Nordstrom 2013 Annual Report Download - page 16

Download and view the complete annual report

Please find page 16 of the 2013 Nordstrom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

16

RESULTS OF OPERATIONS

Our reportable segments are Retail and Credit. Our Retail segment includes our Nordstrom branded full-line stores and online store,

Nordstrom Rack stores, Last Chance clearance store and other retail channels, including HauteLook and Jeffrey stores. For purposes of

discussion and analysis of our results of operations, we combine our Retail segment results with revenues and expenses in the “Corporate/

Other” column of our segment reporting footnote, which also includes our Canadian operations (collectively, the “Retail Business”). We

analyze our results of operations through earnings before interest and income taxes for our Retail Business and Credit, while interest

expense and income taxes are discussed on a total company basis.

Similar to many other retailers, Nordstrom follows the retail 4-5-4 reporting calendar, which included an extra week in the fourth quarter of

2012 (the “53rd week”). The analysis of our results of operations, liquidity and capital resources compares the 52 weeks in 2013 to the 53

weeks in 2012. However, the 53rd week is not included in same-store sales calculations. In 2012, the 53rd week contributed approximately

$0.04 to earnings per diluted share.

As discussed in Note 1: Nature of Operations and Summary of Significant Accounting Policies and Note 16: Segment Reporting in the Notes

to Consolidated Financial Statements, beginning in the first quarter of 2013, we reclassified amounts in our financial statements to better

reflect the way we view and measure our business. As we continue to execute our long-term growth strategy and make investments across

operating segments, aligning expenses with the associated benefits enhances our ability to evaluate segment performance. Historical results

were also reclassified to match the current period presentation. These reclassifications did not impact net earnings, earnings per share,

financial position or cash flows.

We now allocate Nordstrom Rewards loyalty program expenses to our Retail Business. We previously recorded all Nordstrom Rewards

expenses in our Credit segment. In addition, certain technology expenses we previously included in our Retail Business are now allocated to

our Credit segment. These changes within our Retail Business and Credit segment did not impact the presentation of expenses in our

consolidated financial statements. In our Credit segment, we previously presented bad debt expense associated with finance charges and

fees as part of selling, general and administrative expenses. We reclassified these amounts and now present them as a reduction of credit

card revenue.

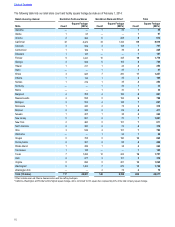

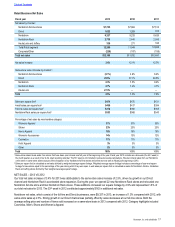

Retail Business

Summary

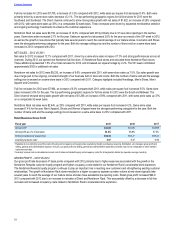

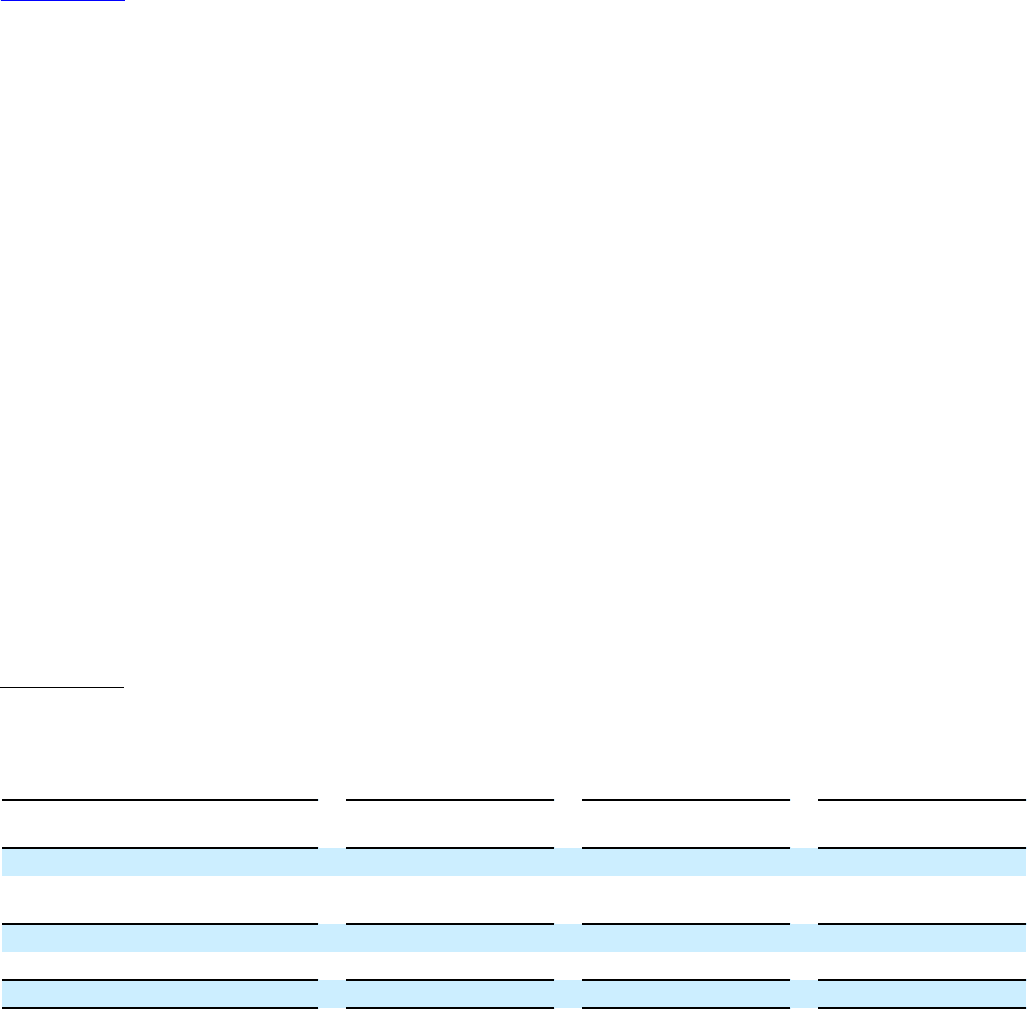

The following table summarizes the results of our Retail Business for the past three years:

Fiscal year 2013 2012 2011

Amount % of net

sales1Amount % of net

sales1Amount % of net

sales1

Net sales $12,166 100.0% $11,762 100.0% $10,497 100.0%

Cost of sales and related buying and

occupancy costs (7,732) (63.6%) (7,427) (63.1%) (6,588) (62.8%)

Gross profit 4,434 36.4% 4,335 36.9% 3,909 37.2%

Selling, general and administrative expenses (3,272) (26.9%) (3,172) (27.0%) (2,808) (26.7%)

Earnings before interest and income taxes $1,162 9.6% $1,163 9.9% $1,101 10.5%

1 Subtotals and totals may not foot due to rounding.

Table of Contents