Nissan 2008 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2008 Nissan annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

82 Nissan Annual Report 2008

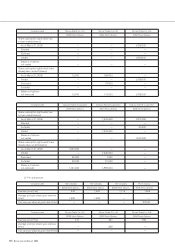

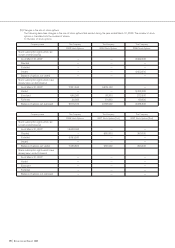

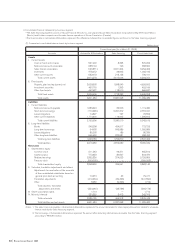

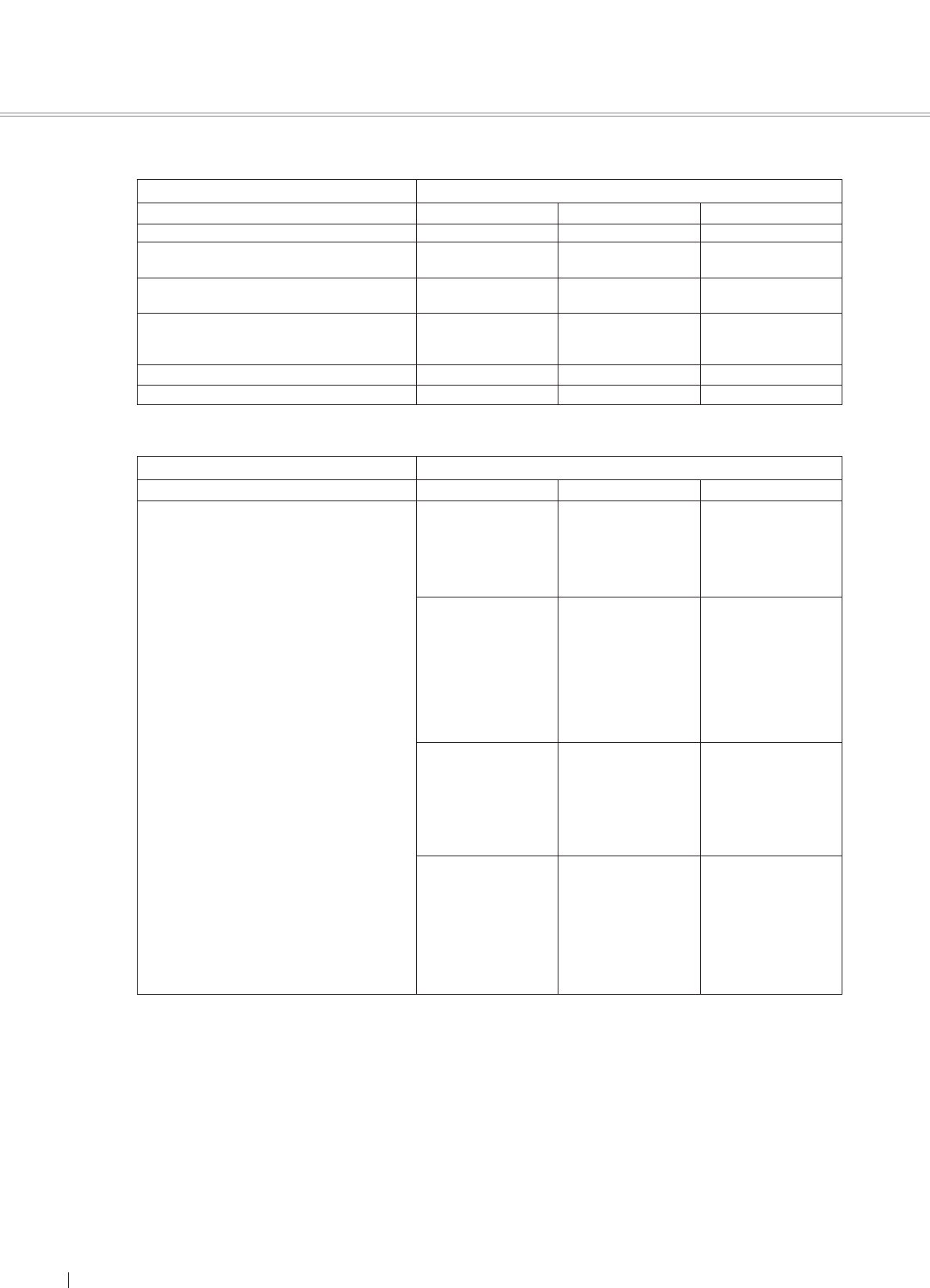

(2) Summarized consolidated statements of income by business segment (Millions of yen)

