Nissan 2008 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2008 Nissan annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

67

Nissan Annual Report 2008

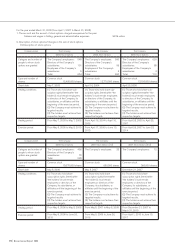

1. Description of retirement benefit plans

The Nissan Group (consisting of the Company and its consolidated subsidiaries) has several defined-benefit and defined-contribution pension

plans. The Company and certain consolidated subsidiaries have adopted both defined-benefit and defined-contribution pension plans,

whereas certain other consolidated subsidiaries have either defined-benefit or defined-contribution pension plans. The defined-benefit

pension plans adopted by the Company and certain domestic subsidiaries include lump-sum payment plans, defined-benefit corporate

pension plans, welfare pension fund plans and tax-qualified plans. Certain employees may be entitled to additional special retirement benefits,

depending on the conditions for the termination of their employment. Certain consolidated subsidiaries have transferred a part of their

previous defined-benefit pension plans to defined-contribution ones during the current fiscal year.

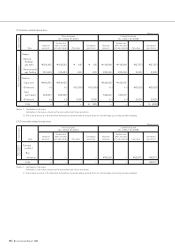

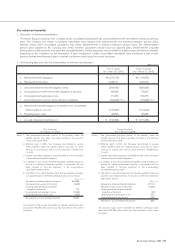

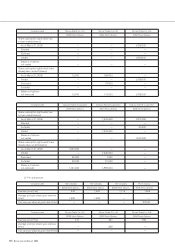

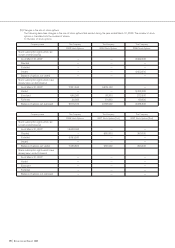

2. The following table sets forth the funded status of retirement benefit plans: (Millions of yen)

Prior fiscal year Current fiscal year

(As of March 31, 2007) (As of March 31, 2008)

a. Retirement benefit obligation ¥(1,273,725) ¥(1,174,330)

b. Plan assets at fair value 1,008,771 905,475

c. Unfunded retirement benefit obligation (a+b) (264,954) (268,855)

d. Unrecognized net retirement benefit obligation at transition 89,822 78,297

e. Unrecognized actuarial gain or loss 81,493 106,478

f. Unrecognized prior service cost (a reduction of liability) (54,049) (47,523) (Note 2)

g. Net retirement benefit obligation recognized in the consolidated

balance sheet (c+d+e+f) (147,688) (131,603)

h. Prepaid pension costs 46,806 45,882

i. Accrued retirement benefits (g–h) ¥ (194,494) ¥ (177,485)

(Note 2)

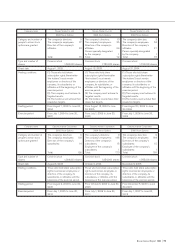

Notes: 1. The government-sponsored portion of the benefits under the

welfare pension fund plans has been included in the amounts

shown in the above table.

2. Effective April 1, 2001, the Company discontinued to provide

certain benefits under the welfare pension fund plan for future

services. As a result, prior service cost (a reduction of liability) was

incurred.

3. Certain subsidiaries adopted a simplified method in the calculation

of their retirement benefit obligation.

4. In addition to the accrued retirement benefits explained above, an

accrual for additional retirement benefits is recognized and has

been included in “Accrued expenses” in the accompanying

consolidated balance sheet.

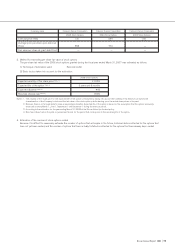

5. The effects of a partial transition from the tax-qualified and lump-

sum payment plans to defined contribution plans are as follows.

(Millions of yen)

Decrease in retirement benefit obligation ¥29,285

Decrease in plan assets at fair value (4,493)

Unrecognized net retirement benefit

obligation at transition 718

Unrecognized actuarial gain or loss (6,202)

Unrecognized prior service cost (526)

Decrease in accrued retirement benefits 18,782

The amount of plan assets transferred to defined contribution plans

amounted to ¥4,493 million, which was fully transferred in the current

fiscal year.

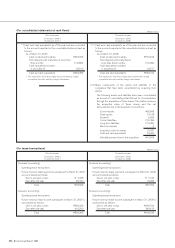

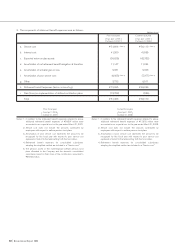

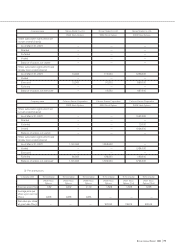

Notes: 1. The government-sponsored portion of the benefits under the

welfare pension fund plans has been included in the amounts

shown in the above table.

2. Effective April 1, 2001, the Company discontinued to provide

certain benefits under the welfare pension fund plan for future

services. As a result, prior service cost (a reduction of liability) was

incurred.

3. Certain subsidiaries adopted a simplified method in the calculation

of their retirement benefit obligation.

4. In addition to the accrued retirement benefits explained above, an

accrual for additional retirement benefits is recognized and has

been included in “Accrued expenses” in the accompanying

consolidated balance sheet.

5. The effects of a partial transition from the tax-qualified, lump-sum

payment and welfare pension fund plans to defined contribution

plans are as follows.

(Millions of yen)

Decrease in retirement benefit obligation ¥7,715

Decrease in plan assets at fair value (7,352)

Unrecognized net retirement benefit

obligation at transition (32)

Unrecognized actuarial gain or loss 322

Unrecognized prior service cost 203

Decrease in accrued retirement benefits 856

The amount of plan assets transferred to defined contribution plans

amounted to ¥7,352 million, which was fully transferred in the current

fiscal year.

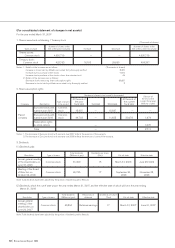

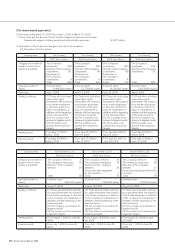

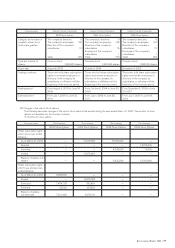

Prior fiscal year Current fiscal year

(As of March 31, 2007) (As of March 31, 2008)

(For retirement benefits)