Nissan 2008 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2008 Nissan annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

4Nissan Annual Report 2008

LETTER FROM THE CFO

Some wonder why Nissan required a CFO after four

years without one. Simply put, we are expanding in

multiple markets, becoming a more global entity, and

a CFO is there to ensure that the company

possesses the resources to continue that growth.

Having a CFO also lends the finance function a more

visible profile, both internally and externally.

My background and experience have been

strongly related to the automotive and finance

industries. I covered the global car industry for a

large New York bank before joining Renault’s

financial team. While serving as the finance services

director at Renault, I worked on all of the company’s

M&A transactions, including Nissan, of course, but

also Mack Trucks, Volvo, Dacia, Samsung, Avtovaz in

Russia, and even the repurchase of the Benetton

Formula One racing team. I have been involved with

Nissan since discussions commenced with Renault

in June of 1998, and I was a member of the Nissan

Diesel board until 2004.

At Nissan, the CFO oversees the treasury

functions, investor relations, tax and customs issues

and the newly created Sales Finance Business Unit.

We share the M&A function with corporate planning,

buying, selling and restructuring companies and

assets, including our internal affiliates. Our office

also participates in the examination and evaluation of

potential new partnerships in the global auto

industry.

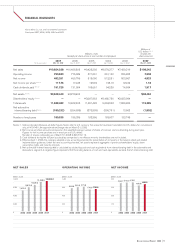

Operating profit, which has been a major Nissan

objective for years, reflects how well we sell our cars,

and how profitable we are. While certain

shareholders and other external observers often

focus on operating profit, this measure tells only part

of the story. We believe free cash flow is a better

gauge, because it encompasses every facet of the

company. In addition to operating margin, free cash

flow also shows how we manage our balance sheet:

the efficiency of our investments, appropriate levels

of inventory and accounts receivable, and so on. Our

previous financial indicator—Return on Invested

Capital (ROIC)—is still a valid measure. However, the

explanation of ROIC can become overtly complex

and technical at times. Cash, on the other hand, is an

easy notion to understand.

Free cash flow is also an important external

indicator that is closely monitored by investors,

analysts and banks, as it measures our ability to pay

our shareholders and debtholders. Nissan benefits

from a strong balance sheet with a large equity base.

Maintaining availability of cash is of the utmost

importance when the automotive industry is facing so

many risks: volatile raw material prices, steep

declines and changes in demand and product mix in

mature markets, adverse foreign exchange rate

movements, and a rapid decline in the lending

capacity of banks and financial markets.

Controlling costs is not enough to overcome the

risk of raw material prices. We also need to adjust

our retail prices upward, and this is what we did

worldwide.

The second risk I had mentioned is equally

powerful. With a wide range and mix of smaller SUVs

and passenger cars, we are probably in a better

position than European and U.S. manufacturers. To

adapt to this new demand, we can rely on our

manufacturing flexibility—a consistent strong point

for Nissan. Despite our good product mix and a

higher market share in many countries, the present

worldwide downturn will put pressure on our sales

volumes.

ALAIN DASSAS

Chief Financial Officer