Nordstrom 2013 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2013 Nordstrom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

52

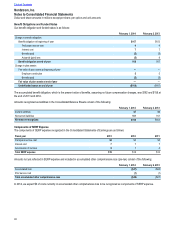

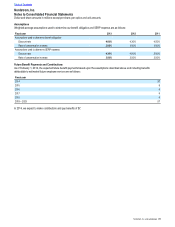

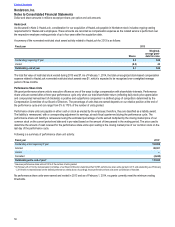

NOTE 9: FAIR VALUE MEASUREMENTS

We disclose our financial assets and liabilities that are measured at fair value in our Consolidated Balance Sheets by level within the fair

value hierarchy as defined by applicable accounting standards:

Level 1: Quoted market prices in active markets for identical assets or liabilities

Level 2: Other observable market-based inputs or unobservable inputs that are corroborated by market data

Level 3: Unobservable inputs that cannot be corroborated by market data that reflect the reporting entity’s own

assumptions

We did not have any financial assets or liabilities that were measured at fair value on a recurring basis as of February 1, 2014 or February 2,

2013.

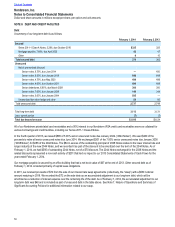

Financial instruments not measured at fair value on a recurring basis include cash and cash equivalents, accounts receivable and accounts

payable and approximate fair value due to their short-term nature. We estimate the fair value of long-term debt using quoted market prices of

the same or similar issues, and as such this is considered a Level 2 fair value measurement. The following table summarizes the carrying

value and fair value estimate of our long-term debt, including current maturities:

February 1, 2014 February 2, 2013

Carrying value of long-term debt1$3,113 $3,131

Fair value of long-term debt 3,511 3,665

1 The carrying value of long-term debt includes the remaining unamortized adjustment from our previous effective fair value hedge.

We also measure certain non-financial assets at fair value on a nonrecurring basis, primarily goodwill and long-lived tangible and intangible

assets, in connection with periodic evaluations for potential impairment. See Note 1: Nature of Operations and Summary of Significant

Accounting Policies for additional information related to goodwill, intangible assets and long-lived assets. We did not record any material

impairment charges for these assets in 2013 and 2012. During the fourth quarter of 2011, as part of our annual impairment analysis for

goodwill related to HauteLook, we wrote down the carrying value of $146 as of the acquisition date to its implied fair value of $121, resulting

in an impairment charge of $25. The impairment charge was included in Retail selling, general and administrative expenses in the

Consolidated Statements of Earnings. We estimate the fair value of goodwill and long-lived tangible and intangible assets using primarily

unobservable inputs, and as such these are considered Level 3 fair value measurements.

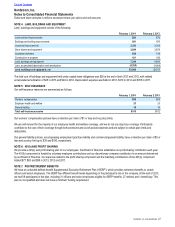

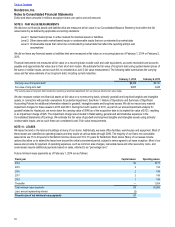

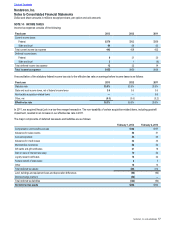

NOTE 10: LEASES

We lease the land or the land and buildings at many of our stores. Additionally, we lease office facilities, warehouses and equipment. Most of

these leases are classified as operating leases and they expire at various dates through 2080. The majority of our fixed, non-cancelable

lease terms are 15 to 30 years for Nordstrom full-line stores and 10 to 15 years for Nordstrom Rack stores. Many of our leases include

options that allow us to extend the lease term beyond the initial commitment period, subject to terms agreed to at lease inception. Most of our

leases also provide for payment of operating expenses, such as common area charges, real estate taxes and other executory costs, and

some leases require additional payments based on sales, referred to as “percentage rent.”

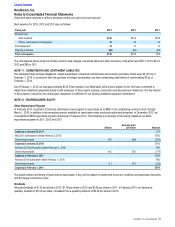

Future minimum lease payments as of February 1, 2014 are as follows:

Fiscal year Capital leases Operating leases

2014 $2 $177

2015 2 193

2016 2 196

2017 2 189

2018 1 186

Thereafter — 1,054

Total minimum lease payments $9 $1,995

Less: amount representing interest (2)

Present value of net minimum lease payments $7

Table of Contents

Nordstrom, Inc.

Notes to Consolidated Financial Statements

Dollar and share amounts in millions except per share, per option and unit amounts