Nordstrom 2013 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2013 Nordstrom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

40

NOTE 1: NATURE OF OPERATIONS AND SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

The Company

Founded in 1901 as a shoe store in Seattle, Washington, today Nordstrom, Inc. is a leading fashion specialty retailer that offers customers a

well-edited selection of high-quality fashion brands focused on apparel, shoes, cosmetics and accessories for men, women and children. This

breadth of merchandise allows us to serve a wide range of customers who appreciate quality fashion and a superior shopping experience.

We offer a wide selection of high-quality brand name and private label merchandise through multiple retail channels, including 117

“Nordstrom” branded full-line stores and our online store at Nordstrom.com (collectively, “Nordstrom”), 140 off-price “Nordstrom Rack” stores,

our “HauteLook” online private sale subsidiary, two “Jeffrey” boutiques and one “Last Chance” clearance store. Our stores are located in 35

states throughout the U.S.

Through our Credit segment, we provide our customers with a variety of payment products and services, including a Nordstrom private label

card, two Nordstrom VISA credit cards and a debit card for Nordstrom purchases. These products also allow our customers to participate in

our loyalty program, which is designed to increase customer visits and spending. Although the primary purposes of our Credit segment are to

foster greater customer loyalty and drive more sales, we also generate revenues from finance charges and other fees on these cards and, on

a consolidated basis, we avoid costs that would be incurred if our customers used third-party cards.

Fiscal Year

We operate on a 52/53-week fiscal year ending on the Saturday closest to January 31st. References to 2013 and all years except 2012 within

this document are based on a 52-week fiscal year, while 2012 is based on a 53-week fiscal year.

Principles of Consolidation

The consolidated financial statements include the balances of Nordstrom, Inc. and its subsidiaries. All intercompany transactions and

balances are eliminated in consolidation.

Use of Estimates

The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America requires

management to make estimates and assumptions that affect the reported amounts of assets, liabilities, revenues and expenses, and

disclosure of contingent assets and liabilities during the reporting period. Uncertainties regarding such estimates and assumptions are

inherent in the preparation of financial statements and actual results may differ from these estimates and assumptions. Our most significant

accounting judgments and estimates include the allowance for credit losses, revenue recognition, inventory, goodwill and income taxes.

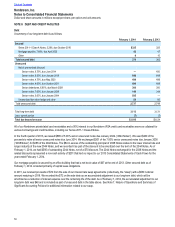

Net Sales

We recognize revenue from sales at our retail stores at the point of sale, net of estimated returns and excluding sales taxes. Revenue from

sales to customers shipped directly from our stores, website and catalog, which includes shipping revenue when applicable, is recognized

upon estimated receipt by the customer. We estimate customer merchandise returns based on historical return patterns and reduce sales

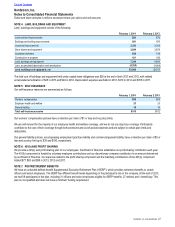

and cost of sales accordingly. Activity in the allowance for sales returns, net, for the past three fiscal years is as follows:

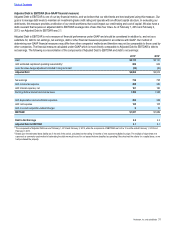

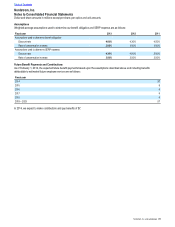

Fiscal year 2013 2012 2011

Allowance at beginning of year $116 $103 $85

Additions 1,880 1,724 1,411

Returns, net1(1,868) (1,711) (1,393)

Allowance at end of year $128 $116 $103

1 Returns, net consist of actual returns offset by the value of the merchandise returned and any sales commission reversed.

Credit Card Revenues

Credit card revenues include finance charges, late fees and other revenue generated by our combined Nordstrom private label card and

Nordstrom VISA credit card programs, and interchange fees generated by the use of Nordstrom VISA cards at third-party merchants. Finance

charges and late fees are assessed according to the terms of the related cardholder agreements and recognized as revenue when earned.

Credit card revenues are recorded net of estimated uncollectible finance charges and fees.

Cost of Sales

Cost of sales includes the purchase cost of inventory sold (net of vendor allowances), in-bound freight and certain costs of loyalty program

benefits related to our credit and debit cards.

Table of Contents

Nordstrom, Inc.

Notes to Consolidated Financial Statements

Dollar and share amounts in millions except per share, per option and unit amounts