Nissan 2008 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2008 Nissan annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

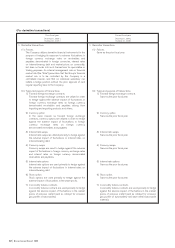

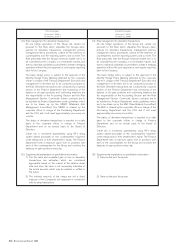

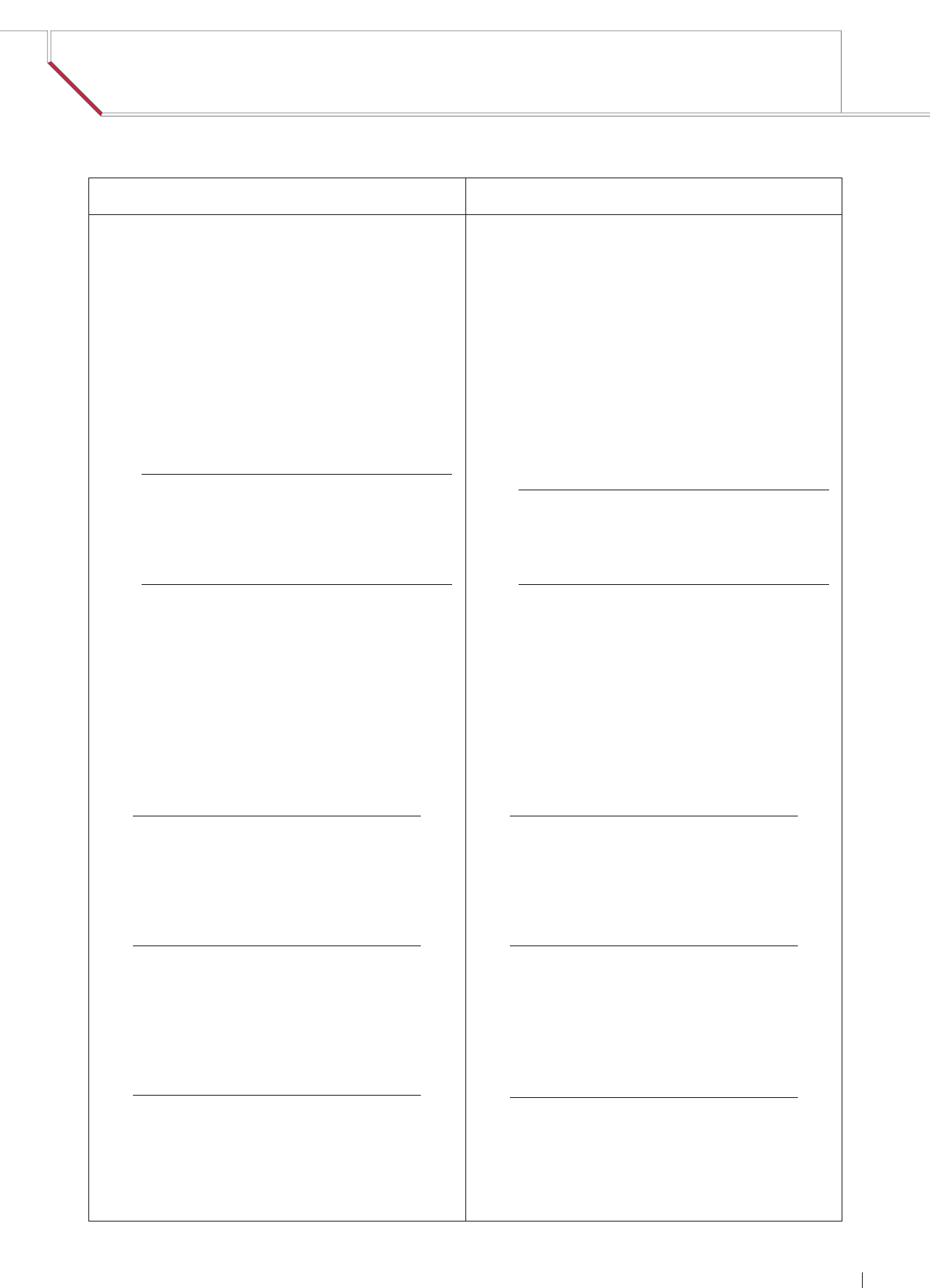

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

55

Nissan Annual Report 2008

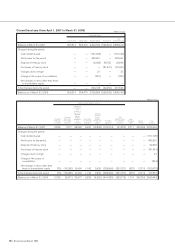

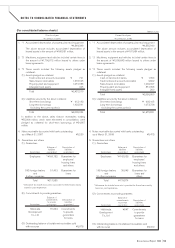

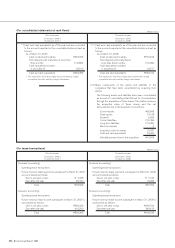

Prior fiscal year Current fiscal year

(As of March 31, 2007) (As of March 31, 2008)

1. *1 Accumulated depreciation of property, plant and equipment

¥4,349,349

The above amount includes accumulated depreciation of

leased assets in the amount of ¥160,851 million.

2. *2 Machinery, equipment and vehicles included certain items in

the amount of ¥1,796,072 million leased to others under

lease agreements.

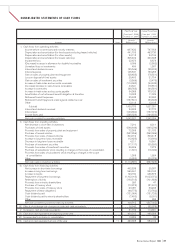

3. *3 These assets included the following assets pledged as

collateral:

(1) Assets pledged as collateral:

Trade notes and accounts receivable ¥ 741

Sales finance receivables 1,378,045

Property, plant and equipment 1,057,988

Intangible fixed assets 445

Total ¥2,437,219

(2) Liabilities secured by the above collateral:

Short-term borrowings ¥ 612,193

Long-term borrowings 1,422,841

(including the current portion)

Total ¥2,035,034

In addition to the above, sales finance receivables totaling

¥55,066 million, which were eliminated in consolidation, were

pledged as collateral for short-term borrowings of ¥54,957

million.

4. Notes receivable discounted with banks outstanding

as of March 31, 2007 ¥5,229

5. Guarantees and others

(1) Guarantees

Balance of Description of

liabilities liabilities

Guarantees guaranteed guaranteed

Employees * ¥160,182 Guarantees for

employees’

housing loans

and others

593 foreign dealers 51,403 Guarantees for

and loans

6 other companies

Total ¥211,585

* Allowance for doubtful accounts is provided for these loans mainly

