Nordstrom 2013 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2013 Nordstrom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Nordstrom, Inc. and subsidiaries 33

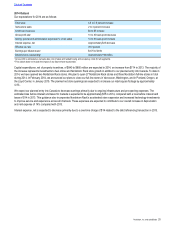

Revenue Recognition

We recognize revenue from sales at our retail stores at the point of sale, net of an allowance for estimated sales returns. Revenue from sales

to customers shipped directly from our stores, website and catalog, which includes shipping revenue when applicable, is recognized upon

estimated receipt by the customer. We estimate customer merchandise returns based on historical return patterns and reduce sales and cost

of sales accordingly.

Although we believe we have sufficient current and historical knowledge to record reasonable estimates of sales returns, there is a possibility

that actual returns could differ from recorded amounts. In the past three years, there were no significant changes in customer behavior and

we have made no material changes to our estimates included in the calculations of our sales return reserve. A 10% change in the sales

return reserve would have had an $8 impact on our net earnings for the year ended February 1, 2014.

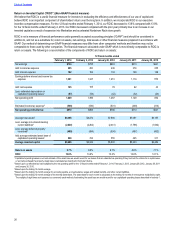

Inventory

Our merchandise inventories are generally stated at the lower of cost or market value using the retail inventory method. Under the retail

method, the valuation of inventories and the resulting gross margins are determined by applying a calculated cost-to-retail ratio to the retail

value of ending inventory. The value of our inventory on the balance sheet is then reduced by a charge to cost of sales for retail inventory

markdowns taken on the selling floor. To determine if the retail value of our inventory should be marked down, we consider current and

anticipated demand, customer preferences, age of the merchandise and fashion trends. Inherent in the retail inventory method are certain

management judgments that may affect the ending inventory valuation as well as gross margin.

We reserve for obsolescence based on historical trends and specific identification. Our obsolescence reserve contains uncertainties as the

calculations require management to make assumptions and to apply judgment regarding a number of factors, including market conditions,

the selling environment, historical results and current inventory trends.

We do not believe that the assumptions used in these estimates will change significantly based on prior experience. In the past three years,

we have made no material changes to our estimates included in the calculations of the obsolescence reserve. A 10% change in the

obsolescence reserve would have had no material impact on our net earnings for the year ended February 1, 2014.

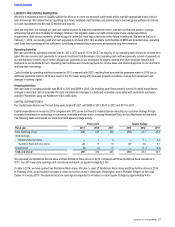

Goodwill

We review our goodwill annually for impairment, or when circumstances indicate its carrying value may not be recoverable. We perform this

evaluation at the reporting unit level, comprised of the principal business units within our Retail segment. To assess the fair value of our

HauteLook goodwill, we utilize both an income approach and a market approach. To determine the fair value of goodwill related to

Nordstrom.com and Jeffrey, we utilize a market approach. We compare the fair value of the reporting unit to its carrying value to determine if

there is potential goodwill impairment. If the fair value of the reporting unit is less than its carrying value, an impairment loss is recorded to

the extent that the fair value of the goodwill within the reporting unit is less than the carrying value of the goodwill.

As part of our impairment testing, we utilize certain assumptions and apply judgment regarding a number of factors. Significant estimates in

the market approach include identifying similar companies and acquisitions with comparable business factors such as size, growth,

profitability, risk and return of investment and assessing comparable earnings or revenue multiples in estimating the fair value of the reporting

unit. Assumptions in the income approach include future cash flows for the business, future growth rates and discount rates. Estimates of

cash flows may differ from actual cash flows due to, among other things, economic conditions, changes to the business model or changes in

operating performance. For Nordstrom.com and Jeffrey, the fair values substantially exceeded carrying values and therefore we had no

goodwill impairment in 2013, 2012 or 2011. In 2011, the year we acquired HauteLook, we recorded a goodwill impairment loss of $25. In

2013 and 2012, our testing indicated that the fair value of HauteLook substantially exceeded the carrying value, and therefore we did not

record goodwill impairment for 2013 or 2012. A 10% change in the fair value of any of our reporting units would not have had an impact on

our net earnings for the fiscal year ended February 1, 2014.

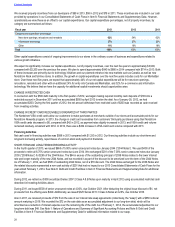

Income Taxes

We regularly evaluate the likelihood of realizing the benefit for income tax positions we have taken in various federal, state and foreign filings

by considering all relevant facts, circumstances and information available to us. If we believe it is more likely than not that our position will be

sustained, we recognize a benefit at the largest amount that we believe is cumulatively greater than 50% likely to be realized. Our

unrecognized tax benefit was $14 as of February 1, 2014 and $15 as of February 2, 2013.

Unrecognized tax benefits require significant management judgment regarding applicable statutes and their related interpretation, the status

of various income tax audits and our particular facts and circumstances. Also, as audits are completed or statutes of limitations lapse, it may

be necessary to record adjustments to our taxes payable, deferred taxes, tax reserves or income tax expense. Such adjustments did not

materially impact our effective income tax rate in 2013 or 2012.

Table of Contents