Nordstrom 2013 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2013 Nordstrom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Nordstrom, Inc. and subsidiaries 51

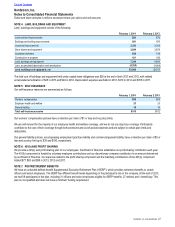

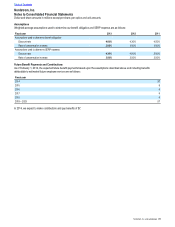

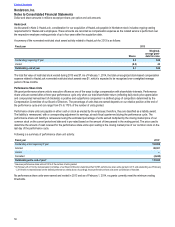

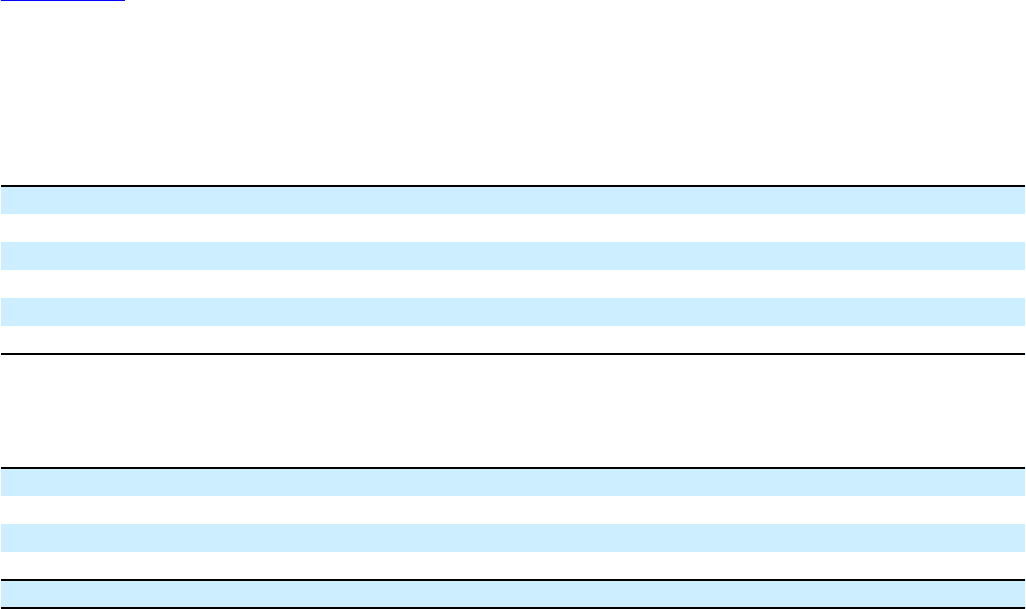

Required principal payments on long-term debt, excluding capital lease obligations, are as follows:

Fiscal year

2014 $6

2015 6

2016 332

2017 657

2018 9

Thereafter 2,124

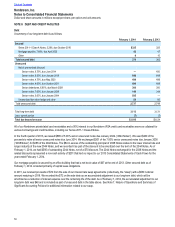

Interest Expense

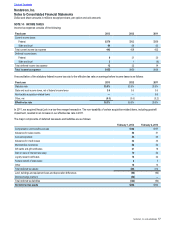

The components of interest expense, net are as follows:

Fiscal year 2013 2012 2011

Interest on long-term debt and short-term borrowings $176 $167 $139

Less:

Interest income (1) (2) (2)

Capitalized interest (14) (5) (7)

Interest expense, net $161 $160 $130

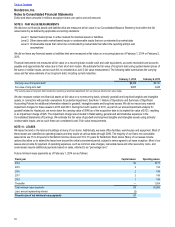

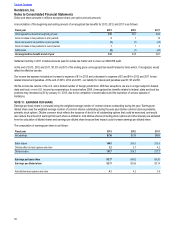

Credit Facilities

As of February 1, 2014, we had total short-term borrowing capacity available for general corporate purposes of $800.

In March 2013, we terminated both our $600 unsecured revolving credit facility that was scheduled to expire in June 2016, and our $200

2007-A Variable Funding Note that was scheduled to expire in January 2014. We replaced these with a new five-year $800 senior unsecured

revolving credit facility (“revolver”) that expires in March 2018. Also in March 2013, our wholly owned subsidiary Nordstrom fsb terminated its

$100 variable funding facility.

Under the terms of our new revolver, we pay a variable rate of interest and a commitment fee based on our debt rating. The new revolver is

available for working capital, capital expenditures and general corporate purposes and backs our commercial paper program. We have the

option to increase the revolving commitment by up to $200, to a total of $1,000, provided that we obtain written consent from the lenders.

The new revolver requires that we maintain an adjusted debt to earnings before interest, income taxes, depreciation, amortization and rent

(“EBITDAR”) leverage ratio of less than four times. As of February 1, 2014 and February 2, 2013, we were in compliance with this covenant.

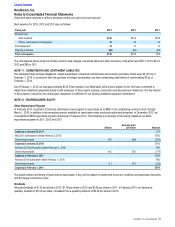

Our $800 commercial paper program allows us to use the proceeds to fund operating cash requirements. Under the terms of the commercial

paper agreement, we pay a rate of interest based on, among other factors, the maturity of the issuance and market conditions. The issuance

of commercial paper has the effect, while it is outstanding, of reducing borrowing capacity under our revolver by an amount equal to the

principal amount of commercial paper.

During 2013, we had no issuances under our commercial paper program and no borrowings under our new revolver, the terminated $600

credit facility, or the terminated Nordstrom fsb credit facility. During 2012, we had no issuances under our commercial paper program and no

borrowings under our $600 credit facility, the $200 Variable Funding Note, or the $100 Nordstrom fsb credit facility.

In November 2013, our wholly owned subsidiary in Puerto Rico entered into a $52 unsecured borrowing facility to support our expansion into

that market. The facility expires in November 2018 and borrowings on this facility incur interest based upon the one-month LIBOR plus

1.275% per annum. During 2013, $2 was borrowed and is outstanding on this facility.

Table of Contents

Nordstrom, Inc.

Notes to Consolidated Financial Statements

Dollar and share amounts in millions except per share, per option and unit amounts