Nordstrom 2013 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2013 Nordstrom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Nordstrom, Inc. and subsidiaries 53

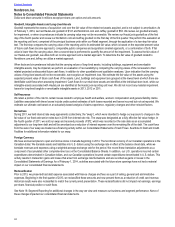

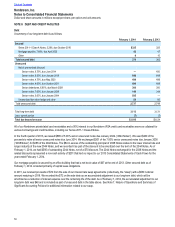

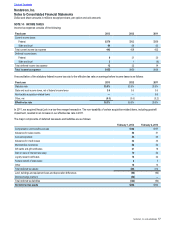

Rent expense for 2013, 2012 and 2011 was as follows:

Fiscal year 2013 2012 2011

Minimum rent:

Store locations $145 $124 $108

Offices, warehouses and equipment 35 32 23

Percentage rent 14 14 12

Property incentives (69) (65) (65)

Total rent expense $125 $105 $78

The rent expense above does not include common area charges, real estate taxes and other executory costs which were $81 in 2013, $74 in

2012 and $69 in 2011.

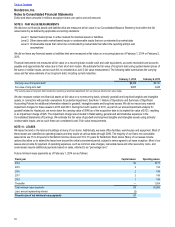

NOTE 11: COMMITMENTS AND CONTINGENT LIABILITIES

Our estimated total purchase obligations, capital expenditure contractual commitments and inventory purchase orders were $2,125 as of

February 1, 2014. In connection with the purchase of foreign merchandise, we have outstanding trade letters of credit totaling $3 as of

February 1, 2014.

As of February 1, 2014, we had approximately $125 of fee interest in our Manhattan full-line store subject to lien. We have committed to

make future installment payments based on the developer of the property meeting construction and development milestones. Our fee interest

in the property is subject to lien until project completion or fulfillment of our existing installment payment commitment.

NOTE 12: SHAREHOLDERS’ EQUITY

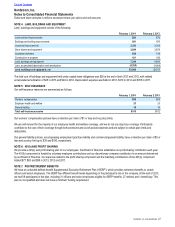

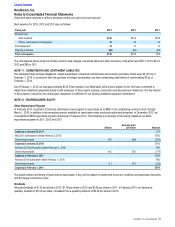

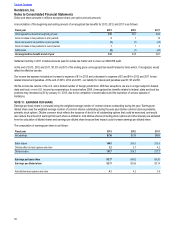

Share Repurchase Program

In February 2013, our Board of Directors authorized a new program to repurchase up to $800 of our outstanding common stock, through

March 1, 2015, in addition to the remaining amount available for repurchase under previously authorized programs. In December 2013, we

completed the $800 repurchase program authorized in February 2012. The following is a summary of the activity related to our share

repurchase programs in 2011, 2012 and 2013:

Shares Average price

per share Amount

Capacity at January 29, 2011 411

May 2011 authorization (ended February 2, 2013) $750

Shares repurchased 18.5 $46 (851)

Capacity at January 28, 2012 $310

February 2012 authorization (ended February 1, 2014) 800

Shares repurchased 14.0 $51 (717)

Capacity at February 2, 2013 $393

February 2013 authorization (ends February 1, 2015) 800

Shares repurchased 9.1 $57 (523)

Capacity at February 1, 2014 $670

The actual number and timing of future share repurchases, if any, will be subject to market and economic conditions and applicable Securities

and Exchange Commission rules.

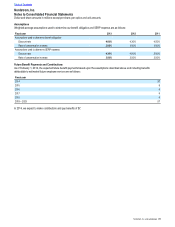

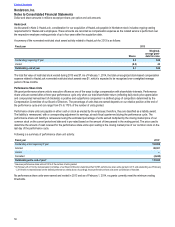

Dividends

We paid dividends of $1.20 per share in 2013, $1.08 per share in 2012 and $0.92 per share in 2011. In February 2014, we declared a

quarterly dividend of $0.33 per share, increased from a quarterly dividend of $0.30 per share in 2013.

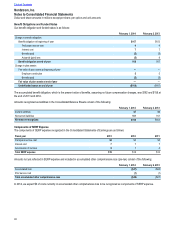

Table of Contents

Nordstrom, Inc.

Notes to Consolidated Financial Statements

Dollar and share amounts in millions except per share, per option and unit amounts