Nissan 2008 Annual Report Download - page 29

Download and view the complete annual report

Please find page 29 of the 2008 Nissan annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

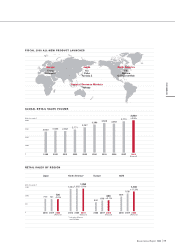

THE ALLIANCE ULTRA-LOW-COST CAR

(AULC)

ELECTRIC VEHICLES (EVs)

2011: Alliance ultra-low-cost car

with Renault and Bajaj

Mass-marketed globally in fiscal 2012

The affordability breakthrough

Denmark

FY2011

Japan

FY2010 U.S. (Tennessee)

FY2010

Portugal

FY2011

Israel

FY2011

27

Nissan Annual Report 2008

NISSAN GT 2012

CARLOS TAVARES

Executive Vice President

number one is clearly in sight, and we will continue to

measure our progress against all of the influential

indicators in all of our key markets.

The growth of Infiniti is supported by expanding

market coverage, including entering Europe—

traditionally the toughest Tier 1 luxury market.

Russia, for example, will have 22 new showrooms

open over the next two years covering every major

city in the country.

Affordable mobility, an attractive EV portfolio and

a luxury push will require enormous resources. We

also need to take care not to fragment our portfolio. I

am confident on both counts. We are creating an

elite and rationalized family of products with global

appeal and positive environmental qualities. They will

generate greater volumes and cost efficiencies in the

years to come.

Light commercial vehicles are a major

pillar of our NISSAN GT 2012 strategy.

The LCV sector is extremely complex,

with multiple segments in multiple

markets. Our portfolio presently covers

around 73 percent of those segments

globally. We will launch 13 new models

between now and 2012, giving us 94

percent coverage and essentially

doubling our turnover.

We have come a long way since

2002. We were OEM buyers then, and

planned to sell just 163,000 units. In

2007, we sold 520,000 LCVs in a total

market of 8.2 million units by our count,

and we have now become OEM

suppliers—a business we will continue

with Dongfeng in China, Ashok Leyland

in India and other customers such as

Renault Trucks.

We did major surgery in 2002 and

2003 to make our LCV business

profitable, adopting what we call the

“Meccano strategy”—using stock and

carryover parts and systems on new

vehicles whenever possible. By 2012 we

will also cut the number of unique LCV

platforms from eleven to two, boosting

our average volume per platform and

gaining significant economies of scale.

We expect TIV in emerging markets

like China, India, Southeast Asia, and

South America to increase rapidly,

pumping up the total market by about 20

percent. We are calling four of our most

crucial new markets “URIC”—meaning the

United States, Russia, India and China.

Nissan remains the only Japanese

maker with a significant LCV presence in

China. To ensure sufficient specialized

LCV capacity, we are building production

facilities in Morocco and Chennai, India.

The Morocco plant will begin supplying

mainland Europe with vehicles from 2010.

This autumn we launch two vehicles in

Russia, and plan to grow the network

there and roll out the entire range by

2012. We are investing 118 million

dollars in our U.S. factory in Canton to

produce three LCVs for our American

market debut in 2010. To meet our

NISSAN GT 2012 goals, we are going

after both conquest and organic growth.

Light Commercial Vehicles

Take the Stage

ANDY PALMER

Corporate Vice President