Nordstrom 2013 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2013 Nordstrom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

44

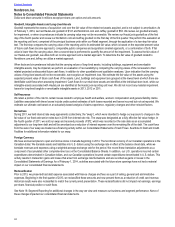

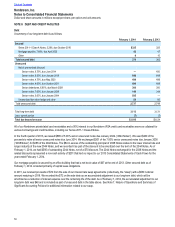

Goodwill, Intangible Assets and Long-Lived Assets

Goodwill represents the excess of acquisition cost over the fair value of the related net assets acquired, and is not subject to amortization. As

of February 1, 2014, we had HauteLook goodwill of $121 and Nordstrom.com and Jeffrey goodwill of $53. We review our goodwill annually

for impairment, or when circumstances indicate its carrying value may not be recoverable. We review our HauteLook goodwill as of the first

day of the fourth quarter and review our Nordstrom.com and Jeffrey goodwill on the first day of the first quarter. We perform this evaluation at

the reporting unit level, comprised of the principal business units within our Retail segment, through the application of a two-step fair value

test. The first step compares the carrying value of the reporting unit to its estimated fair value, which is based on the expected present value

of future cash flows (income approach), comparable public companies and acquisitions (market approach), or a combination of both. If fair

value is lower than the carrying value, then a second step is performed to quantify the amount of the impairment. To assess the fair value of

our HauteLook goodwill, we utilize both an income approach and a market approach. To determine the fair value of goodwill related to

Nordstrom.com and Jeffrey, we utilize a market approach.

When facts and circumstances indicate that the carrying values of long-lived assets, including buildings, equipment and amortizable

intangible assets, may be impaired, we perform an evaluation of recoverability by comparing the carrying values of the net assets to their

related projected undiscounted future cash flows, in addition to other quantitative and qualitative analyses. Upon indication that the carrying

values of long-lived assets will not be recoverable, we recognize an impairment loss. We estimate the fair value of the assets using the

expected present value of future cash flows of the assets. Land, buildings and equipment are grouped at the lowest level at which there are

identifiable cash flows when assessing impairment. Cash flows for our retail store assets are identified at the individual store level, while our

intangible assets associated with HauteLook are identified at the HauteLook reporting unit level. We did not record any material impairment

losses for long-lived tangible or amortizable intangible assets in 2013, 2012 or 2011.

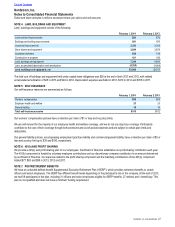

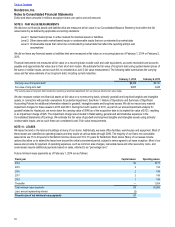

Self-Insurance

We retain a portion of the risk for certain losses related to employee health and welfare, workers’ compensation and general liability claims.

Liabilities associated with these losses include undiscounted estimates of both losses reported and losses incurred but not yet reported. We

estimate our ultimate cost based on an actuarially based analysis of claims experience, regulatory changes and other relevant factors.

Derivatives

During 2011, we held interest rate swap agreements (collectively, the “swap”), which were intended to hedge our exposure to changes in the

fair value of our fixed-rate senior notes due in 2018 from interest rate risk. The swap was designated as a fully effective fair value hedge. In

the fourth quarter of 2011, we sold our swap and received proceeds of $72, which was recorded on the sale date as an accumulated

adjustment to our long-term debt and will be amortized as a reduction of interest expense over the remaining life of the debt. The cash flows

from the sale of our swap are treated as a financing activity within our Consolidated Statements of Cash Flows. See Note 8: Debt and Credit

Facilities for additional information related to our swap.

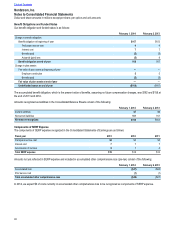

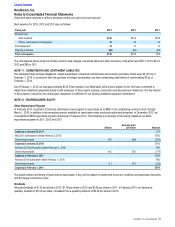

Foreign Currency

We have announced plans to open six full-line stores in Canada beginning in 2014. The functional currency of our Canadian operations is the

Canadian dollar. We translate assets and liabilities into U.S. dollars using the exchange rate in effect at the balance sheet date, while we

translate revenues and expenses using a weighted-average exchange rate for the period. We record these translation adjustments as a

component of accumulated other comprehensive loss on the Consolidated Balance Sheets. In addition, our U.S. operations incurred certain

expenditures denominated in Canadian dollars, and our Canadian operations incurred certain expenditures denominated in U.S. dollars. This

activity results in transaction gains and losses that arise from exchange rate fluctuations and are recorded as gains or losses in the

Consolidated Statements of Earnings. As of February 1, 2014, activities associated with the future store openings have not had a material

impact on our consolidated financial statements.

Reclassification

Prior to 2013, we presented bad debt expense associated with finance charges and fees as a part of selling, general and administrative

expenses. Beginning in the first quarter of 2013, we reclassified these amounts and now present them as a reduction of credit card revenue.

Historical results were also reclassified to match the current period presentation. These reclassifications did not impact net earnings, earnings

per share, financial position or cash flows.

See Note 16: Segment Reporting for additional changes in the way we view and measure our business and segment performance. None of

these changes impacted our consolidated financial statements.

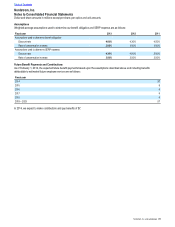

Table of Contents

Nordstrom, Inc.

Notes to Consolidated Financial Statements

Dollar and share amounts in millions except per share, per option and unit amounts