Nordstrom 2013 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2013 Nordstrom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

28

We received property incentives from our developers of $89 in 2013, $58 in 2012 and $78 in 2011. These incentives are included in our cash

provided by operations in our Consolidated Statements of Cash Flows in Item 8: Financial Statements and Supplementary Data. However,

operationally we view these as an offset to our capital expenditures. Our capital expenditure percentages, net of property incentives, by

category are summarized as follows:

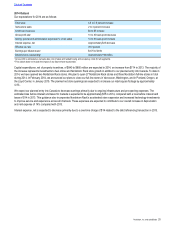

Fiscal year 2013 2012 2011

Category and expenditure percentage:

New store openings, relocations and remodels 62% 54% 62%

Information technology 27% 27% 20%

Other 11% 19% 18%

Total 100% 100% 100%

Other capital expenditures consist of ongoing improvements to our stores in the ordinary course of business and expenditures related to

various growth initiatives.

We expect to significantly increase our capital expenditures, net of property incentives, over the next five years to approximately $3,900,

compared with $2,200 over the previous five years. We plan to spend approximately $840 to $880 in 2014 compared with $714 in 2013. Both

of these increases are primarily due to technology initiatives and our planned entrance into new markets such as Canada, as well as new

Nordstrom Rack and full-line stores. In addition, the growth in capital expenditures over the next five years includes costs for our Manhattan

store. Over these next five years, we expect that approximately 44% of our net capital expenditures will be for new store openings,

relocations, remodels and other with an additional 24% for entry into Canada and Manhattan, and 32% for e-commerce and information

technology. We believe that we have the capacity for additional capital investments should opportunities arise.

CHANGE IN RESTRICTED CASH

In connection with the $500 debt maturity in the first quarter of 2012, we began making required monthly cash deposits of $100 into a

restricted account in December 2011 until we accumulated $500 by April 2012 to retire the debt. As of January 28, 2012, we had

accumulated $200. During the first quarter of 2012, the net amount withdrawn from restricted cash of $200 was recorded as cash received

from investing activities.

CHANGE IN CREDIT CARD RECEIVABLES ORIGINATED AT THIRD PARTIES

The Nordstrom VISA credit cards allow our customers to make purchases at merchants outside of our stores and accumulate points for our

Nordstrom Rewards program. In 2013, the change in credit card receivables from customers’ third-party purchases using their Nordstrom

VISA credit cards decreased to $6, compared with $42 in 2012, as payment rates slightly increased in 2013, and VISA credit card volume

remained relatively consistent with 2012. In 2012, there was a $204 increase in VISA credit card volume compared with 2011.

Financing Activities

Net cash used in financing activities was $589 in 2013 compared with $1,333 in 2012. Our financing activities include our short-term and

long-term borrowing activity, repurchases of common stock and payment of dividends.

SHORT-TERM AND LONG-TERM BORROWING ACTIVITY

In the fourth quarter of 2013, we issued $665 of 5.00% senior unsecured notes due January 2044 (“2044 Notes”). We used $400 of the

proceeds to retire all 6.75% senior unsecured notes due June 2014. We exchanged $201 of the 7.00% senior unsecured notes due January

2038 (“2038 Notes”) for $265 of the 2044 Notes. The $64 in excess of the outstanding principal of 2038 Notes relates to the lower interest

rate and longer maturity of the new 2044 Notes, and we recorded it as part of the discount to be amortized over the term of the 2044 Notes.

As of February 1, 2014, we had $595 of outstanding 2044 Notes, net of a $70 discount. The 2044 Notes exchanged for the 2038 Notes and

the related discounts represented a non-cash activity of $201 that had no impact to our 2013 Consolidated Statements of Cash Flows for the

year ended February 1, 2014. See Note 8: Debt and Credit Facilities in Item 8: Financial Statements and Supplementary Data for additional

information.

During 2012, we retired our $500 securitized Series 2007-2 Class A & B Notes upon maturity in April 2012 using accumulated restricted cash

described in Investing Activities above.

During 2011, we issued $500 of senior unsecured notes at 4.00%, due October 2021. After deducting the original issue discount of $1, net

proceeds from the offering were $499. Additionally, we issued $325 Series 2011-1 Class A Notes at 2.28%, due October 2016.

Also in 2011, we received proceeds of $72 from the sale of our interest rate swap agreements (collectively, the “swap”) with a $650 notional

amount maturing in 2018. We recorded the $72 on the sale date as an accumulated adjustment to our long-term debt, which will be

amortized as a reduction of interest expense over the remaining life of the debt. As of February 1, 2014, the accumulated adjustment to our

long-term debt was $48. See Note 1: Nature of Operations and Summary of Significant Accounting Policies and Note 8: Debt and Credit

Facilities in Item 8: Financial Statements and Supplementary Data for additional information related to our swap.

Table of Contents