Nordstrom 2013 Annual Report Download - page 29

Download and view the complete annual report

Please find page 29 of the 2013 Nordstrom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Nordstrom, Inc. and subsidiaries 29

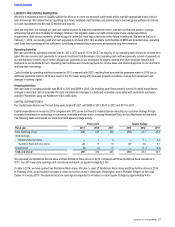

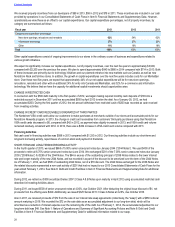

SHARE REPURCHASES

In February 2013, our Board of Directors authorized a new program to repurchase up to $800 of our outstanding common stock, through

March 1, 2015, in addition to the remaining amount available for repurchase under previously authorized programs. During 2013, we

repurchased 9.1 shares of our common stock for an aggregate purchase price of $523. As of February 1, 2014, we had $670 remaining in

share repurchase capacity. The actual number and timing of future share repurchases, if any, will be subject to market and economic

conditions and applicable Securities and Exchange Commission rules.

DIVIDENDS

In 2013, we paid dividends of $234, or $1.20 per share, compared with $220, or $1.08 per share, in 2012. During the first quarter of 2013, we

increased our quarterly dividend from $0.27 per share to $0.30 per share. In determining the amount of dividends to pay, we analyze our

dividend payout ratio and dividend yield, while taking into consideration our current and projected operating performance and liquidity. We

target a 30% to 35% dividend payout ratio, which is calculated as our dividend payments divided by net earnings.

In February 2014, we declared a quarterly dividend of $0.33 per share, increased from a quarterly dividend of $0.30 per share in 2013.

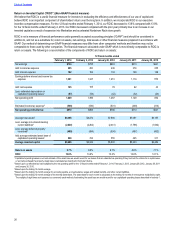

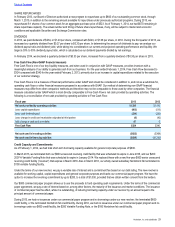

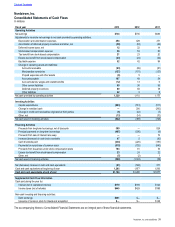

Free Cash Flow (Non-GAAP financial measure)

Free Cash Flow is one of our key liquidity measures, and when used in conjunction with GAAP measures, provides investors with a

meaningful analysis of our ability to generate cash from our business. For the year ended February 1, 2014, Free Cash Flow decreased to

$324 compared with $340 for the year ended February 2, 2013, primarily due to an increase in capital expenditures related to the execution

of our customer strategy.

Free Cash Flow is not a measure of financial performance under GAAP and should be considered in addition to, and not as a substitute for,

operating cash flows or other financial measures prepared in accordance with GAAP. Our method of determining non-GAAP financial

measures may differ from other companies’ methods and therefore may not be comparable to those used by other companies. The financial

measure calculated under GAAP which is most directly comparable to Free Cash Flow is net cash provided by operating activities. The

following is a reconciliation of net cash provided by operating activities to Free Cash Flow:

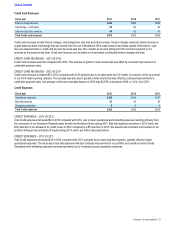

Fiscal year 2013 2012

Net cash provided by operating activities $1,320 $1,110

Less: capital expenditures (803) (513)

Less: cash dividends paid (234) (220)

Less: change in credit card receivables originated at third parties (6) (42)

Add: change in cash book overdrafts 47 5

Free Cash Flow $324 $340

Net cash used in investing activities ($822) ($369)

Net cash used in financing activities ($589) ($1,333)

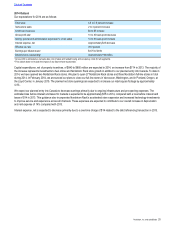

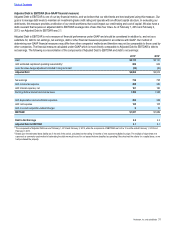

Credit Capacity and Commitments

As of February 1, 2014, we had total short-term borrowing capacity available for general corporate purposes of $800.

In March 2013, we terminated both our $600 unsecured revolving credit facility that was scheduled to expire in June 2016, and our $200

2007-A Variable Funding Note that was scheduled to expire in January 2014. We replaced these with a new five-year $800 senior unsecured

revolving credit facility (“revolver”) that expires in March 2018. Also in March 2013, our wholly owned subsidiary Nordstrom fsb terminated its

$100 variable funding facility.

Under the terms of our new revolver, we pay a variable rate of interest and a commitment fee based on our debt rating. The new revolver is

available for working capital, capital expenditures and general corporate purposes and backs our commercial paper program. We have the

option to increase the revolving commitment by up to $200, to a total of $1,000, provided that we obtain written consent from the lenders.

Our $800 commercial paper program allows us to use the proceeds to fund operating cash requirements. Under the terms of the commercial

paper agreement, we pay a rate of interest based on, among other factors, the maturity of the issuance and market conditions. The issuance

of commercial paper has the effect, while it is outstanding, of reducing borrowing capacity under our revolver by an amount equal to the

principal amount of commercial paper.

During 2013, we had no issuances under our commercial paper program and no borrowings under our new revolver, the terminated $600

credit facility, or the terminated Nordstrom fsb credit facility. During 2012, we had no issuances under our commercial paper program and no

borrowings under our $600 credit facility, the $200 Variable Funding Note, or the $100 Nordstrom fsb credit facility.

Table of Contents