Nordstrom 2013 Annual Report Download - page 15

Download and view the complete annual report

Please find page 15 of the 2013 Nordstrom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Nordstrom, Inc. and subsidiaries 15

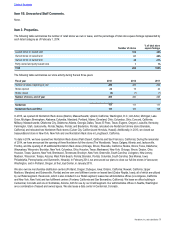

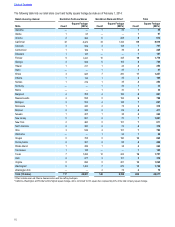

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations.

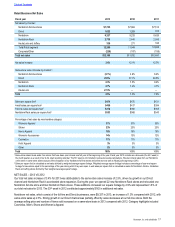

Dollar, share and square footage amounts in millions except percentages, per share and per square foot amounts

OVERVIEW

Nordstrom is a leading fashion specialty retailer offering high-quality apparel, shoes, cosmetics and accessories for women, men and

children. We offer a wide selection of brand name and private label merchandise through our various channels: “Nordstrom” branded full-line

stores and online store at Nordstrom.com, “Nordstrom Rack” off-price stores, “Last Chance” clearance store, “HauteLook” online private sale

website and our “Jeffrey” boutiques. Our stores are located in 35 states throughout the United States. In addition, we offer our customers a

loyalty program along with a variety of payment products and services, including credit and debit cards.

We achieved several milestones in 2013 with a record high in sales, earnings per diluted share, and cash flow from operations. This marked

the fifth consecutive year we generated over one billion dollars in cash flow from operations. Additionally, we generated a Return on Invested

Capital of 13.6% while increasing our capital investments by over 50%. Our performance in 2013 reflected our continued progress in

executing our customer strategy through investments to drive growth across channels, while maintaining our operating discipline around

inventory and expenses. With advancements in technology and specifically in e-commerce, the pace of change is accelerating and redefining

the customer experience across all channels. We believe there is tremendous value in having a platform for the customer experience that

encompasses full-price and off-price, in-store and online. While each of these channels represents a substantial individual opportunity, there

is significant potential for synergies between them to create a unique customer experience across channels to gain market share.

Our Direct business continues to be our fastest-growing customer channel. Direct finished its third consecutive year of approximately 30% or

more of same-store sales growth, with a key driver being increased merchandise selection. We also increased our speed of fulfillment and

delivery, opened a fulfillment center in San Bernardino and announced plans to open an east coast fulfillment center in 2015 to enable

greater customer service.

We are on track to serve more customers through Nordstrom Rack’s accelerated store expansion, with plans to reach approximately 230

stores by 2016, from 140 stores today. Nordstrom Rack net sales increased 12%, driven by 22 new stores, and same-store sales increased

2.7%. Nordstrom Rack sales productivity remains strong at approximately $550 per square foot. Additionally, Rack stores can now accept

HauteLook merchandise returns, adding convenience for our customers while driving incremental traffic to our Racks and further integrating

the customer experience across channels.

While Nordstrom full-line sales trends were softer than anticipated, we have ongoing initiatives around product, service, and the store

environment to elevate the customer experience. Our relocated Glendale, California store incorporated new design concepts that reflect our

customers’ desire for stores that are easier to shop, and we plan to incorporate new designs in future renovations and store openings to

continue meeting our customers changing expectations. We also enhanced our relevance with existing and new customers, demonstrated in

part by our Women’s Apparel business, which was one of our top-performing merchandise categories for the year. We have attracted newer

and younger customers with our repositioned Savvy department to offer on-trend fashion at accessible price points and our expanded

partnership with Topshop, an internationally renowned trend-leading brand. We expanded Topshop merchandise to 41 full-line stores this

year, from 14 at the start of the year.

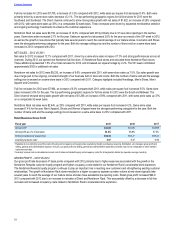

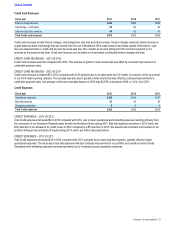

Our credit business also plays an important role in reaching new customers and strengthening existing customer relationships through our

Nordstrom Rewards™ program, payment products and our ability to serve customers directly through our wholly owned credit services. The

Nordstrom Rewards program contributes to our overall results, with members shopping more frequently and spending more on average than

non-members. For the second consecutive year, we opened over one million new accounts. With 3.8 million active members, 2013 sales

from members represented 38% of sales, increasing from 36% in 2012. Our overall credit card portfolio also remains healthy, with

delinquency and write-off trends continuing to improve.

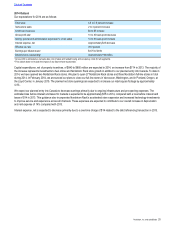

We continue to believe strongly in our customer-centric strategy. To improve the customer experience, we continue to make investments in

our stores, online and in new markets such as Canada and Manhattan. As a result of our planned growth across all of our channels, our

business model continues to evolve to encompass these multiple channels in their various stages of growth. We project that these

investments in our customer strategy will help us achieve long-term top-quartile shareholder returns through high single-digit total sales

growth and mid-teens Return on Invested Capital.

Table of Contents