Nissan 2008 Annual Report Download - page 15

Download and view the complete annual report

Please find page 15 of the 2008 Nissan annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

13

Nissan Annual Report 2008

PERFORMANCE

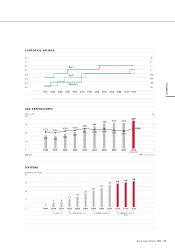

(Billions of yen)

(Billions of yen)

NET CASH FLOW (AUTO)

IMPACT ON OPERATING PROFIT

* Unaudited

Product

enrich./

regulatory

cost

Selling

expenses G&A

& others FOREXPurch.

cost

reduction

Price/

volume mix Warranty

expenses Raw

material

/energy

cost

FY06

O.P.

No Gap*

(same month

as FY07)

Mfg.

expenses R&D

expenses FY07

O.P.

-52.2

-38.1 -18.0 -16.2

+172.9

+75.0 +7.6 -84.7

755.2

-9.2 -1.5 790.8

Tax paidSales

finance

receivables

Working

capital and

others

Net auto

cash at

beginning

of FY07

Net cash

from

operations

CAPEX and

others Dividends

paid Treasury

stock Other

finance

activities

FX rate

impact Net auto

cash at end

of FY07

-154.0

-72.6

-1.6

254.7

+1,110.1

-425.2

-151.7

-48.1 -133.7

-197.6

180.3

Free cash flow

456.7

Financing activities

-333.5

FINANCIAL POSITION

Balance sheet

In fiscal 2007, Nissan’s total consolidated assets

decreased 3.7 percent to ¥11,939.5 billion. Current

assets decreased 3.1 percent to ¥6,294.2 billion.

The main reason was a ¥322.8 billion decrease in

finance receivables, which was offset by a ¥112.3

billion increase in cash on hand and in banks. Fixed

assets decreased to ¥5,645.3 billion, representing a

4.5 percent decline.

Current liabilities decreased 6.0 percent to

¥5,242.6 billion, the result of a ¥340.4 billion

decrease in short-term borrowing. Total long-term

liabilities decreased 3.5 percent to ¥2,847.4 billion,

mainly the result of a ¥116.9 billion decrease in

long-term borrowing.

Net assets decreased 0.7 percent to ¥3,849.4

billion, compared to ¥3,877.0 billion in fiscal 2006.

This was mainly due to changes of ¥332.6 billion

in foreign currency translation adjustments and

¥151.7 billion in dividends paid, which were offset

by the ¥482.3 billion of increased net income

mentioned above.