Prior fiscal year (From April 1, 2006 to March 31, 2007)

Accounts Automobile & Eliminations Sales financing Consolidated total

Net sales 9,773,871 694,712 10,468,583

Cost of sales 7,498,350 528,836 8,027,186

Gross profit 2,275,521 165,876 2,441,397

Operating income as a percentage of net sales 7.2% 10.9% 7.4%

Operating income 701,186 75,753 776,939

Financial income/expenses—net (5,664) 546 (5,118)

Other non-operating income/expenses—net (11,520) 750 (10,770)

Ordinary income 684,002 77,049 761,051

Income before income taxes and minority interests 621,236 76,196 697,432

Net income 413,529 47,267 460,796

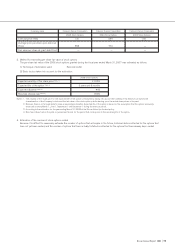

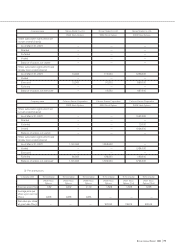

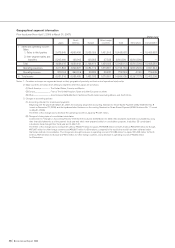

(3) Summarized consolidated statements of cash flows by business segment (Millions of yen)

Prior fiscal year (From April 1, 2006 to March 31, 2007)

Accounts Automobile & Eliminations Sales financing Consolidated total

I. Cash flows from operating activities

Income before income taxes and minority

interests 621,236 76,196 697,432

Depreciation and amortization 447,924 323,299 771,223

Decrease (increase) in finance receivables (22,914) 67,255 44,341

Others (528,386) 58,217 (470,169)

Net cash provided by operating activities 517,860 524,967 1,042,827

II. Cash flows from investing activities

Proceeds from sales of investment securities 37,794 — 37,794

Proceeds from sales of property, plant and

equipment 72,308 0 72,308

Purchases of fixed assets (537,129) (9,719) (546,848)

Purchases of leased vehicles (41,234) (916,122) (957,356)

Proceeds from sales of leased vehicles 7,253 297,659 304,912

Others (35,804) 10,407 (25,397)

Net cash used in investing activities (496,812) (617,775) (1,114,587)

III. Cash flows from financing activities

Net increase in short-term borrowings 418,824 73,714 492,538

Net change in long-term borrowings and

redemption of bonds (215,299) (107,770) (323,069)

Increase in bonds — 123,730 123,730

Others (186,460) 173 (186,287)

Net cash provided by financing activities 17,065 89,847 106,912

IV. Effect of exchange rate changes on cash and

cash equivalents 16,775 (135) 16,640

V. Increase (decrease) in cash and cash equivalents 54,888 (3,096) 51,792

VI. Cash and cash equivalents at beginning of the year 392,505 11,707 404,212

VII. Increase due to inclusion in consolidation 12,571 813 13,384

VIII.Cash and cash equivalents at end of the year 459,964 9,424 469,388

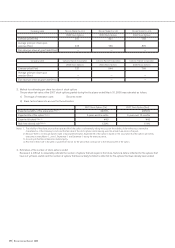

Notes 1. The net increase in short-term borrowings of Automobile & Eliminations includes the amount of ¥16,522 million eliminated for increase in

internal loans receivable from the Sales financing segment.

2. The net change in long-term borrowings and redemption of bonds of Automobile & Eliminations includes the amount of ¥25,073 million

eliminated for increase in internal loans receivable from the Sales financing segment.