Nissan 2008 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2008 Nissan annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

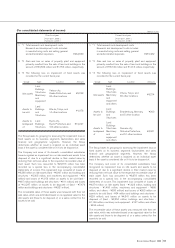

CHANGES IN ACCOUNTING POLICIES

53

Nissan Annual Report 2008

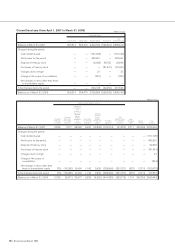

Prior fiscal year Current fiscal year

From April 1, 2006 From April 1, 2007

[

To March 31, 2007

][

To March 31, 2008

]

Accounting standard for share-based payment

Effective April 1, 2006, the Company adopted the Accounting Standard

for Share-based Payment (ASBJ Statement No. 8 issued on December

27, 2005) and the Implementation Guidance on Accounting Standard for

Share-based Payment (ASBJ Guidance No. 11 issued on May 31, 2006).

The effect of this change was to decrease operating income, ordinary

income, and income before income taxes and minority interests by

¥1,037 million for the year ended March 31, 2007, compared with the

corresponding amounts which would have been recorded if the previous

method had been followed.

The effect of this change on Segment Information is explained in the

applicable notes.

Accounting standard for presentation of net assets in the

balance sheet

Effective April 1, 2006, the Company adopted the Accounting Standard

for Presentation of Net Assets in the Balance Sheet (ASBJ Statement

No. 5 issued on December 9, 2005) and the Implementation Guidance

on Accounting Standard for Presentation of Net Assets in the Balance

Sheet (ASBJ Guidance No. 8 issued on December 9, 2005).

Shareholders’ equity under the previous presentation method

amounted to ¥3,543,420 million as of March 31, 2007.

Net assets in the consolidated balance sheet as of March 31, 2007

have been presented in accordance with the revised “Regulations for

Consolidated Financial Statements.”

Change of Closing Dates of Consolidated Subsidiaries

Until the year ended March 31, 2006, since the difference between the

fiscal year end of the parent company and those of 55 consolidated

subsidiaries was within three months, the operating results of those

subsidiaries were consolidated by using their financial statements as of

their respective fiscal year ends. Effective the year ended March 31,

2007, 22 consolidated subsidiaries have been consolidated by using

their financial statements as of the parent’s fiscal year end prepared

solely for consolidation purposes instead of those as of their respective

fiscal year end. This change was made, upon the completion of the

internal reporting systems which allow those subsidiaries to accelerate

their financial statement closing process, in order to make the disclosures

of the consolidated financial statements more meaningful by unifying the

fiscal year. In addition, 33 consolidated subsidiaries have also changed

their fiscal year end to March 31 for the same reason.

As a result, the financial statements of the 55 consolidated

subsidiaries described above were prepared for the 15-month period

from January 1, 2006 to March 31, 2007. The effect of this change was

to increase consolidated net sales by ¥767,606 million, operating income

by ¥21,443 million, ordinary income by ¥18,483 million, net income

before income taxes and minority interests by ¥15,661 million, and net

income by ¥11,589 million compared with the corresponding amounts which

would have been recorded if the previous method had been followed.

This change was made during the second half of the fiscal year,

because the subsidiaries’ internal systems to accelerate their financial

statements closing processes were completed during that period.

The effect of this change on Segment Information is explained in the

applicable notes.

Accounting for Directors’ Retirement Benefits

Until the year ended March 31, certain subsidiaries expensed retirement

benefits for directors and statutory auditors to income when general

shareholders’ meetings approved resolutions for the payment of those

benefits. In April 2007, a new position paper was issued by the Japanese

Institute of Certified Public Accountants to clarify the accounting

treatment for retirement benefits for directors and statutory auditors. In

this connection, certain subsidiaries began to record an accrual for the

retirement benefits for the directors and statutory auditors at the amount

which would have been required to be paid in accordance with their

respective internal rules if those directors and statutory auditors had

resigned their offices as of the balance sheet date in order to establish a

sound financial position.

The effect of this change was to increase selling, general and

administrative expenses by ¥441 million, to decrease operating income

and ordinary income each by ¥441 million, and to decrease income

before income taxes and minority interests by ¥1,569 million for the year

ended March 31, 2008, compared with the corresponding amounts that

would have been recorded under the previous method.

The effect of this change on Segment Information is explained in the

applicable notes.

“Accrued directors’ retirement benefits” recognized on balance sheets

by some of the Company’s consolidated subsidiaries were previously

included in “Accrued retirement benefits.” Following the aforementioned

change, however, they are separately reported effective from the fiscal

year ended March 31, 2008.