Nissan 2008 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2008 Nissan annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

63

Nissan Annual Report 2008

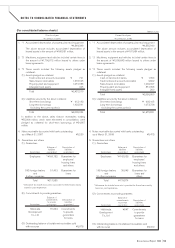

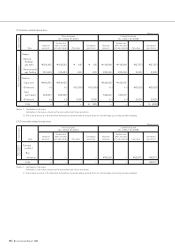

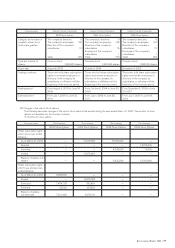

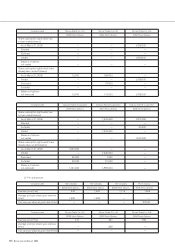

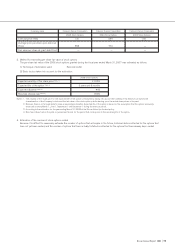

Prior fiscal year Current fiscal year

From April 1, 2006 From April 1, 2007

[

To March 31, 2007

][

To March 31, 2008

]

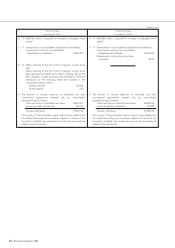

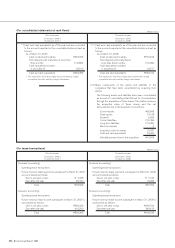

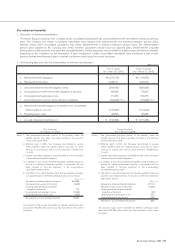

(3) Description of risks relating to derivative transactions

1) Market risk

Although derivative transactions are used for the

purpose of hedging risks on assets and liabilities

recorded in the consolidated balance sheet, there remain

the risk of foreign currency exchange fluctuations on

currency transactions, the risk of interest rate

fluctuations on interest rate transactions and the risk of

market price fluctuations on commodity transactions.

2) Credit risk

The Group is exposed to the risk that a counterparty to

its financial transactions could default and jeopardize

future profits. We believe that this risk is insignificant as

the Group enters into derivative transactions only with

financial institutions which have a sound credit profile.

The Group enters into these transactions also with

Renault Finance S.A. (“RF”), a specialized financial

subsidiary of the Renault Group which, the Company

believes, is not subject to any such material risk. This is

because RF enters into derivative transactions to cover

such derivative transactions with the Group only with

financial institutions of the highest caliber carefully

selected by RF based on its own rating system.

3) Legal risk

The Group is exposed to the risk of entering into a

financial agreement which may contain inappropriate

terms and conditions as well as the risk that an existing

contract may be affected by revisions to the relevant

laws and regulations. The Group’s Legal Department and

Finance Department make every effort to minimize legal

risk by reviewing any new agreements of significance

and by reviewing the related documents which are

retained on file in a central location.

(3) Description of risks relating to derivative transactions

1) Market risk

Same as the prior fiscal year.

2) Credit risk

Same as the prior fiscal year.

3) Legal risk

Same as the prior fiscal year.

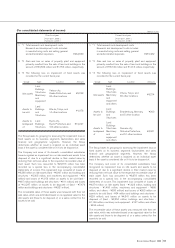

(For derivative transactions)