based on past experience.

(2) Commitments to provide guarantees

Balance of

commitments Description of

to provide liabilities

Guarantees guarantees guaranteed

Hibikinada ¥1,064 Commitments

Development to provide

Co., Ltd. guarantees

for loans

(3) Outstanding balance of installment receivables sold

with recourse ¥6,076

1. *1 Accumulated depreciation of property, plant and equipment

¥4,355,940

The above amount includes accumulated depreciation of

leased assets in the amount of ¥197,954 million.

2. *2 Machinery, equipment and vehicles included certain items in

the amount of ¥1,598,643 million leased to others under

lease agreements.

3. *3 These assets included the following assets pledged as

collateral:

(1) Assets pledged as collateral:

Cash on hand and in banks ¥ 1,993

Trade notes and accounts receivable 2,662

Sales finance receivables 1,230,097

Property, plant and equipment 851,998

Intangible fixed assets 200

Total ¥2,086,950

(2) Liabilities secured by the above collateral:

Short-term borrowings ¥ 602,105

Long-term borrowings 1,073,726

(including the current portion)

Total ¥1,675,831

4. Notes receivable discounted with banks outstanding

as of March 31, 2008 ¥5,473

5. Guarantees and others

(1) Guarantees

Balance of Description of

liabilities liabilities

Guarantees guaranteed guaranteed

Employees * ¥142,926 Guarantees for

employees’

housing loans

and others

196 foreign dealers 36,948 Guarantees for

and loans and

10 other companies others

Total ¥179,874

* Allowance for doubtful accounts is provided for these loans mainly

based on past experience.

(2) Commitments to provide guarantees

Balance of

commitments Description of

to provide liabilities

Guarantees guarantees guaranteed

Hibikinada ¥847 Commitments

Development to provide

Co., Ltd. guarantees

for loans

(3) Outstanding balance of installment receivables sold

with recourse ¥3,470

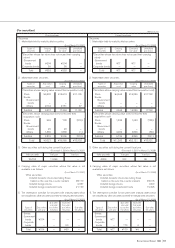

(Millions of yen)

(For consolidated balance sheets)