Nordstrom 2013 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2013 Nordstrom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

42

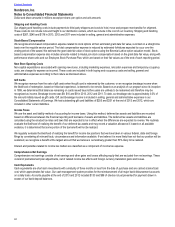

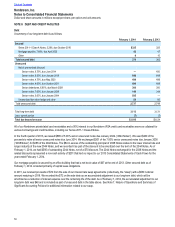

Shipping and Handling Costs

Our shipping and handling costs include payments to third-party shippers and costs to hold, move and prepare merchandise for shipment.

These costs do not include in-bound freight to our distribution centers, which we include in the cost of our inventory. Shipping and handling

costs of $267, $240 and $178 in 2013, 2012 and 2011 were included in selling, general and administrative expenses.

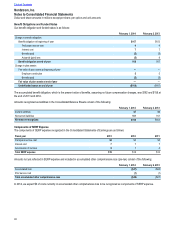

Stock-Based Compensation

We recognize stock-based compensation expense related to stock options at their estimated grant date fair value, recorded on a straight-line

basis over the requisite service period. The total compensation expense is reduced by estimated forfeitures expected to occur over the

vesting period of the award. We estimate the grant date fair value of stock options using the Binomial Lattice option valuation model. Stock-

based compensation expense also includes amounts related to HauteLook stock compensation based on the grant date fair value, along with

performance share units and our Employee Stock Purchase Plan, which are based on their fair values as of the end of each reporting period.

New Store Opening Costs

Non-capital expenditures associated with opening new stores, including marketing expenses, relocation expenses and temporary occupancy

costs, are charged to expense as incurred. These costs are included in both buying and occupancy costs and selling, general and

administrative expenses according to their nature as disclosed above.

Gift Cards

We recognize revenue from the sale of gift cards when the gift card is redeemed by the customer, or we recognize breakage income when

the likelihood of redemption, based on historical experience, is deemed to be remote. Based on an analysis of our program since its inception

in 1999, we determined that balances remaining on cards issued beyond five years are unlikely to be redeemed and therefore may be

recognized as income. Breakage income was $9, $10 and $9 in 2013, 2012 and 2011. To date, our breakage rate is approximately 3.0% of

the amount initially issued as gift cards. Gift card breakage income is included in selling, general and administrative expenses in our

Consolidated Statements of Earnings. We had outstanding gift card liabilities of $255 and $231 at the end of 2013 and 2012, which are

included in other current liabilities.

Income Taxes

We use the asset and liability method of accounting for income taxes. Using this method, deferred tax assets and liabilities are recorded

based on differences between the financial reporting and tax basis of assets and liabilities. The deferred tax assets and liabilities are

calculated using the enacted tax rates and laws that are expected to be in effect when the differences are expected to reverse. We routinely

evaluate the likelihood of realizing the benefit of our deferred tax assets and may record a valuation allowance if, based on all available

evidence, it is determined that some portion of the tax benefit will not be realized.

We regularly evaluate the likelihood of realizing the benefit for income tax positions that we have taken in various federal, state and foreign

filings by considering all relevant facts, circumstances and information available. If we believe it is more likely than not that our position will be

sustained, we recognize a benefit at the largest amount that we believe is cumulatively greater than 50% likely to be realized.

Interest and penalties related to income tax matters are classified as a component of income tax expense.

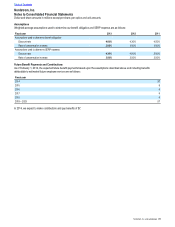

Comprehensive Net Earnings

Comprehensive net earnings consists of net earnings and other gains and losses affecting equity that are excluded from net earnings. These

consist of postretirement plan adjustments, net of related income tax effects and foreign currency translation gains and losses.

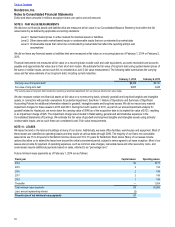

Cash Equivalents

Cash equivalents are short-term investments with a maturity of three months or less from the date of purchase and are carried at amortized

cost, which approximates fair value. Our cash management system provides for the reimbursement of all major bank disbursement accounts

on a daily basis. Accounts payable at the end of 2013 and 2012 included $133 and $86 of checks not yet presented for payment drawn in

excess of our bank deposit balances.

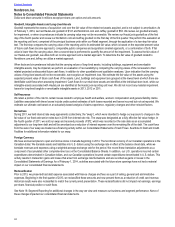

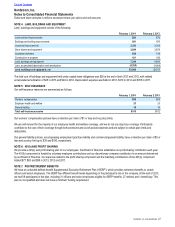

Table of Contents

Nordstrom, Inc.

Notes to Consolidated Financial Statements

Dollar and share amounts in millions except per share, per option and unit amounts