Nissan 2008 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2008 Nissan annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

52 Nissan Annual Report 2008

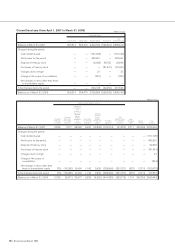

Prior fiscal year Current fiscal year

From April 1, 2006 From April 1, 2007

[

To March 31, 2007

][

To March 31, 2008

]

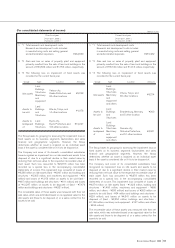

(6) Hedge accounting

1) Hedge accounting

Deferral hedge accounting is adopted for derivatives

which qualify as hedges, under which unrealized gain or

loss is deferred.

2) Hedging instruments and hedged items

·Hedging instruments ...... Derivative transactions

·Hedged items ....................... Hedged items are primarily

forecast sales denominated in foreign currencies.

3) Hedging policy

It is the Company’s policy that all transactions

denominated in foreign currencies are to be hedged.

4) Assessment of hedge effectiveness

Hedge effectiveness is not assessed if the substantial

terms and conditions of the hedging instruments and the

hedged forecasted transactions are the same.

5) Risk management policy with respect to hedge accounting

The Company manages its derivative transactions in

accordance with its internal “Policies and Procedures for

Risk Management.”

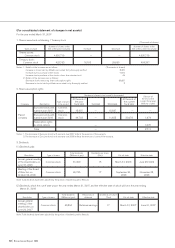

(7) Accounting for consumption tax

Transactions subject to consumption tax are recorded at

amounts exclusive of consumption tax.

(8) Accounting policies adopted by foreign consolidated subsidiaries

The financial statements of the Company’s subsidiaries in

Mexico and other countries have been prepared based on

general price-level accounting. The related revaluation

adjustments made to reflect the effect of inflation in those

countries in the accompanying consolidated financial

statements have been charged or credited to operations and

are directly reflected in valuation, translation adjustments

and others.

5. Valuation of assets and liabilities of consolidated subsidiaries

Assets and liabilities of consolidated subsidiaries acquired

through business combinations are carried at fair value at the

time of acquisition.

6. Amortization of goodwill and negative goodwill

Goodwill and negative goodwill have been amortized evenly over

periods not exceeding 20 years, determined based on their

materiality. However, immaterial goodwill and negative goodwill

are charged or credited to income in the year of acquisition.

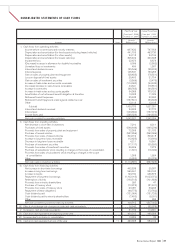

7. Cash and cash equivalents in the consolidated statements of

cash flows

Cash and cash equivalents consist of cash on hand, cash in

banks which can be withdrawn at any time and short-term

investments with a maturity of three months or less when

purchased which can easily be converted to cash and are

subject to little risk of change in value.

(6) Hedge accounting

1) Hedge accounting

Same as the prior fiscal year.

2) Hedging instruments and hedged items

·Hedging instruments ...... Derivative transactions

·Hedged items ....................... Hedged items are primarily

forecast sales denominated in foreign currencies,

and receivables and payables denominated in

foreign currencies.

3) Hedging policy

Same as the prior fiscal year.

4) Assessment of hedge effectiveness

Same as the prior fiscal year.

5) Risk management policy with respect to hedge accounting

Same as the prior fiscal year.

(7) Accounting for consumption tax

Same as the prior fiscal year.

(8) Adoption of consolidated taxation system

The Company and some of its subsidiaries adopted the

consolidated taxation system effective from the fiscal year

ended March 31, 2008.

(9) Accounting policies adopted by foreign consolidated subsidiaries

The financial statements of the Company’s consolidated

subsidiaries in Mexico have been prepared based on general

price-level accounting. The related revaluation adjustments

made to reflect the effect of inflation in Mexico in the

accompanying consolidated financial statements have been

charged or credited to operations and are directly reflected

in valuation, translation adjustments and others.

5. Valuation of assets and liabilities of consolidated subsidiaries

Same as the prior fiscal year.

6. Amortization of goodwill and negative goodwill

Goodwill and negative goodwill have been amortized evenly over

periods not exceeding 20 years, during which their effect can be

recognized, determined based on their materiality. However,

immaterial goodwill and negative goodwill are charged or

credited to income in the year of acquisition.

7. Cash and cash equivalents in the consolidated statements of

cash flows

Same as the prior fiscal year.