October 2016 $325 325

Mortgage payable, 7.68%, due April 2020 42 47

Other 910

Total secured debt 376 382

Unsecured

Net of unamortized discount:

Senior notes, 6.75%, due June 2014 —400

Senior notes, 6.25%, due January 2018 648 648

Senior notes, 4.75%, due May 2020 499 498

Senior notes, 4.00%, due October 2021 499 499

Senior debentures, 6.95%, due March 2028 300 300

Senior notes, 7.00%, due January 2038 146 344

Senior notes, 5.00%, due January 2044 595 —

Unamortized fair value hedge and other 50 60

Total unsecured debt 2,737 2,749

Total long-term debt 3,113 3,131

Less: current portion (7) (7)

Total due beyond one year $3,106 $3,124

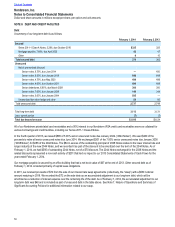

All of our Nordstrom private label card receivables and a 90% interest in our Nordstrom VISA credit card receivables serve as collateral for

various borrowings and credit facilities, including our Series 2011-1 Class A Notes.

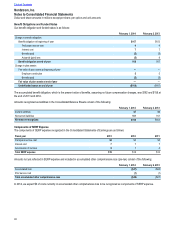

In the fourth quarter of 2013, we issued $665 of 5.00% senior unsecured notes due January 2044 (“2044 Notes”). We used $400 of the

proceeds to retire all senior unsecured notes due June 2014. We exchanged $201 of the 7.00% senior unsecured notes due January 2038

(“2038 Notes”) for $265 of the 2044 Notes. The $64 in excess of the outstanding principal of 2038 Notes relates to the lower interest rate and

longer maturity of the new 2044 Notes, and we recorded it as part of the discount to be amortized over the term of the 2044 Notes. As of

February 1, 2014, we had $595 of outstanding 2044 Notes, net of a $70 discount. The 2044 Notes exchanged for the 2038 Notes and the

related discounts represented a non-cash activity of $201 that had no impact to our 2013 Consolidated Statements of Cash Flows for the

year ended February 1, 2014.

Our mortgage payable is secured by an office building that had a net book value of $67 at the end of 2013. Other secured debt as of

February 1, 2014 consisted primarily of capital lease obligations.

In 2011, we received proceeds of $72 from the sale of our interest rate swap agreements (collectively, the “swap”) with a $650 notional

amount maturing in 2018. We recorded the $72 on the sale date as an accumulated adjustment to our long-term debt, which will be

amortized as a reduction of interest expense over the remaining life of the debt. As of February 1, 2014, the accumulated adjustment to our

long-term debt was $48 and is included as part of unsecured debt in the table above. See Note 1: Nature of Operations and Summary of

Significant Accounting Policies for additional information related to our swap.

Table of Contents

Nordstrom, Inc.

Notes to Consolidated Financial Statements

Dollar and share amounts in millions except per share, per option and unit amounts