Nissan 2008 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2008 Nissan annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

68 Nissan Annual Report 2008

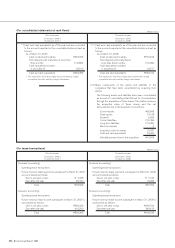

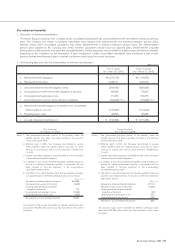

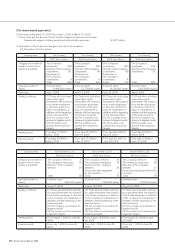

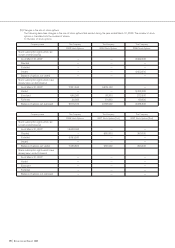

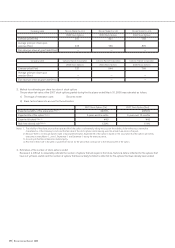

3. The components of retirement benefit expenses were as follows: (Millions of yen)

Prior fiscal year Current fiscal year

From April 1, 2006 From April 1, 2007

[

To March 31, 2007

][

To March 31, 2008

]

a. Service cost ¥ 51,696)(Note 2) ¥ 50,119)(Note 2)

b. Interest cost 41,209 41,855

c. Expected return on plan assets (39,625) (42,332)

d. Amortization of net retirement benefit obligation at transition 11,147 11,244

e. Amortization of actuarial gain or loss 9,031 9,006

f. Amortization of prior service cost (6,925) (Note 3) (7,377) (Note 3)

g. Other 3,732 6,511

h. Retirement benefit expenses (a+b+c+d+e+f+g) ¥ 70,265 ¥ 69,026

i. Gain (Loss) on implementation of defined contribution plans (18,782) (856)

Total ¥ 51,483 ¥ 68,170

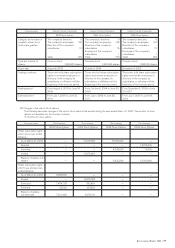

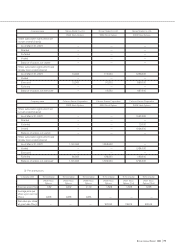

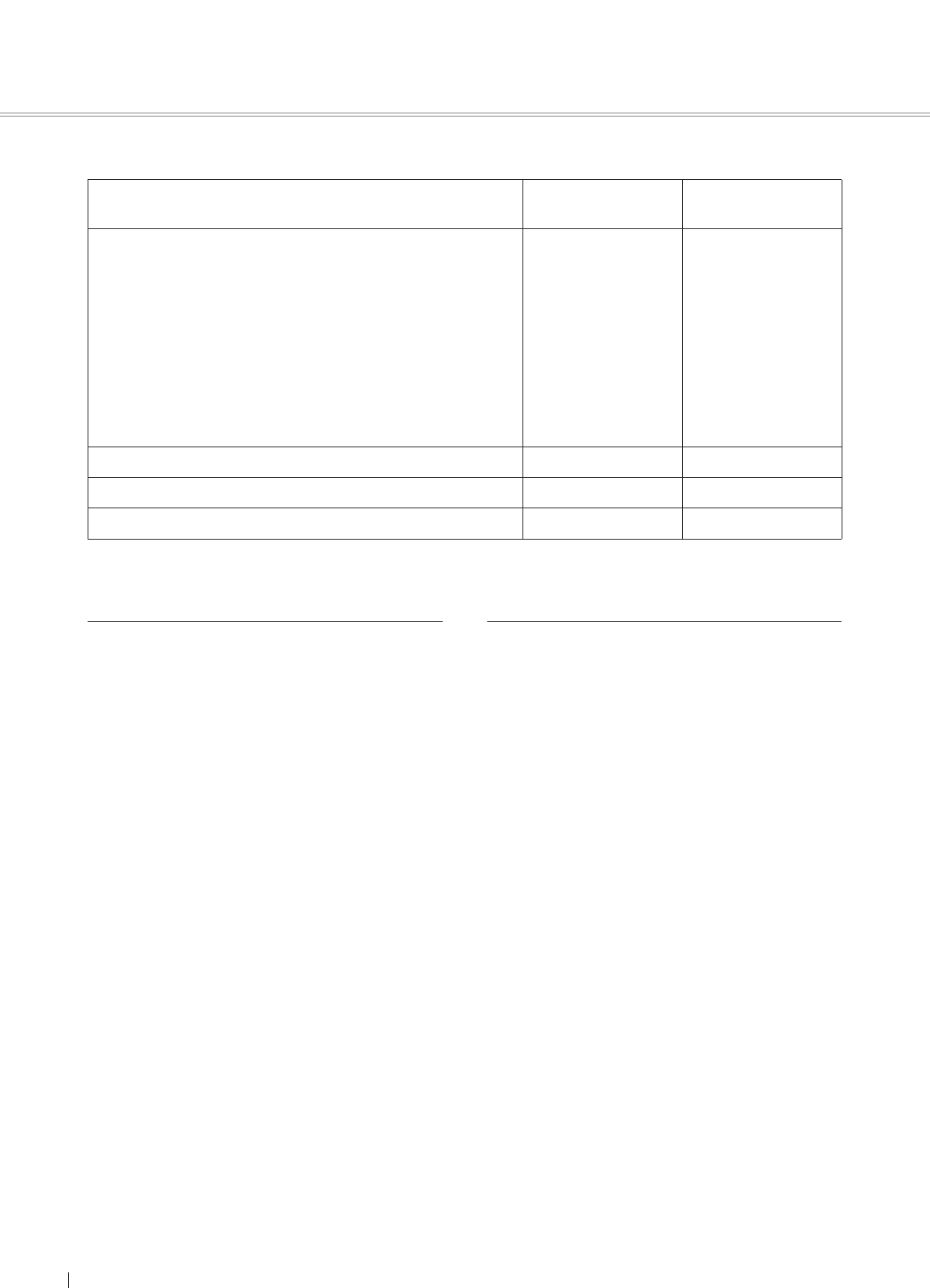

Prior fiscal year Current fiscal year

From April 1, 2006 From April 1, 2007

[

To March 31, 2007

][

To March 31, 2008

]

Notes: 1. In addition to the retirement benefit expenses referred to above,

additional retirement benefit expenses of ¥34,297 million were

accounted for as a special loss for the year ended March 31, 2007.

2. Service cost does not include the amounts contributed by

employees with respect to welfare pension fund plans.

3. Amortization of prior service cost represents the amount to be

recognized for this fiscal year with respect to prior service cost

explained in Note 2 to the table setting forth the fund status.

4. Retirement benefit expenses for consolidated subsidiaries

adopting the simplified method are included in a. “Service cost.”

5. The pension assets in the multi-employer welfare pension fund

plans allocated to the Company and the domestic consolidated

subsidiaries based on their share of the contributions amounted to

¥39,703 million.

Notes: 1. In addition to the retirement benefit expenses referred to above,

additional retirement benefit expenses of ¥17,575 million were

accounted for as a special loss for the year ended March 31, 2008.

2. Service cost does not include the amounts contributed by

employees with respect to welfare pension fund plans.

3. Amortization of prior service cost represents the amount to be

recognized for this fiscal year with respect to prior service cost

explained in Note 2 to the table setting forth the fund status.

4. Retirement benefit expenses for consolidated subsidiaries

adopting the simplified method are included in a. “Service cost.”