Nordstrom 2013 Annual Report Download - page 25

Download and view the complete annual report

Please find page 25 of the 2013 Nordstrom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Nordstrom, Inc. and subsidiaries 25

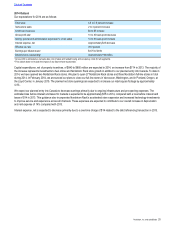

2014 Outlook

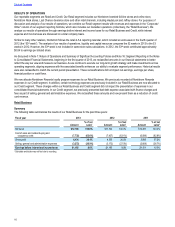

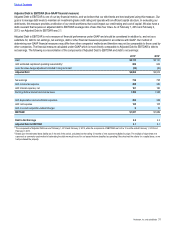

Our expectations for 2014 are as follows:

Total sales 5.5 to 7.5 percent increase

Same-store sales 2 to 4 percent increase

Credit card revenues $0 to $5 increase

Gross profit rate110 to 30 basis point decrease

Selling, general and administrative expenses (% of net sales) 10 to 30 basis point increase

Interest expense, net Approximately $25 decrease

Effective tax rate 39.0 percent

Earnings per diluted share2$3.75 to $3.90

Diluted shares outstanding2Approximately 196 million

1 Gross profit is calculated as net sales less cost of sales and related buying and occupancy costs (for all segments).

2 This outlook does not include the impact of any future share repurchases.

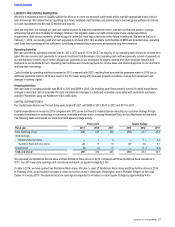

Capital expenditures, net of property incentives, of $840 to $880 million are expected in 2014, an increase from $714 in 2013. The majority of

the increase represents investments to fuel online and Nordstrom Rack store growth in addition to our planned entry into Canada. To date in

2014, we have opened two Nordstrom Rack stores. We plan to open 27 Nordstrom Rack stores and three Nordstrom full-line stores in total

during 2014. In February 2014, we announced our plans to close our full-line stores in Vancouver, Washington, and in Portland, Oregon, at

the Lloyd Center, in January 2015. The planned net store openings are expected to increase our retail square footage by approximately

4.4%.

We expect our planned entry into Canada to decrease earnings primarily due to ongoing infrastructure and pre-opening expenses. The

estimated loss before interest and taxes for Canada is expected to be approximately $35 in 2014, compared with a loss before interest and

taxes of $14 in 2013. This guidance also incorporates Nordstrom Rack’s accelerated store expansion and increased technology investments

to improve service and experience across all channels. These expenses are expected to contribute to our overall increase in depreciation

and rent expense of 14% compared with 2013.

Interest expense, net is expected to decrease primarily due to a one-time charge of $14 related to the debt refinancing transaction in 2013.

Table of Contents