Nissan 2008 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2008 Nissan annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

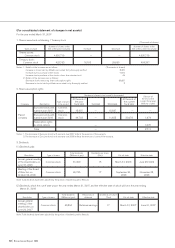

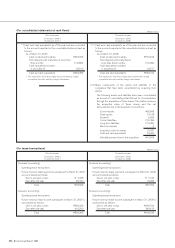

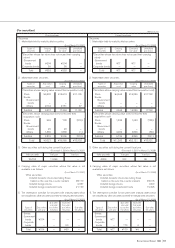

62 Nissan Annual Report 2008

Prior fiscal year Current fiscal year

From April 1, 2006 From April 1, 2007

[

To March 31, 2007

][

To March 31, 2008

]

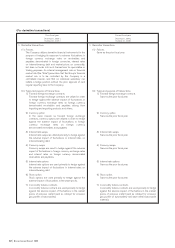

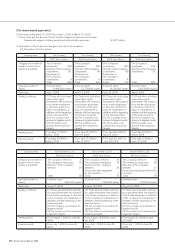

1. Derivative transactions

(1) Policies

The Company utilizes derivative financial instruments for the

purpose of hedging its exposure to adverse fluctuations in

foreign currency exchange rates on receivables and

payables denominated in foreign currencies, interest rates

on interest-bearing debt and market prices on commodity,

but does not enter into such transactions for speculative or

trading purposes. An internal management rule on financial

market risk (the “Rule”) prescribes that the Group’s financial

market risk is to be controlled by the Company in a

centralized manner, and that no individual subsidiary can

initiate a hedge position without the prior approval of, and

regular reporting back to the Company.

(2) Types and purpose of transactions:

1) Forward foreign exchange contracts

Forward foreign exchange contracts are utilized in order

to hedge against the adverse impact of fluctuations in

foreign currency exchange rates on foreign currency

denominated receivables and payables arising from

importing and exporting products and others.

2) Currency option

In the same manner as forward foreign exchange

contracts, currency options are utilized in order to hedge

against the adverse impact of fluctuations in foreign

currency exchange rates on foreign currency

denominated receivables and payables.

3) Interest rate swaps

Interest rate swaps are utilized primarily to hedge against

the adverse impact of fluctuations in interest rates on

interest-bearing debt.

4) Currency swaps

Currency swaps are used to hedge against the adverse

impact of fluctuations in foreign currency exchange rates

and interest rates on foreign currency denominated

receivables and payables.

5) Interest rate options

Interest rate options are used primarily to hedge against

the adverse impact of fluctuations in interest rates on

interest-bearing debt.

6) Stock option

Stock options are used primarily to hedge against the

adverse impact of fluctuations in the share prices.

7) Commodity futures contracts

Commodity futures contracts are used primarily to hedge

against the adverse impact of fluctuations in the market

prices of precious metal (used as catalyst for emission

gas purifier of automobiles).

1. Derivative transactions

(1) Policies

Same as the prior fiscal year.

(2) Types and purpose of transactions:

1) Forward foreign exchange contracts

Same as the prior fiscal year.

2) Currency option

Same as the prior fiscal year.

3) Interest rate swaps

Same as the prior fiscal year.

4) Currency swaps

Same as the prior fiscal year.

5) Interest rate options

Same as the prior fiscal year.

6) Stock option

Same as the prior fiscal year.

7) Commodity futures contracts

Commodity futures contracts are used primarily to hedge

against the adverse impact of fluctuations in the market

prices of precious metal (used as catalyst for emission

gas purifier of automobiles) and base metal (automobile

material).

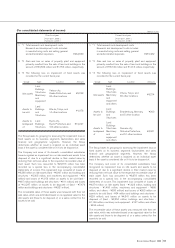

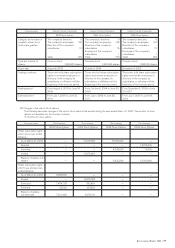

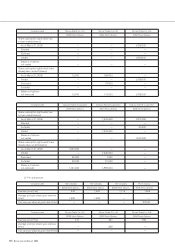

(For derivative transactions)